From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineChina’s Steel Market Surge: Activity Rises Amid EU CBAM Developments

Significant developments in China’s steel industry have emerged following the approval by the Provisional CBAM calculation values pass committee vote and the EU Commission finalizes CBAM benchmarks, default values ahead of January 2026 launch. These regulatory changes appear linked to satellite-observed upticks in activity across several key steel plants.

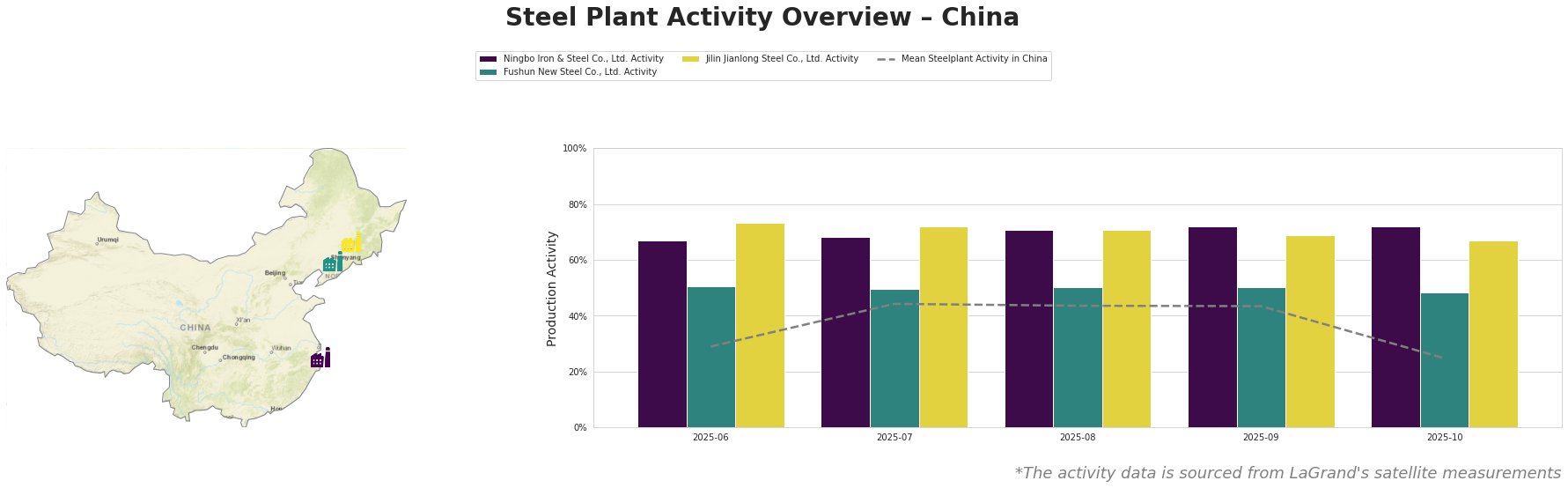

In June 2025, activity at Ningbo Iron & Steel Co., Ltd. peaked at 67%, while Jilin Jianlong Steel Co., Ltd. reached 73%. Following the news articles detailing changes in EU carbon regulations, there was a notable increase in July and August activities, with average activity levels climbing to 44% in July. However, by October, the mean activity saw a drop to 25%, but Ningbo maintained a stable level of 72%. This stability, particularly within Ningbo, does not correlate directly with the EU developments but indicates resilience amidst fluctuating market dynamics.

Ningbo Iron & Steel Co., Ltd., located in Zhejiang, operates primarily as an integrated steel producer using blast furnace and basic oxygen furnace technologies. Despite variability in mean activity levels, it maintained strong operational metrics with a focus on various structural steels. The alignment with EU adjustments suggests enhanced competitiveness in response to foreign market pressures emerging from CBAM regulations.

Fushun New Steel Co., Ltd. based in Liaoning, displayed less variation in activity, remaining around 50% through the observed months. Its significant workforce and the range of products, including high-quality carbon structural steels, position it to potentially benefit from rising domestic demand despite fluctuations in export opportunities due to stringent European regulations.

Jilin Jianlong Steel Co., Ltd., while experiencing a drop in activity after achieving 73% in June, maintained a robust production capacity for automotive structural steel and various other forms, indicating resilience but reflecting the broader market adjustability in response to the EU’s evolving CBAM strategy.

The EU carbon regulations imply potential increases in costs for imports from China, particularly through raise in default emissions values, urging Chinese producers to enhance production efficiency and emissions data tracking. Steel buyers should closely monitor these trends and consider immediate procurement to hedge against potential cost increases due to rising CBAM liabilities against Chinese imports.

Given the observed stable activities combined with upcoming regulatory impacts, steel buyers are advised to secure contracts proactively with Ningbo and Jilin plants while remaining agile to shifts following the final CBAM benchmarks implementation.