From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineEuropean Steel Market Update: Optimism Amidst CBAM Dynamics and Rising Prices

European steel prices are exhibiting a very positive outlook, particularly driven by recent developments around the Carbon Border Adjustment Mechanism (CBAM). The article European heavy plate prices rise on CBAM cost support; slab import dynamics raise concerns highlights that domestic plate prices across Southern and Northern Europe have increased, with optimism surrounding CBAM’s cost implications. Activity levels at selected steel plants show corresponding trends, specifically reflecting a robust market sentiment reinforced through the upcoming holiday season.

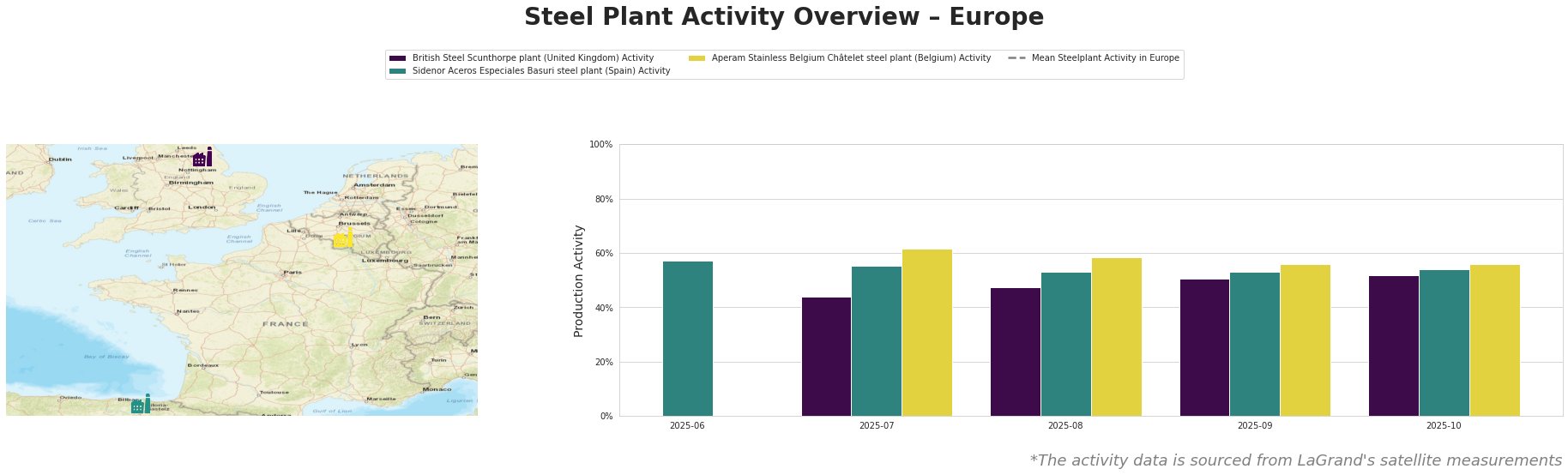

Measured Activity Overview

The British Steel Scunthorpe plant showed a consistent recovery in activity, rising from 44% in July to 52% in October. This increase aligns with the observed price rises noted in European plate market holds as CBAM concerns cloud import activity; slab dips on thin bookings, indicating that domestic production is robust as buyers prepare for year-end stocking. Conversely, Sidenor Aceros Especiales Basuri and Aperam Stainless Belgium Châtelet maintained stable activity levels, remaining competitive in the domestic market, but faced challenges due to CBAM uncertainties regarding imports.

British Steel’s jump to 52% activity is significant compared to the mean plant activity’s decline to 27.2% in October, correlating with rising domestic prices as noted in various reports. While Sidenor and Aperam held steady at lower values, their performance indicates a protective stance against import pressures, highlighted by rising local prices attributed to CBAM concerns.

Evaluated Market Implications

The current pricing dynamics create potential supply disruptions, particularly for Sidenor Aceros Especiales Basuri, as concerns regarding slab imports persist. Steel buyers should prioritize procurement from the British Steel Scunthorpe plant, given its higher activity level and positive sentiment around CBAM.

Recommendations:

– Steel buyers should secure domestic plate purchases from British Steel, capitalizing on current price stability and favorable production activity.

– Monitor CBAM implications closely; anticipated additional costs could influence import competitiveness, recommending timely acquisition of inventory before significant shifts occur.

– Consider limiting imports in favor of domestic supplies to avoid potential premium costs associated with emissions data verification as noted in European plate market holds as CBAM concerns cloud import activity; slab dips on thin bookings.

In summary, the ongoing optimism in European steel prices amid emerging CBAM costs suggests a proactive purchasing strategy focused on domestic suppliers, particularly those demonstrating rising activity.