From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineSurge in Asian Steel Plant Activity Amid CBAM Developments Signals Positive Market Outlook

Recent developments in Asia’s steel market exhibit a marked increase in operational activity across key plants, reinforced by the implications of the Carbon Border Adjustment Mechanism (CBAM). Significant news regarding the Provisional CBAM calculation values pass committee vote and EU Commission finalizes CBAM benchmarks, default values ahead of January 2026 launch has highlighted crucial milestones that are likely to affect steel import costs, particularly from countries like China and India, and seems to correspond with observed increases in plant activity.

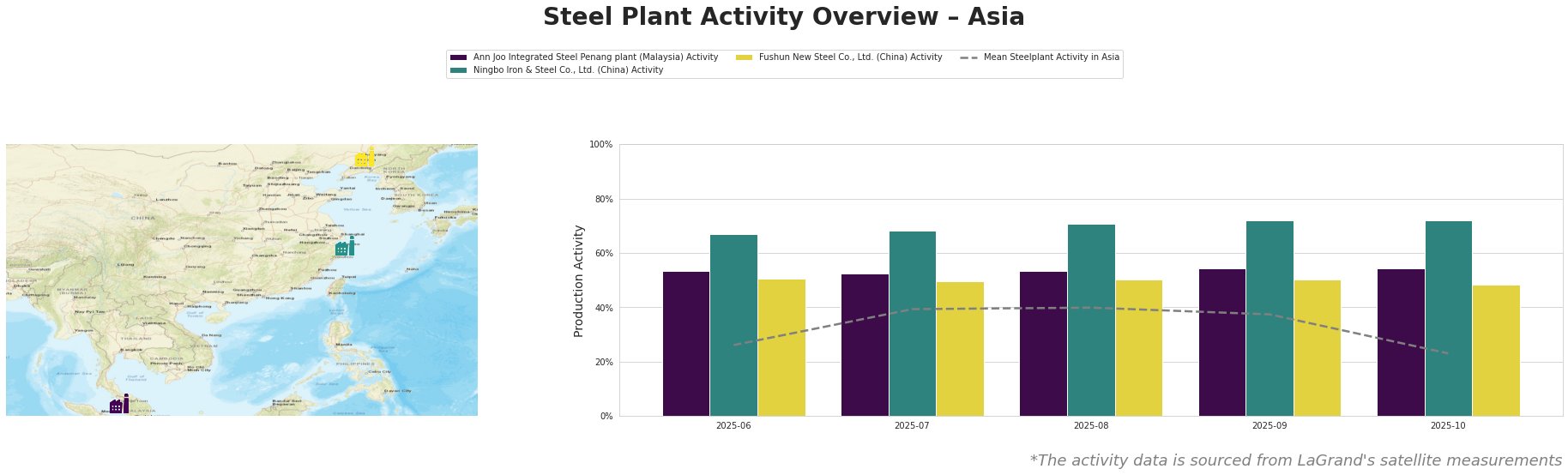

Measured Activity Overview

The Ningbo Iron & Steel Co., Ltd. shows a robust peak activity of 72% in the months leading to October 2025, outstripping the mean activity across Asia, indicating significant operational readiness. Although the mean overall activity dipped to 23% in October, the Ann Joo Integrated Steel Penang plant and Fushun New Steel Co., Ltd. remained relatively stable, with their activity levels at 54% and 48%, respectively. No direct link to recent changes could be established.

Plant Insights

The Ann Joo Integrated Steel Penang plant, located in Malaysia, operates with a crude steel production capacity of 500,000 tonnes and primarily uses the Blast Furnace (BF) method, complemented by an Electric Arc Furnace (EAF). The activity measurement is stable, maintaining impressive levels nearing 54%, yet does not show a direct connection with the aforementioned CBAM developments. Their strong emphasis on responsible steel production positions them well in response to evolving global standards.

Conversely, the Ningbo Iron & Steel Co., Ltd. in Zhejiang, with a capacity of 4 million tonnes, reflects an impressive gain in activity, indicative of heightened demand or production capabilities at 71% in August. It relies solely on BOF technology without an EAF, signaling a strategic focus on integrated production pathways. Potential influences from the CBAM benchmarks could pose challenges for their export competitiveness if import costs rise significantly.

Finally, the Fushun New Steel Co., Ltd., holding a capacity of 3.3 million tonnes, has consistently shown activity at approximately 50%. While no immediate correlations to the recent developments were explicitly established, its operational status remains resilient in the face of external pressures.

Evaluated Market Implications

The observed peaks in operational levels, particularly in Ningbo, underscore a proactive response from major players amidst impending regulatory frameworks such as CBAM. The steel procurement sector should take note of potential supply disruptions stemming from increased costs due to stricter emissions reporting standards in Europe, particularly affecting Chinese and Indian imports.

Steel buyers should consider increasing procurement from regions showing resilience, such as Malaysia’s Ann Joo plant, while also preparing for significant shifts in pricing structures due to EU benchmark implementations starting January 2026. As operational levels fluctuate in response to market demands and regulatory changes, strategic purchasing plans must be adaptable to navigate the evolving landscape effectively.