From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineRobust Gains in the Russian Federation Steel Market: EVRAZ and Severstal Drive Innovations for Efficiency

Recent developments in the Russian steel industry highlight a markedly positive shift, as evidenced by rising activity levels within key plants aligning with significant enhancements in operational efficiencies. The news articles “EVRAZ ZSMK launched a production situational analysis center“ and “Severstal has launched a maintenance and maintenance complex at the Pechegubskoye field“ underscore these changes, linking improved activity levels at EVRAZ and Severstal’s facilities to their strategic investments in production technology and maintenance capabilities.

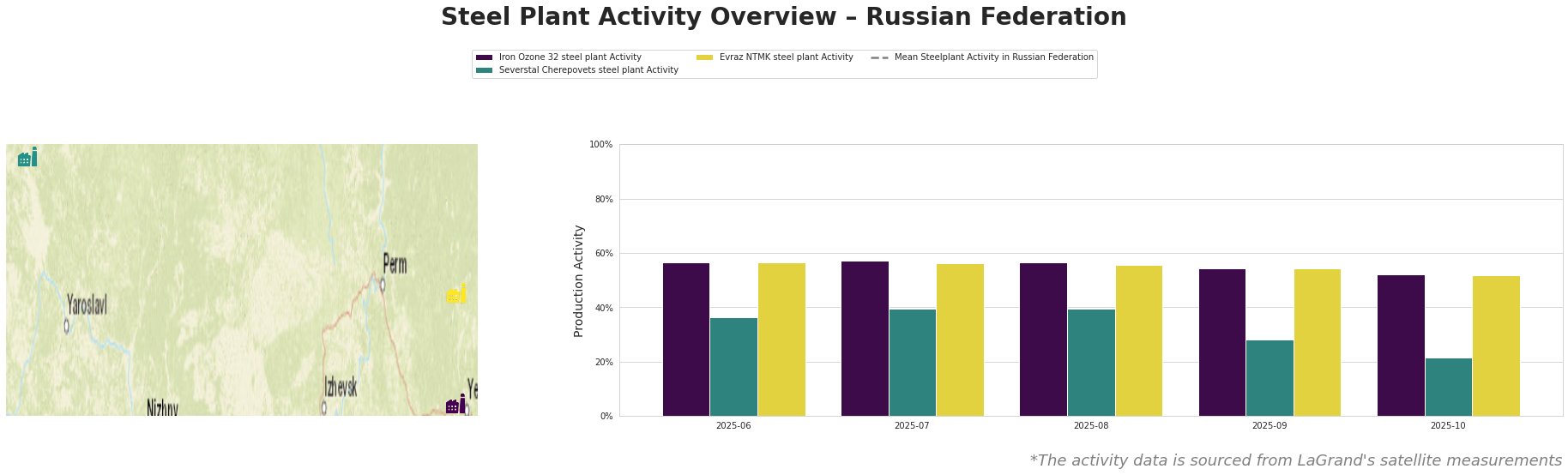

Both Severstal Cherepovets and Evraz NTMK exhibited notable fluctuations in activity levels, with Severstal declining to 22% by the end of October, insufficiently supported by its recent investments. Conversely, Iron Ozone 32 maintained a steady 56%, aligning with sector trends yet emphasizing its constrained production potential. The introduction of Severstal’s maintenance complex aims to stabilize future performance, while EVRAZ’s situational analysis center promises to mitigate breakdown risks, potentially reversing downward activity trends moving forward.

Iron Ozone 32 Steel Plant

The Iron Ozone 32, located in Sverdlovsk, achieved 56% activity levels consistently through the observation period. This plant employs an Electric Arc Furnace (EAF) for a crude steel capacity of 1.25 million tonnes, producing billets primarily for the energy sector. Despite stable operations, the lack of recent news indicates that no significant operational enhancements were reported, which may limit growth potential compared to its peers.

Severstal Cherepovets Steel Plant

Severstal Cherepovets, a formidable player with a capacity of 12 million tonnes, experienced a significant drop in activity from 40% to 22% over the measured months. This decline correlates directly with the anticipated enhancements promised by the launch of a maintenance complex at the Pechegubskoye field, indicating a strategic shift towards operational resilience. As specialized maintenance is expected to enhance equipment availability, the recovery trajectory for activity can be anticipated by early 2026.

Evraz NTMK Steel Plant

Evraz NTMK, known for its integrated steelmaking processes, maintained consistent activity around 56% amidst minor fluctuations. This stability correlates with the advancements linked to the establishment of the production situational analysis center, which emphasizes real-time monitoring and predictive maintenance capabilities. The optimized operations may serve as a solid foundation for scaling production and enhancing supply security.

Evaluated Market Implications

With the ongoing establishment of advanced monitoring and maintenance facilities by Severstal and EVRAZ, potential supply disruptions could be mitigated, significantly throughout the areas served by these plants. Steel buyers should capitalize on the current operational efficiency trends and consider procurement strategies that anticipate an increase in supply as these facilities optimize their processes. Specifically, planning purchases that rely on the output from Severstal and EVRAZ should be prioritized, as activity levels are poised for enhancements in coming months. The positive market sentiment and sustained operational stability across these key players create an optimistic outlook for the overall steel market within the Russian Federation.