From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineAsia’s Steel Market: Strong Activity Trends Signal Positive Outlook for Buyers and Analysts

Recent observations indicate robust activity levels in Asia’s steel market, driven by emerging production enhancements and stabilization in key input costs. The article Viewpoint: Mining in 2025: emerging trends and predictions for 2026 highlights significant shifts towards renewable energy and essential commodities, which correlates with the increased output at various steel plants. However, it’s imperative to note that no direct correlation can be drawn between this news and the specific satellite data observed.

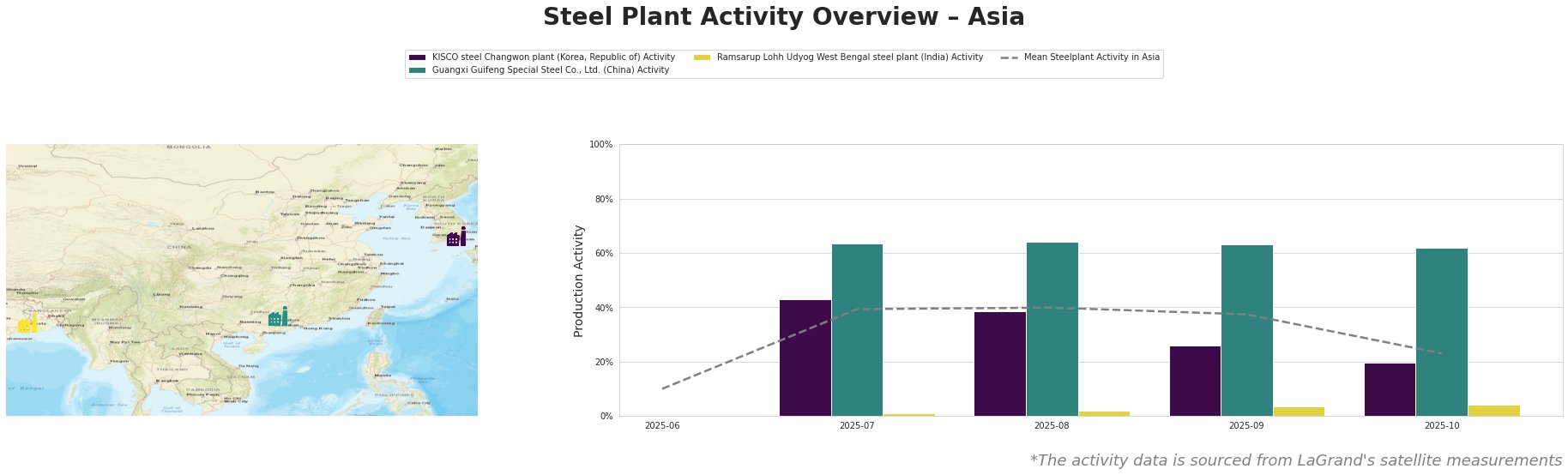

The KISCO steel Changwon plant in South Korea displayed a significant rise in activity to 43% in July, but observed a decline to 20% by October. This decline aligns with the broader mean activity trend, which fell sharply in that period, suggesting external pressures that could impact operations. This fluctuation does not link directly with any specific news event.

Guangxi Guifeng Special Steel Co., Ltd. maintained elevated activity levels around 63-64% throughout much of the period, concluding October at 62%. This resilience indicates strong demand for special steel, which may correlate implicitly with competitive pressures discussed in Viewpoint: Indonesia’s MHP surge to hit nickel prices, though no direct cause-and-effect relationship was established.

The Ramsarup Lohh Udyog West Bengal plant saw modest activity, peaking at just 4% in October. This low level suggests potential supply constraints warranting attention as the plant struggles for greater output in an increasingly dynamic market.

Given the observed activity trends, steel buyers should closely monitor pricing trends and output levels at KISCO and Guangxi Guifeng, where operational stability remains. Procurement strategies may need to pivot, particularly if Ramsarup’s lower output does not show signs of sustainable improvement. The activity drop at KISCO could signal impending shortages, incentivizing buyers to secure inventories now before potential supply disruptions arise.

Overall, stakeholders in the steel supply chain should leverage these insights for informed decision-making, ensuring resilience against emerging market dynamics.