From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EnginePoland Steel Market Update: Price Stability Amid Weak Demand as Holiday Season Approaches

Poland’s steel market is experiencing a neutral sentiment, characterized by stable pricing and reduced activity levels driven by weak demand. The articles titled “Weak demand keeps Polish long steel prices flat; holiday lull“ and “Weak demand keeps prices for Polish rolled products at the same level; holiday lull“ highlight recent market stasis due to seasonal demand declines leading into the holidays. Notably, this indicates an immediate impact on steel plant activity, as seen in satellite data.

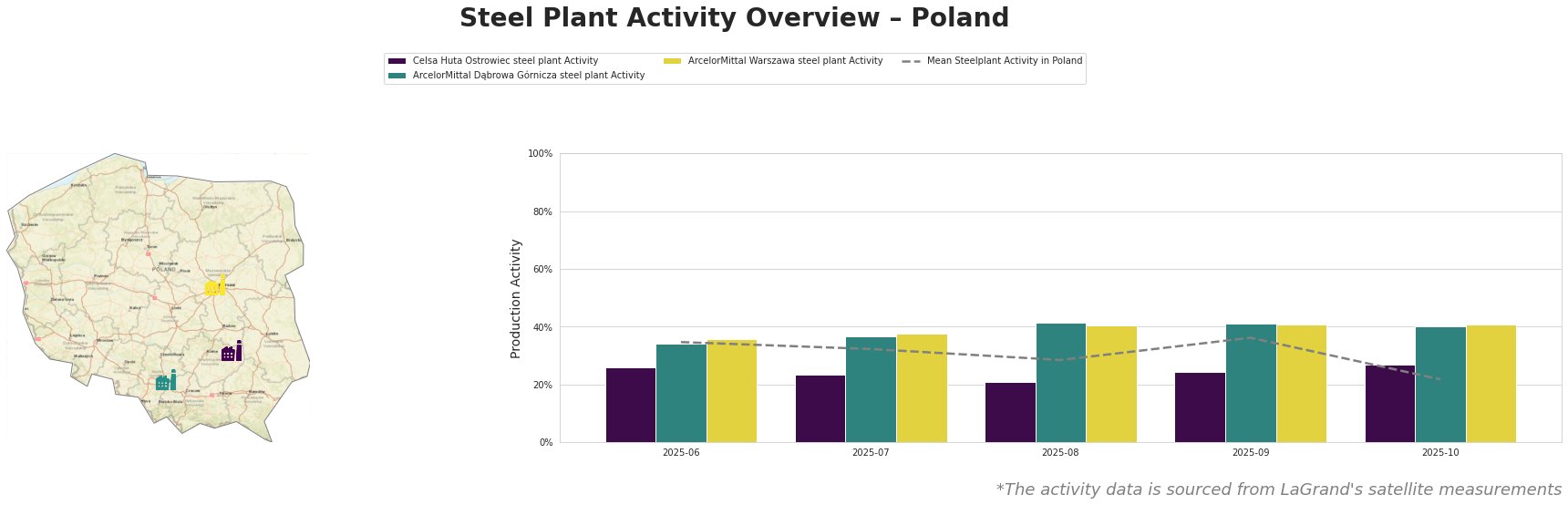

Overall, the mean steel plant activity in Poland has shown a decreasing trend from 35% in June to 22% in October 2025. Celsa Huta Ostrowiec, which mainly produces finished rolled products, saw a decline from 26% to 27% activity levels, highlighting a significant drop in operations. Meanwhile, ArcelorMittal Dąbrowa Górnicza maintained relatively stable activity at 40%, aligning with the neutral price sentiment reported.

Celsa Huta Ostrowiec: This plant uses electric arc furnace technology to produce finished rolled items such as rebar and bars. Its observed activity fell sharply to a low of 21% (August). Although it recovered slightly by October, reflecting the quiet market described in “Domestic prices for long products in Poland have not changed, the market is slowing down due to the holidays at the end of the year,” the overall drop correlates with reduced demand and holiday-related slowdowns.

ArcelorMittal Dąbrowa Górnicza: As an integrated facility, its activity has remained relatively strong, with fluctuations mainly around the 40% mark. This stability can be linked to broader market trends discussed in the news articles, where even during low demand periods, it seems well-supported by a consistent product portfolio, including wire rod and sheet piles.

ArcelorMittal Warszawa: This plant, focusing on a mix of crude and finished products, experienced minimal changes in activity values between September and October, maintaining activity levels around 41%. Its resilience in a sluggish market reflects the prevailing conditions cited in “Weak demand keeps prices for Polish rolled products at the same level; holiday lull.”

Evaluating the connections established, potential disruptions could arise for Celsa Huta Ostrowiec should demand challenges persist beyond the holiday season. Buyers should prepare for potential shortages or price increases in early next year as higher scrap prices are reported, particularly in “Local scrap metal prices in Poland strengthened at a higher level in December,” indicating an uptick in raw material costs.

For procurement actions, it is recommended that steel buyers prioritize securing orders from ArcelorMittal Dąbrowa Górnicza and Warszawa to hedge against potential price rises and supply constraints. These plants appear more resilient to demand fluctuations, supported by their diverse offerings and strong supply capabilities. As price stability is noted, lock-in contractual agreements now could ensure favorable rates in the coming months before any anticipated regulation impacts materialize.