From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineAsian Steel Market on the Rise: Strategic Acquisition Sparks Positive Activity

In Asia, recent developments signal a very positive outlook for the steel market, highlighted by major acquisitions such as Interpipe enters agreement to purchase AMTP Roman shares and Metinvest acquires Romanian pipe plant ArcelorMittal Tubular Products. These developments correlate with increased activity levels at key plants, which show notable rises in production despite previous challenges.

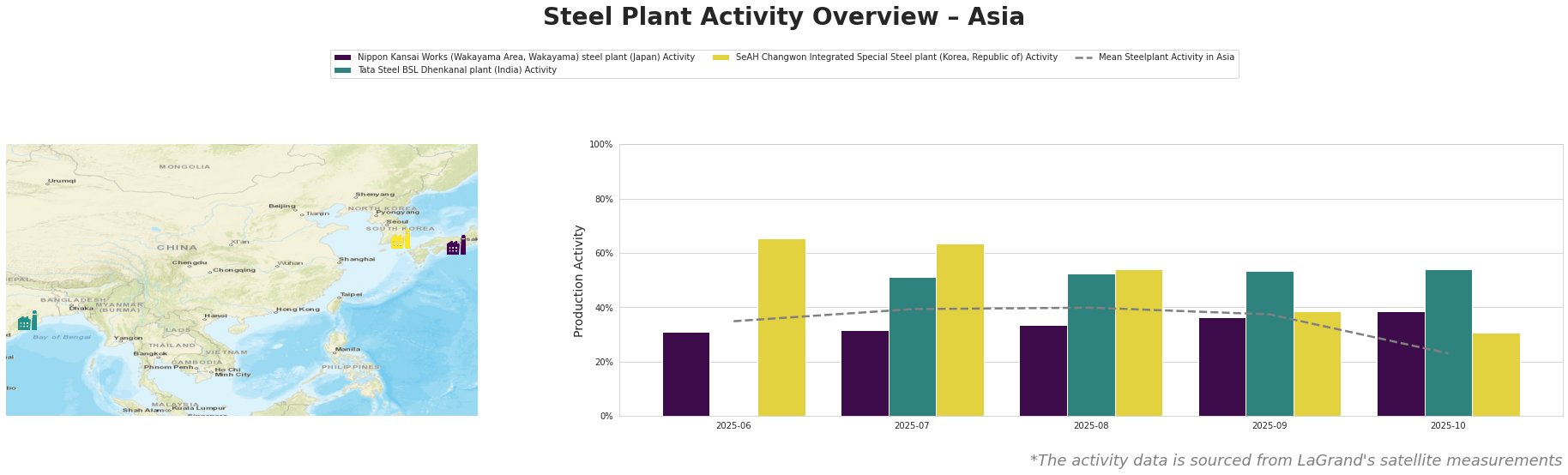

The overall mean steel plant activity in Asia shows significant fluctuations, peaking at 40.0% in August. Notably, SeAH Changwon’s activity remains consistently high, reaching 65.0% in June, which aligns with both Interpipe and Metinvest’s acquisitions as they expand into strategic markets.

Nippon Kansai Works experienced a slight uptick in activity, reaching 39.0% in October, while Tata Steel BSL Dhenkanal’s activity showed resilience consistently above 50% in July and August. This can be linked to the acquisition activities aiming to enhance production capabilities, allowing for optimized resource sharing and potentially increased throughput.

Despite its current downturn to 23.0% in October, the activity is expected to rebound in light of ongoing investments and modernization in response to strengthening export markets.

Implications for Market Analysts and Buyers:

-

Potential Supply Disruptions: Given the fluctuations in mean activity, especially the drop to 23.0% in October, buyers should stay cautious about the supply continuities from Nippon Kansai and consider alternative suppliers, especially when procuring high-demand products.

-

Recommended Procurement Actions:

- SeAH Changwon Implementation: Buyers targeting high-value stainless steel should prioritize SeAH Changwon, leveraging its strong output of up to 65.0%, especially given their focus on sectors like automotive and energy.

- Watch Dhenkanal’s Productivity: With Tata Steel’s stability in output above 50% during critical months, establishing contracts well ahead of time may yield advantages, ensuring supply security as the market adjusts to new acquisitions.

Overall, these developments reflect a transforming landscape in the Asian steel market that professionals must navigate strategically to optimize procurement efficiency.