From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EnginePositive Steel Market Trends in Asia: China Faces Overcapacity Challenges Amid Record Exports

Recent developments in the Asian steel market highlight a complex landscape influenced by China’s capacity issues and record export levels. Significant pieces such as “China’s excess capacity problem has no quick fix – WorldSteel“ and “Worldsteel: The problem of excess steel production capacity in China will not be easy to solve“ underscore the challenges stemming from China’s declining domestic demand and increasing export pressures. These factors are observed in satellite data reflecting changes in operational activity across targeted steel plants.

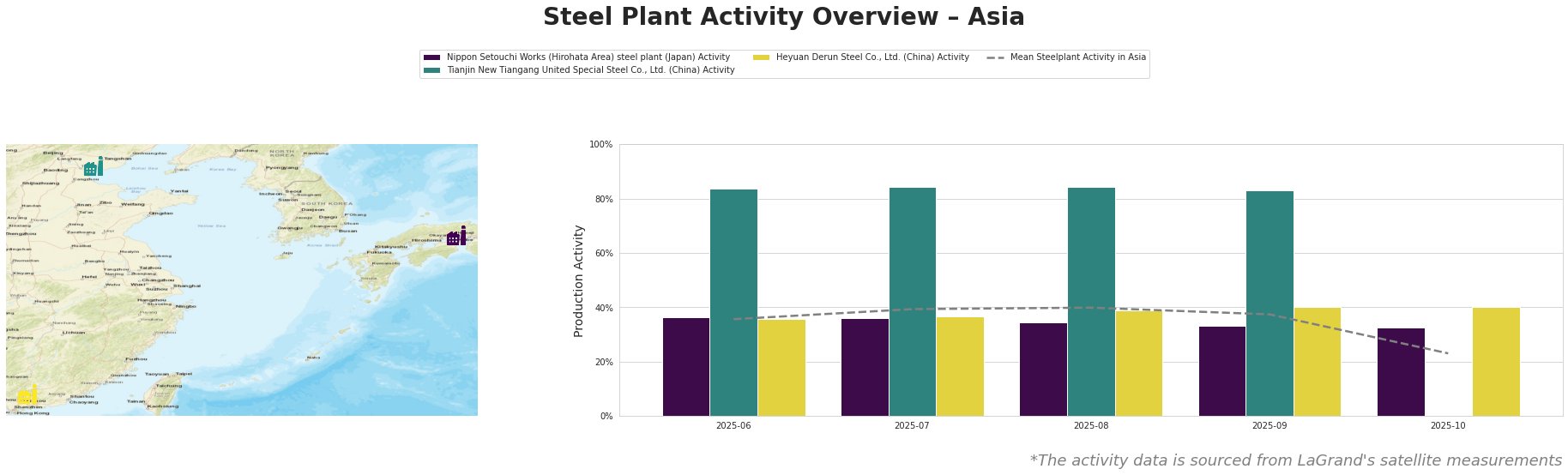

The recent data shows a noted decline in overall steel activity across Asia, with the mean steel plant activity dropping significantly to 23% in October, well below earlier months. Particularly, activity at Tianjin New Tiangang United Special Steel Co., Ltd. remained stable at 84%, indicating resilience amidst broader market challenges. Conversely, the Nippon Setouchi Works exhibited a decline from 39% in July to 23% in October, possibly influenced by supply chain disruptions associated with emerging export regulations.

The Heyuan Derun Steel Co., Ltd. displayed increasing stability, maintaining operations at 40% despite broader market fluctuations. Incorporating insights from “China issues new regulations for exports of steel products“, it’s evident that the recent regulatory shifts could impact operational dynamics and pricing strategies that buyers ought to monitor closely.

Tianjin’s strong performance juxtaposes with China’s challenges outlined by Edwin Basson, as mentioned in “China’s steel surplus becoming increasingly difficult to address”. The anticipated record exports, influenced by declining domestic demand — projected to decrease by 2% in 2025 — face headwinds from rising international trade barriers.

Given these findings, procurement professionals should consider the following actions:

-

Monitor Regulatory Changes: With new export regulations set to affect various steel products effective January 1, 2026, buyers should plan procurement strategies to mitigate potential supply interruptions and cost fluctuations.

-

Diversify Supply Sources: While Tianjin’s stability is promising, fluctuations in Nippon Setouchi’s activity levels suggest potential risks. Establishing alternative supply channels is advisable to hedge against localized disruptions.

-

Engage in Forward Contracts: Utilize the current market dynamics to negotiate long-term agreements at stable pricing, especially with suppliers capable of sustaining higher levels of output amidst the regulatory climate.

In summary, while the overall sentiment remains positive due to robust export levels, steel buyers should remain vigilant about local production variances and regulatory impacts affecting supply chains in Asia.