From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EnginePositive Trends in Ukraine’s Steel Market: Key Insights and Recommendations for Buyers

In Ukraine’s steel industry, marked changes are evident due to evolving export patterns and plant activities. As detailed in the news article “Ukraine reduced semi-finished exports by 30.5% y/y in January-November”, there was a notable decline in semi-finished steel exports, which decreased 30.5% year-on-year while “Flat steel exports from Ukraine rose by 8.1% y/y in January-November” highlights a significant increase in flat rolled steel exports. These trends correlate with observed satellite data indicating fluctuating activity levels at major steel plants.

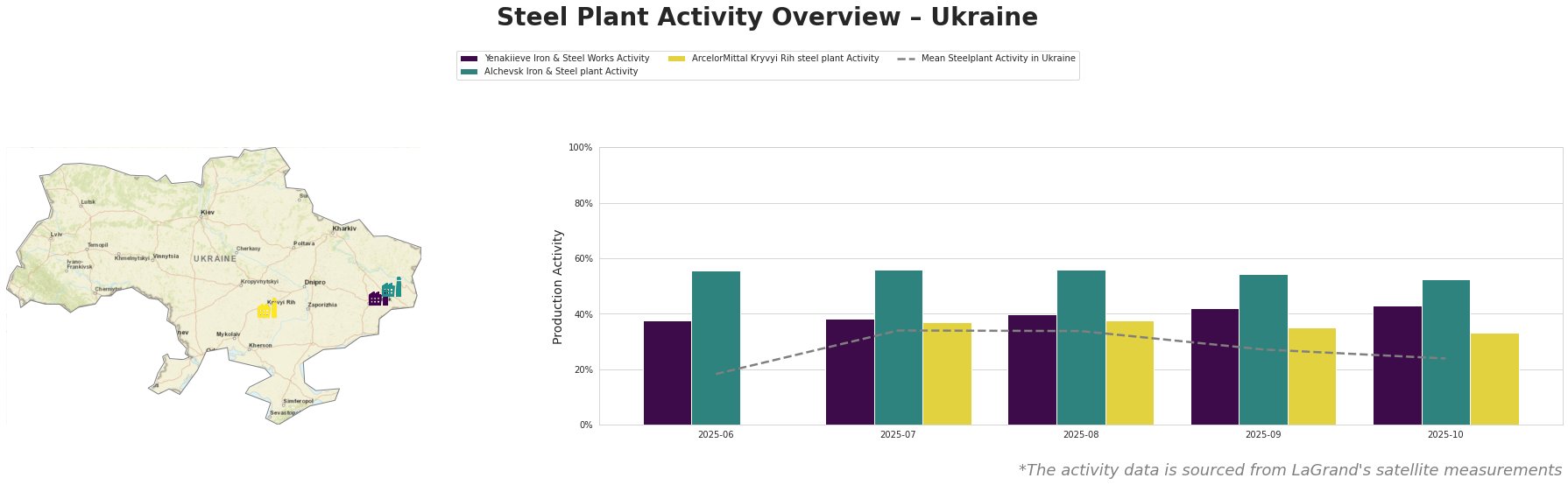

The overall activity observed at steel plants has varied significantly. Yenakiieve Iron & Steel Works peaked at 56% activity in June and July, coinciding with a relative stabilization in overall steel production. The Alchevsk Iron & Steel plant maintained robust activity levels, consistently operating at or above 54%, which supports the increase in flat steel exports. Noteworthy is the decrease to 24% mean activity in October which can be linked to the reduced volume of semi-finished products, as articulated in the article “Ukraine’s total steel exports down 4.7 percent in Jan-Nov 2025.”

Yenakiieve Iron & Steel Works, producing both semi-finished and finished rolled products primarily through integrated processes, saw a gradual increase in activity but dropped back to 43% by October. This decline is indirectly related to the market shift away from semi-finished exports, as outlined in “Ukraine’s semi-finished steel exports decline by 30.5% in January–November.” Alchevsk Iron & Steel’s maintained activity level indicates robust demand and consistent operations, potentially addressing the shortfall in semi-finished exports highlighted.

ArcelorMittal Kryvyi Rih, the largest plant, showcased lower activity levels at 33% and caters to both domestic and export markets. While all plants showed a temporary decline towards October, the export gains in flat products suggest an ongoing demand that could stabilize these operations if cultivated through strategic procurement.

Supply chain implications arise predominantly from the reduced exports of semi-finished steel, positioning Alchevsk and ArcelorMittal as critical producers of flat products. Steel buyers should prioritize sourcing from plants demonstrating consistent higher levels of activity, particularly Alchevsk, to safeguard against potential supply gaps arising from semi-finished product shortages.

Recommended actions include:

– Engage with Alchevsk Iron & Steel given its steady output aligning with increased flat steel demand, referenced in “Flat steel exports from Ukraine rose by 8.1% y/y in January-November.”

– Monitor Yenakiieve’s production closely as its fluctuations point to potential re-engagement opportunities for semi-finished products as market conditions evolve.

These strategies can enhance procurement efficacy and mitigate risks associated with fluctuating steel product availability in the Ukrainian market.