From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineEurope Steel Market Report: Updates from Ukraine and EU Steel Pipe Production Trends – December 2025

Ukraine’s steel sector is showing positive growth amid an overall neutral market sentiment in Europe. Recent articles highlight significant changes: “Ukraine has increased steel production and consumption“ reveals that apparent steel consumption in Ukraine grew by 10.9% in 2024, while “Pipe production in the EU falls for the sixth consecutive quarter – EUROFER“ indicates ongoing declines in EU steel pipe production, impacting suppliers and demand.

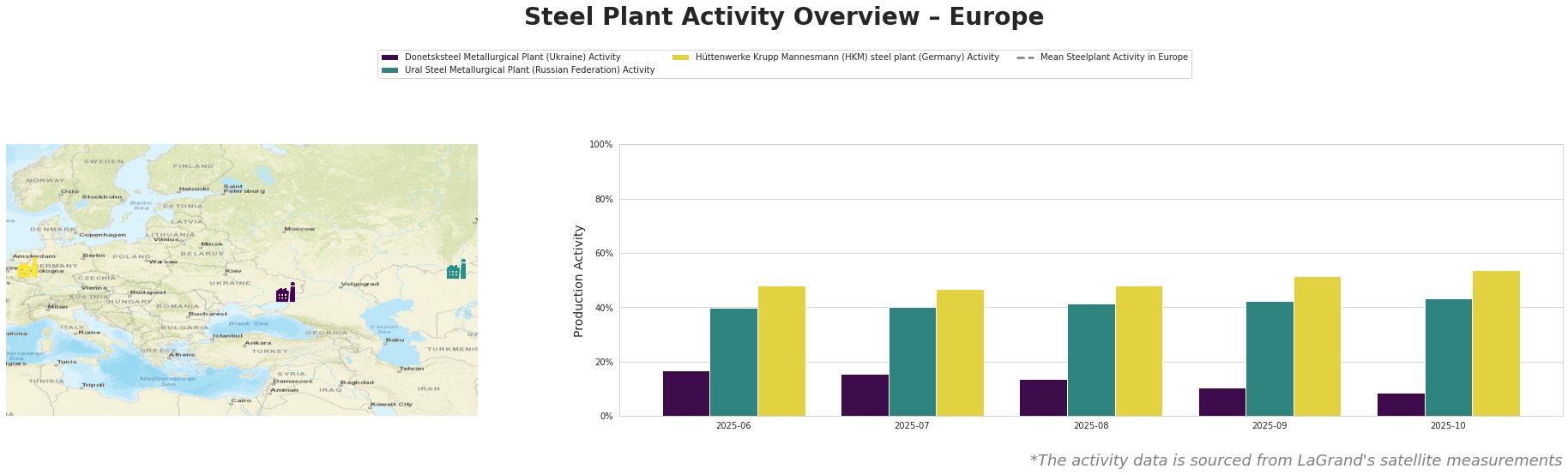

Measured Activity Overview

The data indicates notable declines in activity levels for all observed plants in Europe, with a significant drop in Donetsksteel from 17.0% in June to 9.0% by October 2025. The Ural Steel plant saw a more gradual downturn from 40% to 43% over the same period, while HKM demonstrated slightly more resilience, increasing from 48% up to 54% in October. However, the overall mean steelplant activity trended downwards through this period, indicating a weakening industry context.

Steel Plant Insights

Donetsksteel Metallurgical Plant

Located in Donetsk, this facility focuses primarily on pig iron production with a capacity reaching 1500 tons. Activity dropped considerably from 17% in June to 9% in October, reflecting possible impacts from supply chain and geopolitical struggles, consistent with the challenges outlined in “Pipe production in the EU falls for the sixth consecutive quarter – EUROFER.” This connection establishes that ongoing market crises play a role in operational challenges.

Ural Steel Metallurgical Plant

Based in Orenburg, Ural Steel has a substantial crude steel capacity of 1600 tons and produces a diverse range of semi-finished products, including flat products. Though activity levels remained relatively stable between 40% and 43%, it still reflects general industry downturns noted in the EUROFER report. In the context of the rising pig iron output reported in “Ukraine reports 10.2 percent rise in pig iron output for Jan-Nov 2025,” it suggests Ural Steel’s potential sourcing challenges for inputs, given global supply changes.

Hüttenwerke Krupp Mannesmann (HKM)

This German plant operates at a higher capacity with a diverse product lineup, achieving activity levels up to 54%. The ongoing challenges in the EU market are acute, as detailed in the article discussing EU pipe production declines, emphasizing reduced demand. HKM’s relative resilience hints at a strategic focus on segments less affected by the crisis, yet buyers should note the overall cautious market outlook.

Evaluated Market Implications

In response to a challenging market characterized by declining steel pipe production and geopolitical tensions affecting supply chains, steel buyers should consider the following actions:

- Strategic Sourcing: Engage closely with suppliers in Ukraine, as “Ukraine produced 5.97 million tons of rolled steel in January-November“ suggests potential capacity for export that may not correlate with supply chain disruptions.

- Evaluate Alternatives: Given that Ural Steel’s activity levels remain constrained, buyers should diversify procurement sources to mitigate risks associated with potential supply shortages.

- Monitor EU Market Changes: With pipe production plummeting, look for firms like HKM that maintain higher activity levels, as they may have more flexibility in adapting to market demands.

These insights drawn from recent news and activity data outline a nuanced market positioning for steel procurement in Europe, reflecting a complex interplay between rising output in Ukraine and stagnant demands within the EU.