From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EnginePositive Momentum in Europe’s Steel Market: Activity Ramps Up Amid Key Plant Developments

Recent activities in Europe’s steel market signal a positive trend as notable developments at key plants indicate potential for increased production and innovation. Analyzing the news, “ArcelorMittal Spain tests new BF restart solution“ and “Sidenor Group conducts first green hydrogen combustion tests in steel ladle heating”, we see a direct correlation between the attempts to optimize production capabilities and satellite data indicating changing activity levels at identified steel plants.

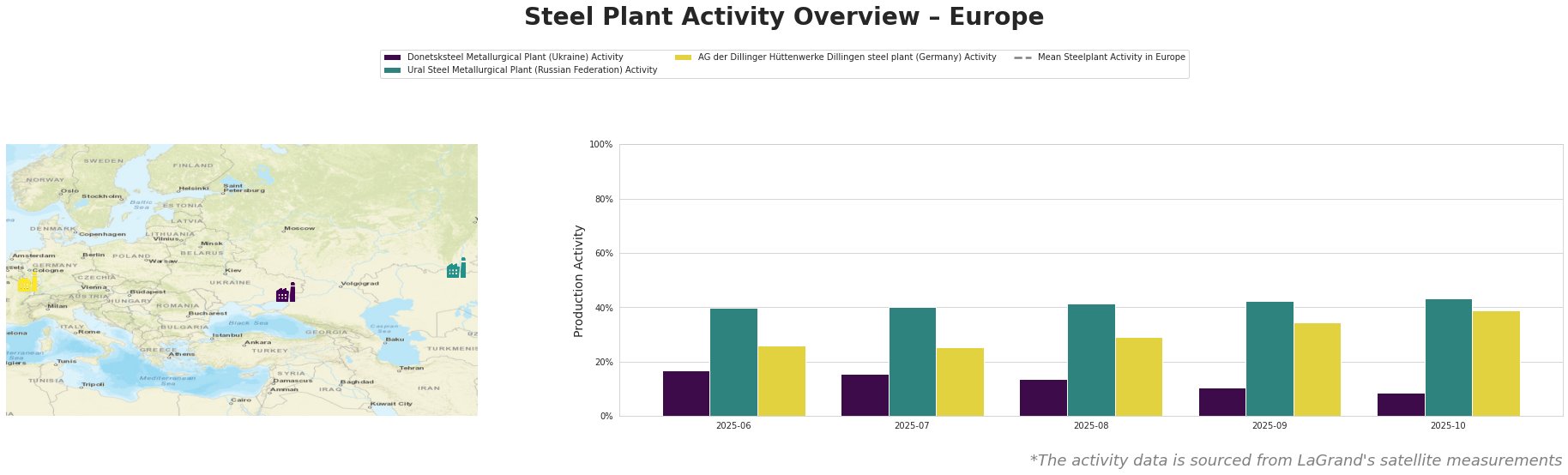

Measured Activity Overview

Activity levels at the Ural Steel Plant have remained relatively stable with a peak at 43% in October, aligning with improved operational strategies and growth in demand for their offerings (pig iron, cast and rolled products). Meanwhile, ArcelorMittal’s efforts to restart blast furnace B at its Gijon plant may directly impact future production levels, as initial pig iron output is expected to stabilize by early 2026—potentially integrating with satellite data showing enhanced activity levels.

Donetsksteel has struggled significantly, with activity dropping to 10% in September and 9% in October; there are no recent news articles to directly link these declines to operational decisions or market factors, suggesting ongoing challenges exterior to recent developments.

Evaluated Market Implications

The challenges at Donetsksteel, alongside the innovative changes at ArcelorMittal and Sidenor, suggest a bifurcated market landscape. While Donetsksteel faces persistently low productivity, ArcelorMittal’s potential revival in Spain and Sidenor’s green initiatives may lead to more competitive pricing as supply dynamics shift.

Steel buyers should consider establishing contracts with ArcelorMittal, particularly for pig iron, as increased production following the Gijon restart could lead to stabilized pricing and availability. Additionally, Sidenor’s strides in hydrogen usage may offer future low-emission steel products, aligning with growing market demands for sustainability.

In summary, while ArcelorMittal and Sidenor are poised to enhance supply capabilities, Buyer attention should shift towards monitoring Donetsksteel’s recovery potential to mitigate risks associated with price volatility and supply shortages.