From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineEurope Steel Market Report: Strong Activity and Positive Outlook Amid Growing Renewable Fuel Demand

The European steel market is experiencing a significant upswing, prompted by robust activity levels across key plants. Notably, recent developments cited in “Viewpoint: Dutch ticket move to help low-emission fuels“ and “Viewpoint: EU ethanol supported by mandates in 2026“ highlight a sustained rise in demand for sustainable products, which is paralleled by increased operational activity in the steel sector, confirming an interconnected positive trend.

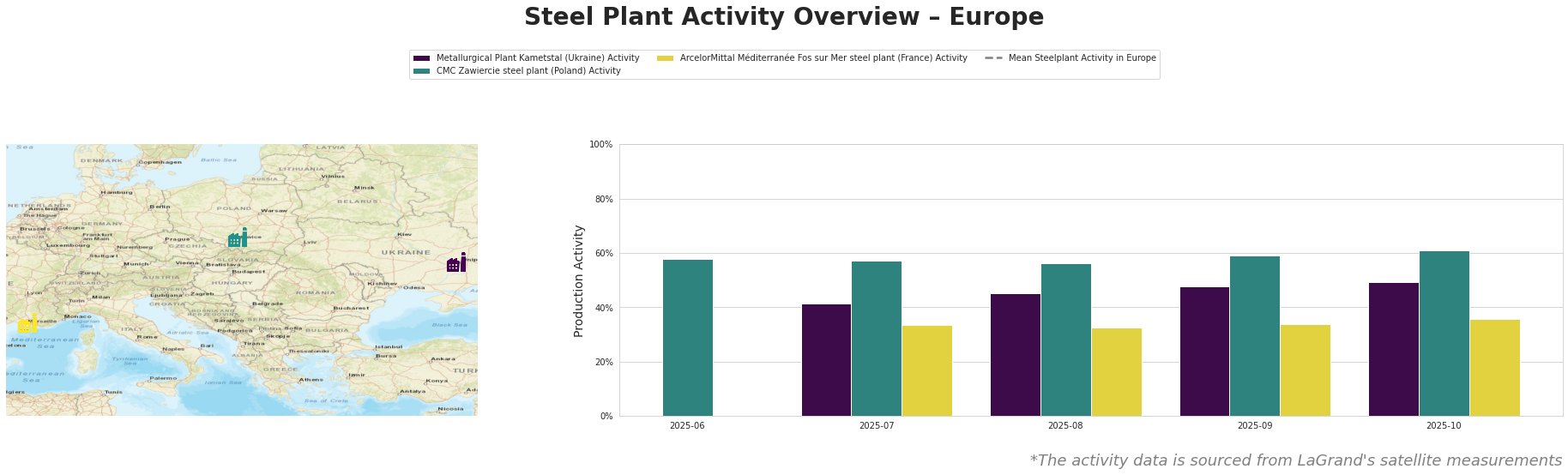

Metallurgical Plant Kametstal, located in Ukraine, has shown stable activity levels with a rise to 49% by October 2025 from 41% in July. However, the mean activity across European plants has notably decreased from approximately 40.78% in June to 27.19% in October. The improvement in Kametstal’s activity could be linked indirectly to market sentiment suggested by the changing dynamics in renewable energy regulations, as seen in the articles.

In contrast, CMC Zawiercie steel plant in Poland experienced a rise, peaking at 61% in October from 57% in July. This aligns with the impending shifts indicated in “Viewpoint: Dutch ticket move to help low-emission fuels”, where policy changes could incentivize greater production of advanced fuels and potentially drive up demand for steel used in renewable applications.

Activity at ArcelorMittal Méditerranée Fos sur Mer has seen a modest stability around 33-36% despite shifts in regulatory environments, underscoring the challenges faced by established plants in adapting to rapid market changes, albeit without a direct connection to the articles currently available.

Evaluated Market Implications

Given the significant legislative shifts toward renewable fuel mandates, specifically in the Netherlands and Germany, there is heightened demand for steel used in low-emission technologies, warranting proactive procurement strategies. Buyers should consider securing contracts with CMC Zawiercie, which is well-positioned to ramp up production in light of increased ethanol demand and potential disruptions tied to policy changes.

Kametstal’s increasing activity may provide a strategic opportunity for sourcing, but operational risks remain due to geopolitical uncertainties. Thus, strategic diversification in supplier relationships is crucial. As market conditions shift in response to legislative changes and production trends highlighted in the mentioned articles, timely procurement actions will be essential for securing competitive advantages in this dynamic sector.