From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineStrong Steel Market in Europe: Activity Surge Amid Strategic Moves in Spain and Italy

Europe’s steel market sentiment is very positive, driven by significant operational updates and strategic acquisitions. Notably, “ArcelorMittal makes new attempts to restart blast furnace B at its plant in Gijón“ and “Two bids submitted for acquisition of former Ilva plants in Taranto“ reflect a vital shift in production dynamics. Satellite data indicates positive movement in steel plant activities across the region, with particular attention on ArcelorMittal and the former Ilva assets.

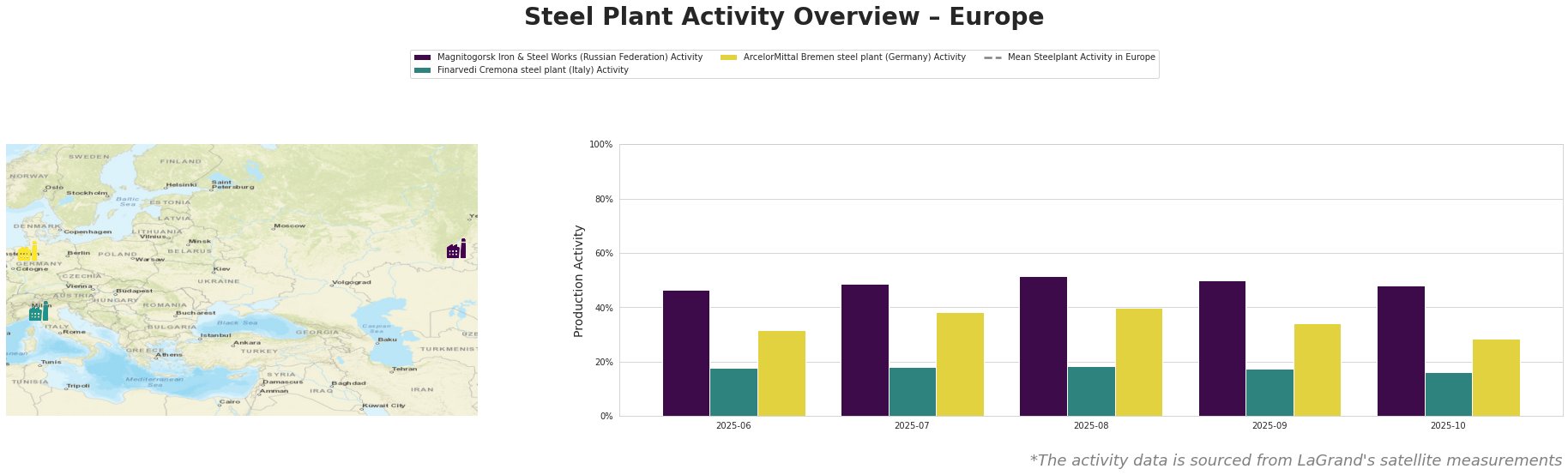

The Mean Steelplant Activity saw a peak at 407779666.0 in July and August 2025. While there was a subsequent decline, activity levels largely remain higher than June. Magnitogorsk Iron & Steel Works exhibited stability with a minor increase from 46.0 to 52.0, indicating strong operational consistency. In contrast, Finarvedi experienced a decrease from 18.0 to 16.0, reflecting potential procurement sensitivities that require attention. The ArcelorMittal Bremen plant’s activities declined from 38.0 to 29.0, observed alongside the news of planned maintenance at the coatings line in Avilés, indicating a direct relationship with operational adjustments.

ArcelorMittal’s Gijón plant is attempting to restart operations at blast furnace B, which has implications for potential supply stabilization in early 2026. Satellite data confirms an uptick in activity, anticipated to stabilize shortly after successful restarting initiatives. The bid submissions for the former Ilva plants at Taranto signal an active interest in revitalizing Italy’s largest steelmaking hub, where plans for decarbonization and new energy solutions could transform regional supply capabilities.

Evaluated Market Implications:

Given the positive sentiment due to operational restarts and acquisition activities, regions involving ArcelorMittal and the Taranto plant are critical for supply continuity. Buyers should consider establishing relationships with Gijón and Taranto sources. For Finarvedi, activity drops suggest caution; procurement strategies should incorporate flexibility to adapt to potential production limitations.