From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineAsia Steel Market: India’s Import Surge Offsets Regional Slowdown, Vietnam Plant Booms

Asia’s steel market presents a mixed picture as of early December 2025. India’s increased iron ore imports contrast with sluggish domestic steel demand, while specific plant activity reveals localized supply dynamics. According to “India increases iron ore imports amid shortage of high-quality raw materials,” India’s iron ore imports have surged, potentially impacting regional supply chains. No direct link can be established between this news and satellite-observed plant activity. However, “Indian steel market stagnation worsens in Nov’25, outlook remains gloomy” highlights challenges within the Indian market.

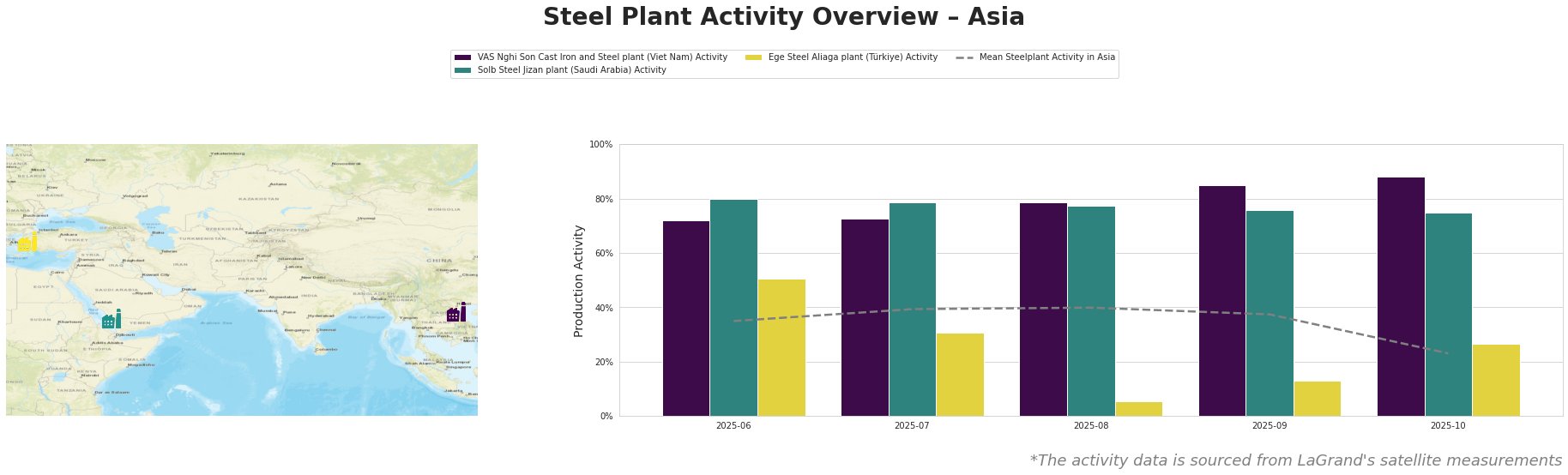

Here’s a look at recent monthly activity trends observed via satellite:

The mean steel plant activity in Asia experienced a sharp decline in October 2025, dropping to 23%, significantly below the previous months. VAS Nghi Son Cast Iron and Steel plant shows consistently high activity. Solb Steel Jizan plant shows high, but slowly decreasing activity. Ege Steel Aliaga plant activity is highly volatile and lower than the average. No direct connection between these plant activities and the provided news articles can be established.

VAS Nghi Son Cast Iron and Steel plant, located in Thanh Hoa, Vietnam, boasts a crude steel capacity of 3150 ttpa, relying on electric arc furnaces (EAF) for production of semi-finished and finished rolled products like billet, rebar, and wire rod. Observed activity has consistently remained high, peaking at 88% in October 2025, far exceeding the Asian average. This suggests strong localized demand and efficient operations. There is no evidence in the provided news articles that directly explain this observed activity.

Solb Steel Jizan plant, situated in the Jizan Region of Saudi Arabia, possesses a crude steel capacity of 1200 ttpa, utilizing EAF technology to produce billet, rebar, rebar in coil, and wire rod. Its activity has been consistently high but slightly decreasing, from 80% in June to 75% in October 2025, but still significantly higher than the Asian average. There is no evidence in the provided news articles that directly explain this observed activity.

Ege Steel Aliaga plant, located in İzmir, Türkiye, has a crude steel capacity of 2000 ttpa, using EAF technology for rebar and wire rod production, powered by the İzdemir Enerji power station. Observed activity has been highly volatile, dropping to just 5% in August 2025 and peaking at 50% in June. In October it reached 27%. This is mostly lower than the Asian average. There is no evidence in the provided news articles that directly explain this observed activity.

Evaluated Market Implications:

Given the “Indian steel market stagnation worsens in Nov’25, outlook remains gloomy,” steel buyers should exercise caution regarding potential price volatility in India, particularly for rebar and wire rod due to high inventory. Consider diversifying procurement sources beyond India in the short term.

The consistently high activity at VAS Nghi Son Cast Iron and Steel plant suggests a stable supply source in Vietnam. Buyers seeking semi-finished products in Southeast Asia could consider this plant a reliable option.

The volatility observed at Ege Steel Aliaga plant indicates potential supply uncertainty. Buyers should closely monitor the Turkish steel market and explore alternative suppliers.