From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineAsia’s Steel Market: Strong Growth and Expansion Signals from Major Producers

Recent developments in Asia’s steel market reveal a very positive sentiment, propelled by significant investment announcements and robust activity levels at key steel plants. Notable articles, such as Nippon Steel plans to invest $39 billion in expanding production by 2030 and AMNS India to triple its domestic steelmaking capacity to 25-26 million mt by 2030, highlight a concerted effort to enhance production capabilities amid anticipated rising demand across the region. Satellite observational data corroborates these expansions, with marked increases in activity levels at several steel plants over recent months.

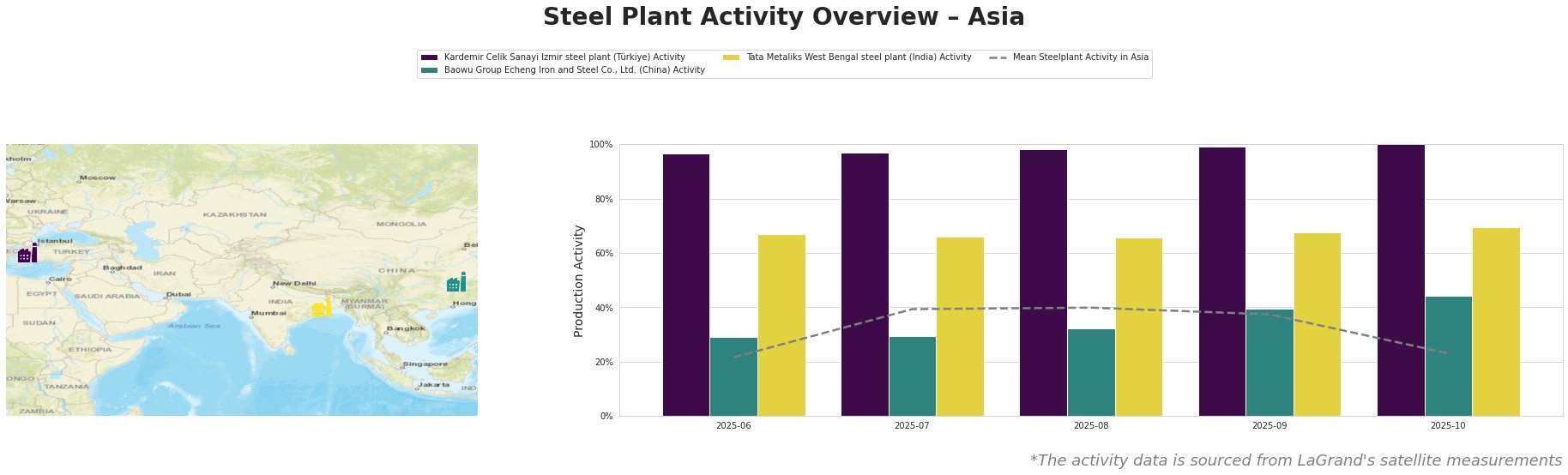

The Kardemir Celik Sanayi Izmir steel plant has demonstrated consistently high activity nearing full capacity over recent months, peaking at 100% in October 2025. This sustained high performance aligns with Nippon Steel’s aggressive expansion plans, emphasizing the need for buyers to maintain a close watch on supply levels potentially influenced by these growth trajectories.

In contrast, the Baowu Group Echeng Iron and Steel Co., Ltd. has shown varying activity, commencing at 29% and rising to 44%. Although their performance lags behind Kardemir, it reflects a gradual increase, possibly positioned to adapt as market conditions evolve with increased production from Nippon and AMNS India.

The Tata Metaliks West Bengal steel plant reflects stable activity in the 66-70% range during this period, indicating confidence in operational efficiency, aligning with the regional expectations of growth invigorated by AMNS India’s planned expansions.

Given these insights, steel buyers should closely monitor production announcements from Nippon Steel and AMNS India, as the projected increases in capacity could lead to enhanced supply dynamics. Moreover, it’s critical to consider procurement strategies that account for potential bottlenecks or delays in ramping up production. The specific expansions are poised to influence pricing and availability across the board, particularly in the Southeast Asian market where consumption is expected to surge.

In summary, strong expansions from major players coupled with observed high-capacity utilization at specified plants create favorable conditions for buyers, emphasizing the importance of strategic procurement amidst such dynamic market shifts.