From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineStrong Market Confidence in Europe’s Steel Sector: Impacts of HRC Price Movements and CBAM Implementation

Recent developments in the European steel market reflect an optimistic outlook driven by rising hot rolled coil (HRC) prices, particularly influenced by EU HRC prices show limited movement despite ArcelorMittal’s push and CBAM check for revision of HRC prices in Italy. These articles highlight ArcelorMittal’s upward pricing strategy and the impact of the Carbon Border Adjustment Mechanism (CBAM), correlating with observed increases in manufacturing activity levels at some plants.

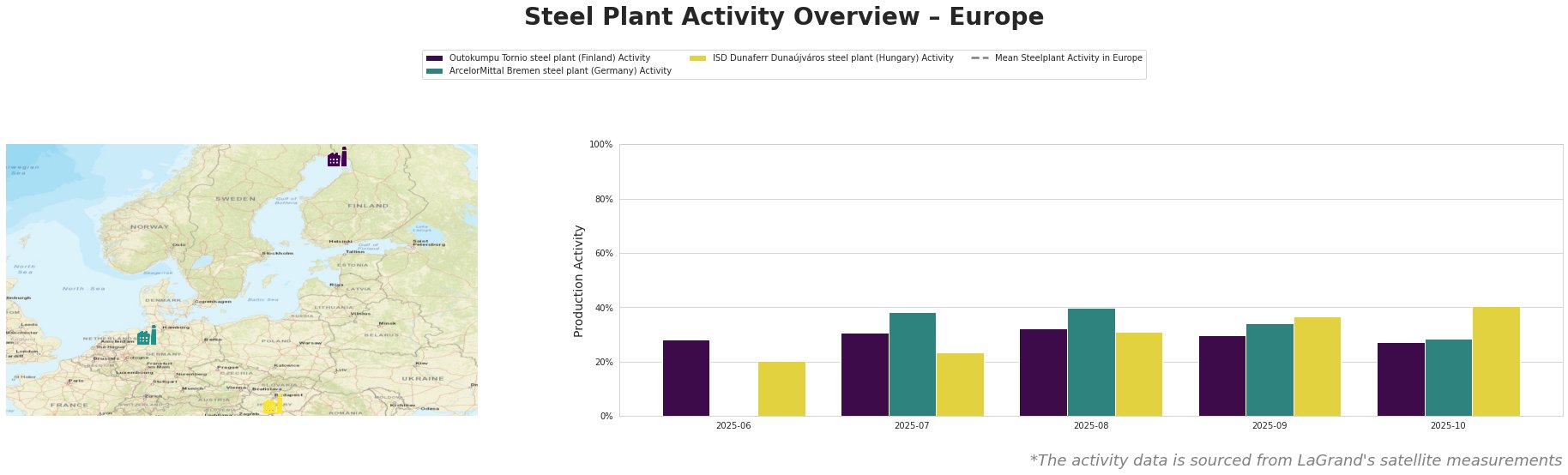

The satellite data indicates a fluctuation in activity levels, notably peaking at 40% for the ArcelorMittal Bremen plant in August 2025, which aligns with the heightened pricing strategies highlighted in both EU HRC prices show limited movement… and European steel HRC market slows ahead of year-end break. However, activity dipped post-August, suggesting sensitivity to market changes.

At the Outokumpu Tornio steel plant, activity remained steady, recorded at 31% in July and August 2025, possibly reflecting market adaptation to the expected price changes due to rising domestic pricing pressures outlined in the news articles. Its production focus on electric arc furnace (EAF) technology allows it to compete effectively in an evolving market driven by material compliance concerns from the new CBAM regulations.

The ArcelorMittal Bremen steel plant, which produces predominantly hot rolled and cold rolled products using integrated processes, experienced a decrease from 40% in August to 29% in October 2025, potentially indicating a pre-year-end slowdown in activity as suppliers recalibrate amidst fluctuating demand, corroborated by the European steel HRC market slows ahead of year-end break.

In contrast, the ISD Dunaferr Dunaújváros steel plant demonstrated a consistent increase in activity, reaching 40% by October 2025, suggesting a robust operational capability to meet ongoing demand while navigating the market complexities highlighted by the CBAM.

The combination of localized price uplifts from ArcelorMittal and the anticipated increases in domestic consumption paints a picture of growing confidence in the European steel industry. Buyers are advised to consider pressing purchase decisions for Q1 2026 to benefit from current price levels before full implications of the CBAM are realized, particularly focusing on domestic suppliers whose prices might stabilize at a premium due to regulatory pressures.

As anticipated demand rises, procurement strategies should prioritize partnerships with compliant local producers, especially plants aligned with environmental standards, potentially mitigating risks associated with supply disruptions due to the evolving regulatory landscape surrounding carbon emissions.