From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineEuropean Steel Market Shows Strong Momentum Amidst Increased Ukrainian Activity

In Europe, the steel market exhibits a very positive sentiment, primarily influenced by a notable rise in Ukrainian steel exports and increased plant activity. As reported in Flat steel exports from Ukraine rose by 8.1% y/y in January-November, significant growth has been observed with a 155% increase in flat steel exports in November alone. This surge corresponds with improved activity levels at key European steel plants, as indicated by satellite data.

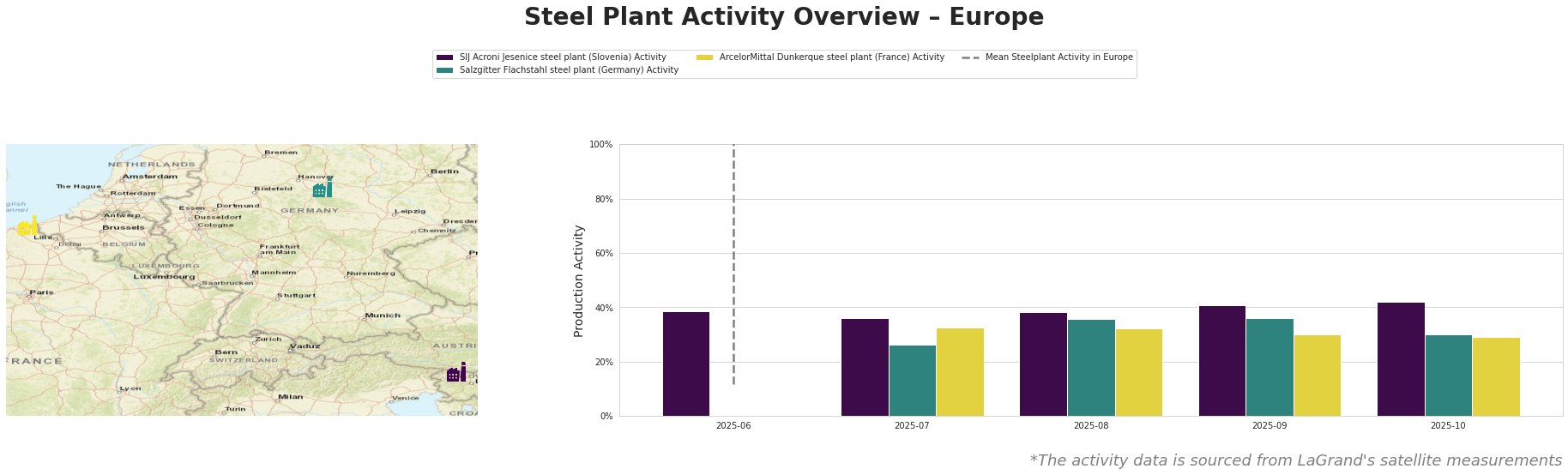

The data indicates a fluctuating yet improving trend in European steel plant activities, particularly highlighting SIJ Acroni Jesenice which registered a peak activity of 42% in October. This aligns with the increased export activity cited in Ukraine increased exports of long products by 43% y/y in January-November, suggesting a responsive market to Ukrainian supply dynamics. Conversely, Salzgitter Flachstahl’s recent activity contracted to 30% in October despite prior stability, reflecting broader market uncertainties, potentially influenced by global downturns in steel production, as mentioned in Global steel production fell by 4.6% y/y in November.

The SIJ Acroni Jesenice steel plant, utilizing EAF technology, operates at a capacity of 726,000 tons and has seen its activity rise from 39% earlier in the year to a significant peak of 42%. The plant’s focus on semi-finished and finished rolled products feeds into the contemporary demand for flat rolled steel as specified in the aforementioned Ukrainian export report. The alignment of its production capacity with burgeoning demand positions it favorably for procurement opportunities.

Salzgitter Flachstahl, with a capacity of 5.2 million tons and extensive integrated steel processes, reported a decrease in activity levels to 30%. Although this decline contradicts market trends, it presents a potential supply disruption for customers reliant on hot and cold rolled products. Buyers should monitor this plant’s output closely, particularly in light of the Steel production in 2026 may remain at 7.2 million tons – GMK Center forecast, which cautions on future output uncertainties.

ArcelorMittal Dunkerque, with a capacity of 6.75 million tons, remains a significant player, though activity levels maintained a lower percentage compared to competitors due to ongoing process upgrades. The stability of output amid fluctuating demands aligns with market shifts noted in Ukraine imported over 1 million tons of flat rolled steel products in 11 months, which could limit availability from ArcelorMittal as it adjusts to maintain competitiveness.

Steel buyers should consider diversifying procurement strategies to leverage increased exports from Ukrainian mills while also preparing for potential supply interruptions from the Salzgitter and ArcelorMittal facilities. Establishing relationships with transport companies capable of rapid response logistics will be essential to capitalize on this dynamic market environment.