From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineSurge in European Steel Activity Amid Positive Market Outlook: Key Insights for Procurement

Recent developments in the European steel market show positive trends driven by increased activity in key plants and a rise in exports from Ukraine. The article titled Ukraine exported 1.73 million tons of pig iron in January-November highlights a substantial 49% increase in pig iron exports to the EU and US, significantly indicating an uptick in production. This correlates with observable satellite data showing heightened activity at significant European steel plants.

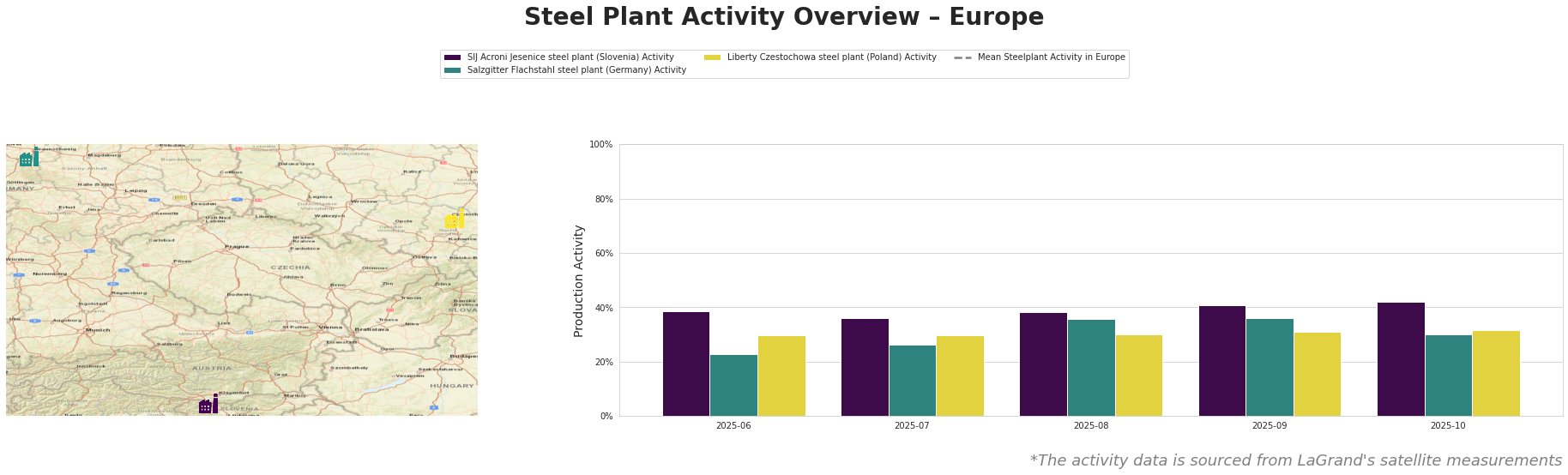

These trends reflect fluctuating activity levels, with the peak activity reaching 42% in October for the mean across all plants. SIJ Acroni Jesenice consistently maintained activity in the low 40% range, while Salzgitter and Liberty Czestochowa showed stability with slight decreases but still within healthy operational levels.

The Flat steel exports from Ukraine rose by 8.1% y/y in January-November further confirms the positive sentiment, as it indicates an increase in flat rolled steel likely feeding positive activity levels in European plants. The consistent demand from Poland, Bulgaria, and Italy (major importers of steel) has likely contributed to maintaining strong output levels at European plants.

The SIJ Acroni Jesenice steel plant, primarily focusing on semi-finished and finished rolled steel products, demonstrated solid activity levels, registering 42% in October, which aligns with heightened export demand as Ukraine boosted its own exports. Salzgitter Flachstahl, with its integrated BF process and a strong repertoire in finished rolled products, maintained a steady activity at approximately 30-36%, indicative of solid yet cautious production scaling amid market demands referenced in the mentioned articles.

Liberty Czestochowa’s focus on plates remains stable even though it has less capacity than other plants. Nevertheless, its activity level reflects responsiveness to regional needs, underscored by Ukraine’s diminishing exports of semi-finished steel, as indicated in Ukraine reduced semi-finished exports by 30.5% y/y in January-November.

To capitalize on the positive trends, steel procurement professionals should consider the following actionable insights:

-

Diversify Supply Sources: With Ukraine’s export shifts to the US and EU, it’s essential to diversify supplier bases reflecting the growing demand in specific regions like Poland and Bulgaria. The noted increase in flat steel exports is a key factor in this strategy.

-

Monitor Activity Levels: Procurement strategies should adapt based on the observed peak activities at plants. Higher activity levels may indicate a conducive environment for negotiations and favorable pricing.

-

Leverage Favorable Prices: Despite some challenges in revenue due to pricing conditions in markets, the overall supply picture remains strong. By aligning purchasing strategies with proactive market analysis, organizations can optimize procurement terms.

By harnessing these insights, stakeholders can effectively navigate the evolving landscape of the European steel market and ensure responsive procurement strategies that align with the current activity trends.