From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineSteel Market Overview in Oceania: Neutral Sentiment Amid Stable Activity Levels

In Oceania, steel market activity remains neutral as recent developments have not shifted buyer sentiment significantly. The articles “European domestic HRC prices decrease slightly, the market expects new rules” and “Slow demand, ample stocks keep European HRC market flat as industry digests CBAM updates“ relay insights into unchanged trading conditions that are echoing through the Oceania market as local producers continue to navigate these broader trends with steady production levels.

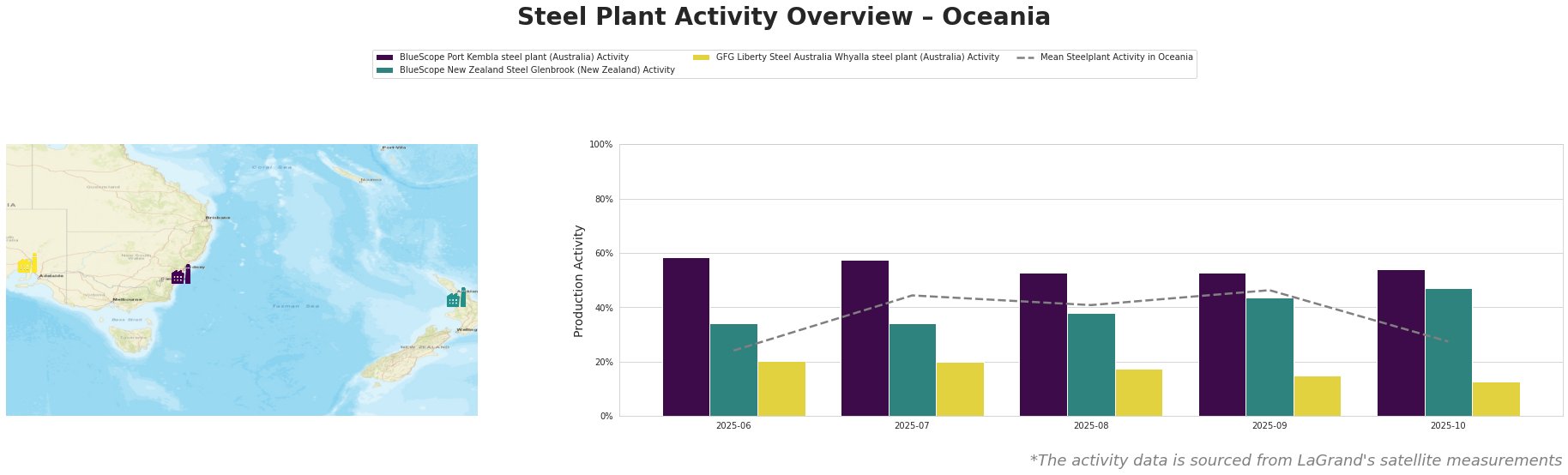

Overall, the mean activity across plants decreased notably from 44.0% in July to just 27.0% by October 2025, reflecting a downward trend in demand and utilization. BlueScope Port Kembla displayed stable operations, with a slight fluctuation from 59.0% in June to 54.0% in October. In contrast, activity at GFG Liberty Steel fell sharply from 20.0% to 13.0%. The stability at BlueScope suggests a more resilient positioning amidst the wider slowdown, while the Whyalla plant’s decline underscores deeper challenges tied to market demand.

BlueScope Port Kembla, with a capacity of 3.2 million tonnes of crude steel, operates primarily on a basic oxygen furnace (BOF) technology to produce hot rolled coils and plates aimed at the building sector. Its consistent activity levels of around 54% in October indicate it has managed inventory pressures better than others. The absence of recent regulatory hurdles in Australia may contribute to its resilience, differentiating it from the broader European market dynamics as noted in articles discussing price stability amid regulatory uncertainty.

BlueScope New Zealand Steel Glenbrook, utilizing direct reduced iron (DRI) technology, has seen marginal variations but maintained a decent activity level of 47% in October, strongly linked to the demand for semi-finished and finished rolled steel products. Its stable production hints at relatively firm local market conditions, although external factors from Europe may apply pressure in the longer term.

Conversely, GFG Liberty Steel Australia’s Whyalla plant, which predominantly features BOF operations, has noticeably reduced its activity to 13%—reflecting a larger reliance on external orders. This substantial drop correlates with the lack of purchasing urgency described in “European steel HRC trading slow, limited flexibility on offers, buyers well-stocked“, indicating a clear connection to inventory strategies influencing local market dynamics.

Potential supply disruptions could be anticipated from GFG Liberty Steel, as its low production levels may struggle to meet any sudden upticks in demand, especially if European market conditions influence import strategies. Steel buyers should consider accelerating their procurement from BlueScope Port Kembla, which appears comparatively robust, to mitigate risks associated with possible shortages down the line, as indicated by the current trends in plant utilization and external market influences.