From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineSteel Market Insights: Europe’s Activity and Trends Signaling a Very Positive Outlook

Recent developments in Europe’s steel industry highlight significant market activity, with notable trends stemming from both domestic and international dynamics. Citing the news article “France’s steel product export value down 3.5 percent in Jan-Sept 2025“, as well as “France’s steel product import value down 10.7% in Jan-Sept 2025,” the steel manufacturing output shows shifts that warrant close attention from buyers and analysts. These changes appear to correlate with observed increases in activity at several key plants, underscoring the need for proactive procurement strategies.

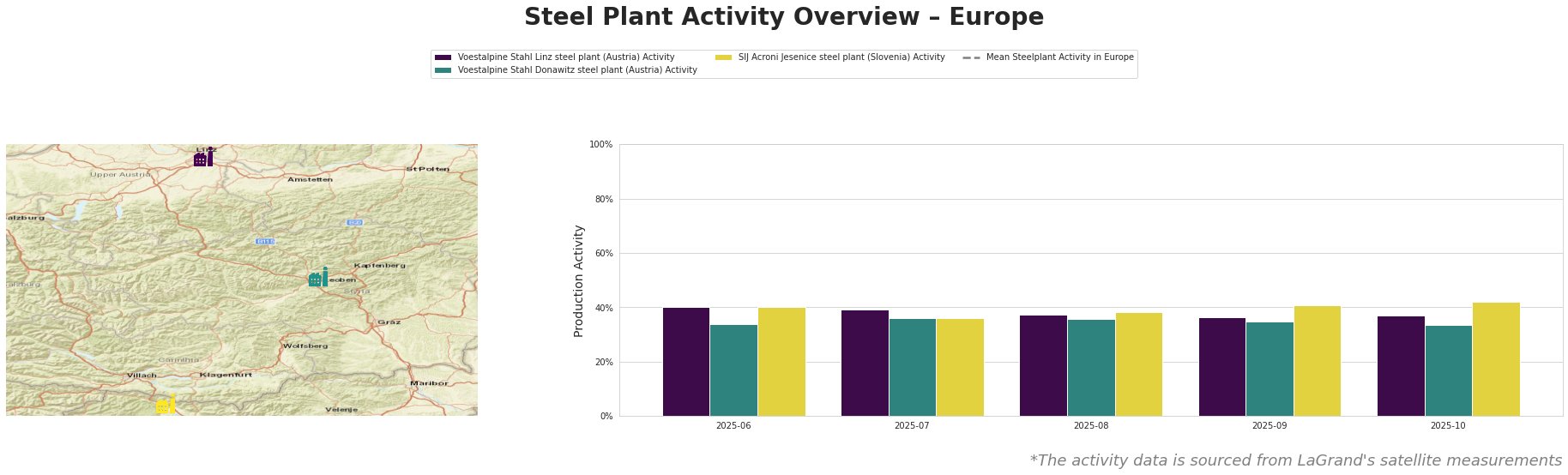

Measured Activity Overview

Observations reveal that the overall mean activity in European steel plants experienced fluctuations over recent months, peaking at 40% before declining to 36% in September and recovering to 37% in October. Notably, the SIJ Acroni Jesenice steel plant demonstrated a robust increase from 41% in September to 42% in October. Conversely, the Voestalpine Stahl Linz and Donawitz plants exhibited relatively stable but lower activity levels, signaling that while there is a downward trend in export values, local production remains resilient, as noted in “France’s metal industry output up one percent in Oct 2025 from Sept“.

Evaluated Market Implications

The relationship between declining export and import values, particularly in France’s steel market, suggests a tightening supply chain and potential disruptions in procurement. Notably, the decreased import values by 10.7% signal that international competitors might be facing challenges, justifying a closer look at local supply chains.

Steel buyers should closely monitor the SIJ Acroni Jesenice steel plant, which is currently performing stronger than its counterparts, suggesting a steady output that may cater effectively to demand spikes. The increase in production capacity at this plant may present opportunities for buyers to secure advantageous procurement terms.

Moreover, fluctuations in Voestalpine Stahl’s activities, in light of the broader market decline as cited in the articles, may necessitate immediate procurement actions to secure favorable pricing before further decreases in production activity occur.

In conclusion, proactive procurement strategies leveraging the rising activity of key plants like SIJ Acroni Jesenice and considering localized production shifts in light of decreasing imports and exports will be crucial for buyers to navigate the evolving European steel landscape.