From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EnginePositive Outlook for Asia’s Steel Market: Activity Trends Linked to Tata Steel’s Expansion Plans

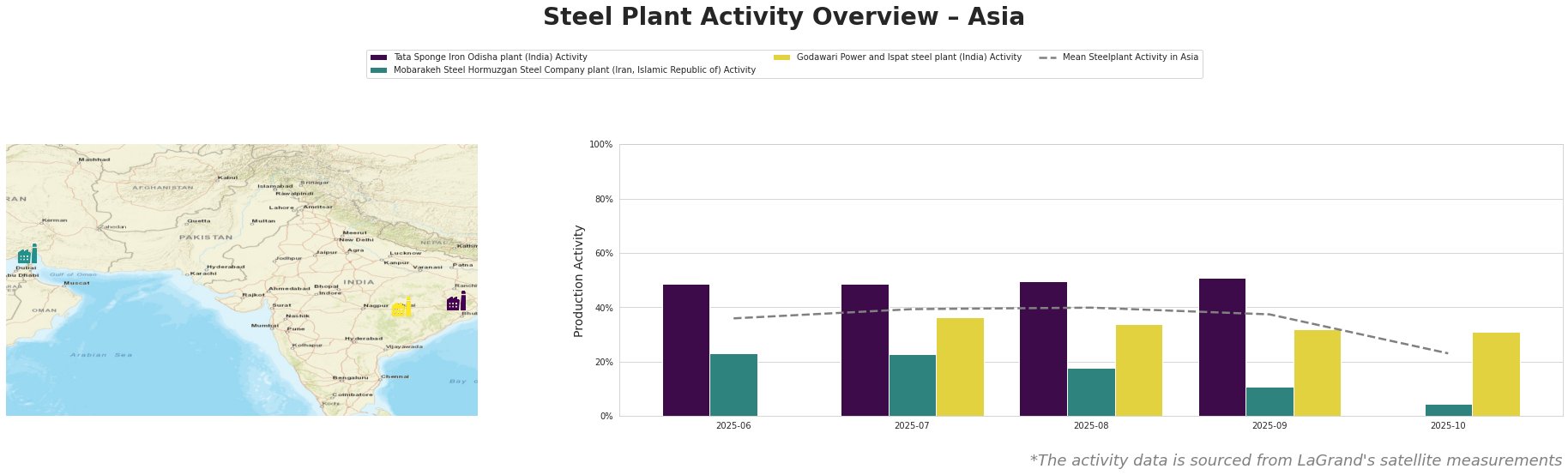

Tata Steel’s commitment to increasing its production capacity in India is a significant development for the Asian steel market. As outlined in “Tata Steel outlines plans to expand capacity in India“, the company plans an expansion that could positively impact regional supply dynamics. This optimism is corroborated by recent satellite observations showing increased activity levels at various steel plants, particularly in connection with Tata’s initiatives, while varying trends at other facilities require attention.

The Tata Sponge Iron Odisha plant has shown a remarkable increase in activity, reaching 51% as of September 2025, an indicator of rising production capability aligned with Tata’s expansion plans. This aligns with the news about Tata Steel’s strategic investments that target enhanced output in key product segments for specific industries, particularly automotive.

In contrast, the Mobarakeh Steel Hormuzgan Steel Company plant’s activity experienced a significant drop to 11% due to factors which do not appear to be directly linked to the underscored news. Similarly, Godawari Power and Ispat demonstrated stability around 31%, suggesting a consistent production level amidst the fluctuations in other facilities. Despite the lack of explicit connections between the observed activities in these plants and the news reports, steady performance at Godawari may imply a resilient market strategy, particularly as supply chains evolve.

The upward trend observed at Tata Sponge Iron aligns with Tata Steel’s proactive measures in expanding its capacity and retail segments. Conversely, any procurement strategy should account for potential disruptions or fluctuations in supply, particularly from Mobarakeh, which may struggle with its market position.

Steel buyers should prioritize securing contracts with Tata Steel, given their potential increase in output and diverse products. Continuously monitor the activity levels and adjust procurement volume from other plants to mitigate risks associated with drops in production or unexpected changes in market conditions. Moreover, exploring partnerships with Tata could lead to improved supply reliability in Asia’s dynamic steel market.