From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EnginePositive Trends in Asia’s Steel Market: Insights from Plant Activities and Import Dynamics

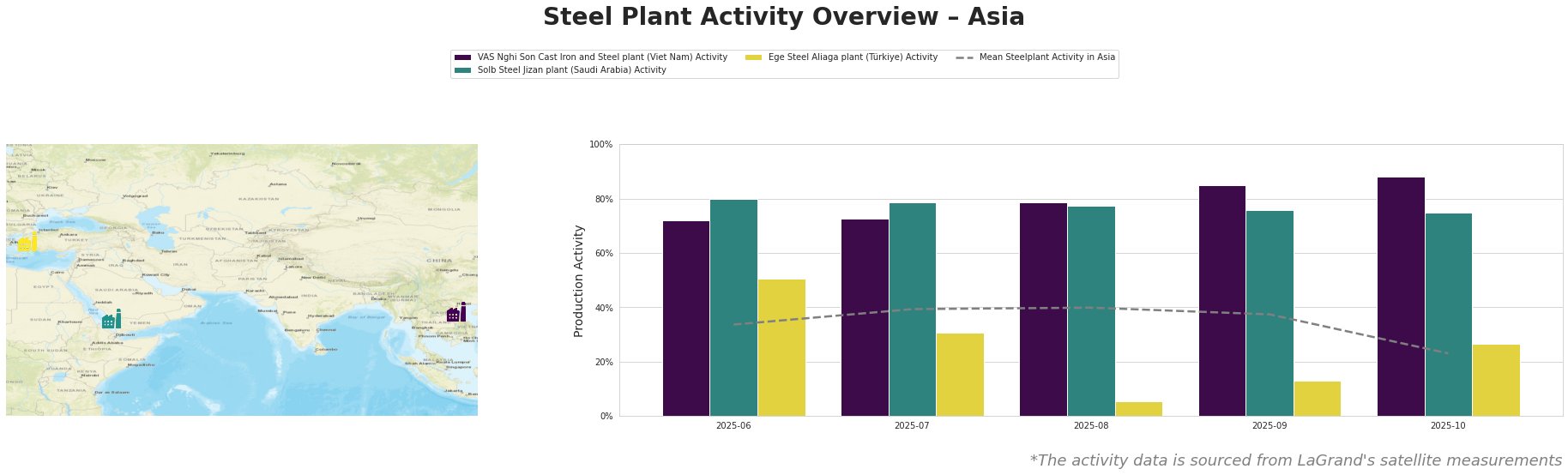

Recent developments in Asia’s steel market have showcased a predominantly positive sentiment, with key indicators driven by activity changes at pivotal steel plants and heightened iron ore imports. Notably, the article “India increases iron ore imports amid shortage of high-quality raw materials“ underlines the surge in India’s imports to over 10 million tons, well-aligned with satellite-observed spikes in activity at the VAS Nghi Son Cast Iron and Steel plant, which showed significant operational activity peaking at 88% in October 2025. Conversely, the article “Indian steel market stagnation worsens in Nov’25, outlook remains gloomy“ illustrates ongoing price declines in the steel sector, further emphasizing the market’s nuanced dynamics.

Activity levels at the observed plants reflect significant variability. The VAS Nghi Son Cast Iron and Steel plant in Vietnam displayed a peak activity level of 88% in October 2025, indicative of strong production output amidst higher ore availability. In contrast, the Solb Steel Jizan plant maintained robust performance, though at slightly lower levels, peaking at 80% in June. Ege Steel Aliaga, however, showed noteworthy declines, hitting a low of 5% in August, suggesting struggles likely related to market fluctuations discussed in “Indian steel market stagnation worsens in Nov’25, outlook remains gloomy”.

For each plant, shifts in activity correlate with regional market dynamics. The VAS Nghi Son is increasingly capitalizing on import-driven demand for high-quality ore, as indicated by the Indian market’s shift to sourcing from overseas in response to domestic shortages. The Solb Steel Jizan plant, while stable, could face risks from tightened international supplies linked to fluctuations noted in Vale’s reduced production forecast in “Vale lowers its forecast for iron ore production in 2026.” In contrast, Ege Steel Aliaga’s low output levels suggest challenges in securing competitive pricing against fluctuating import duties discussed in “India: Bulk HRC imports fall by nearly 55percent year-on-year in Nov’25 even as provisional safeguard duty expires.”

From these insights, procurement professionals should be aware of the following actionable recommendations:

– Favor sourcing from the VAS Nghi Son as it ramps up production capabilities in response to increasing demand and availability of quality ore.

– Monitor supply channels from the Solb Steel Jizan plant, especially concerning the stability of iron ore imports amidst the forecasted production cuts from Vale.

– Assess pricing strategies for Ege Steel Aliaga, as its performance may be influenced significantly by the evolving import/export landscape post-safeguard duty lapse.

Addressing these factors will enable buyers to secure competitive advantages and mitigate risks associated with supply disruptions in Asia’s dynamic steel landscape.