From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EnginePositive Steel Market Outlook in Europe: Insights from Recent Production Data and Plant Activity

In Europe, the steel market is witnessing a positive sentiment despite localized production challenges. Recent reports, such as “Italy reduced steel production by 11.8% m/m in November“ and “Germany reduced steel production by 9.1% m/m in November,” highlight declines in monthly production levels in key markets. Nevertheless, cumulative steel production in Italy saw a year-over-year increase, suggesting resilience in certain segments. This contrast aligns with observed satellite data, revealing varying activity levels among significant steel plants.

Recent Monthly Activity Trends

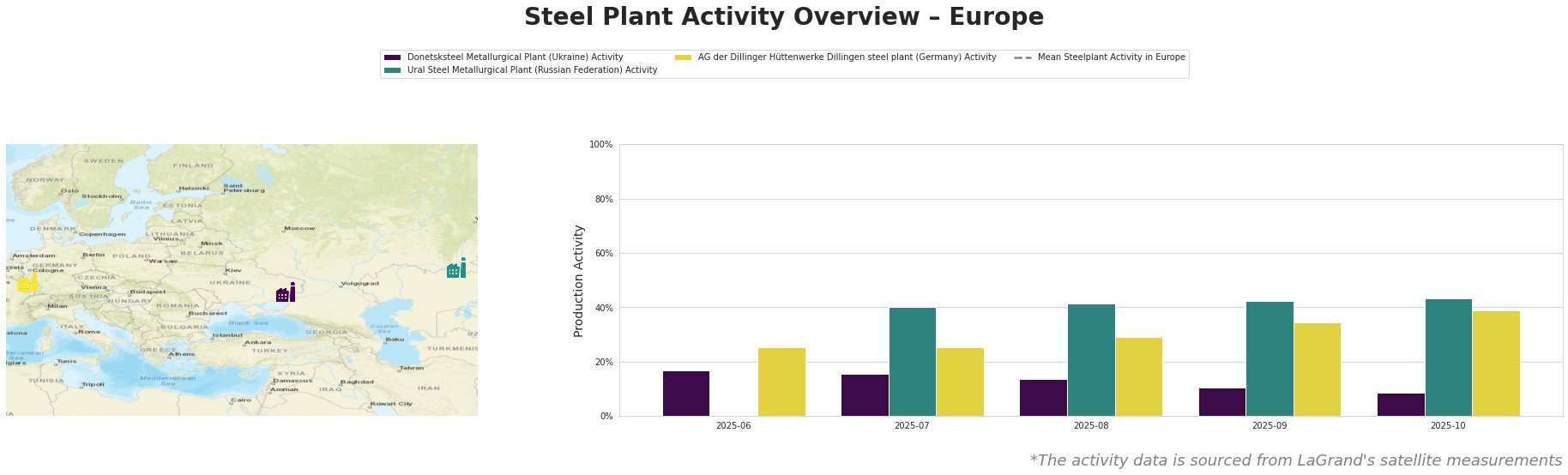

The mean activity level across European steel plants is on a downward trend, decreasing from 17.0% to 9.0% from June to October 2025. Notably, the Donetsksteel Metallurgical Plant exhibited a rising activity level, peaking at 43.0% in October, indicating robust resilience despite broader market challenges.

Plant Narratives and Activity Insights

Donetsksteel Metallurgical Plant: Operating with a focus on integrated blast furnace (BF) technology, this facility’s activity has generally increased, reaching 43% in October. This uptick is noteworthy amidst generally decreasing regional activity levels and does not connect with the recent production declines in Italy and Germany.

Ural Steel Metallurgical Plant: This facility, primarily employing electric arc furnaces (EAF), showcased a decline in activity levels, aligning with the reported downturns in Germany’s steel output. However, the lack of direct linkage means this plant may be responding to different market factors not detailed in the aforementioned articles.

AG der Dillinger Hüttenwerke Dillingen: Established as a critical player in producing heavy steel products, its activity levels remain stable within the mean European range. There is no direct correlation with the production data from Italy or Germany, indicating a potential buffer against the region’s downturn.

Evaluated Market Implications

The reductions in steel production reported in Germany and Italy suggest potential supply disruptions in these markets, which can critically impact procurement strategies, particularly for buyers dependent on flat and long products. Buyers should monitor trends closely in relation to the Donetsksteel plant’s rising activity, suggesting a possible alternative sourcing option amid declining outputs in major European plants.

Recommended Actions for Steel Buyers:

– Increase procurement from producers showing stable or rising output, such as Donetsksteel, to mitigate risks associated with the declining outputs from Italian and German plants.

– Keep a close watch on developments in the Ural Steel and AG der Dillinger facilities, as shifts in their activity levels may signal further structural changes in the European steel market.

Focusing strategies on responsive and robust supply avenues is crucial for navigating the evolving landscape presented by these current market dynamics.