From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineIndia Steel Market Surges: JFE Investment & Plant Revivals Signal Strong Growth

India’s steel sector is poised for significant expansion. The revival of defunct plants and major foreign investments, are reshaping the market landscape. News articles are supported by observed increases in average steel plant activity levels, particularly in JSW steel facilities.

The planned revival of the VISL steel mill, as reported in “India’s steel ministry prepares $448 million DPRs to revive defunct VISL steel mill,” indicates government efforts to boost domestic production. JFE Steel’s substantial investment in a joint venture with JSW, detailed in “JFE Steel to establish joint venture with India’s JSW worth $3.4 billion” and “Integrated Steel Plant Joint Venture with JSW Steel in India,” directly relates to observed activity increases at JSW plants, suggesting preparation for enhanced production capacity.

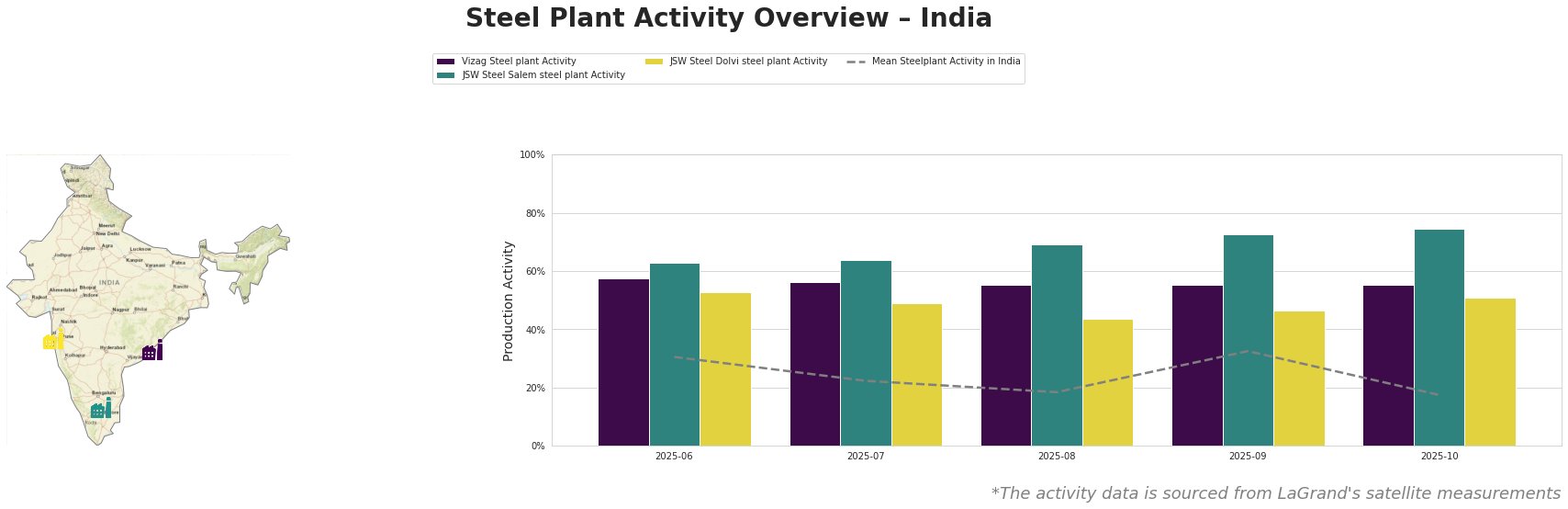

Overall activity levels have been volatile. The mean activity across all observed Indian steel plants peaked in September at 33%, before declining to 17% in October. Vizag Steel Plant shows relatively stable activity levels around 55-58% throughout the period. JSW Steel Salem Plant exhibited the highest activity levels and a rising trend, peaking at 75% in October. JSW Steel Dolvi plant activity decreased to a low of 44% in August, followed by fluctuating increases to 51% in October.

Vizag Steel Plant: Located in Andhra Pradesh, Vizag Steel Plant has a crude steel capacity of 7.3 million tons per annum (MTPA), relying on integrated BF-BOF processes. Satellite data indicates relatively stable activity around 55-58% between June and October, despite fluctuations in the overall Indian market. No direct connection to the named news articles can be established based on this stable trend.

JSW Steel Salem Plant: Situated in Tamil Nadu, JSW Steel Salem produces approximately 1.03 MTPA of crude steel using integrated BF and EAF processes. The satellite data shows a clear upward trend in activity, rising from 63% in June to a peak of 75% in October, significantly exceeding the mean Indian steel plant activity. This increase aligns with JFE Steel’s investment in JSW, detailed in “JFE Steel to establish joint venture with India’s JSW worth $3.4 billion” and “Integrated Steel Plant Joint Venture with JSW Steel in India,” suggesting increased production in anticipation of the joint venture’s expansion plans.

JSW Steel Dolvi Plant: Located in Maharashtra, JSW Steel Dolvi possesses a crude steel capacity of 5 MTPA, utilizing both integrated BF and DRI-EAF processes. The plant’s activity decreased to a low of 44% in August, followed by fluctuating increases to 51% in October. This plant is also impacted by the JFE steel investment but no direct link for the fluctuating trend in observation data can be established.

The JFE/JSW joint venture, as highlighted in “JFE Steel to establish joint venture with India’s JSW worth $3.4 billion,” aims to significantly increase production at JSW’s integrated plant. This investment could lead to increased demand for iron ore and coking coal, potentially impacting raw material prices and supply chains. The revival of VISL, as per “India’s steel ministry prepares $448 million DPRs to revive defunct VISL steel mill,” could introduce additional supply into the market, particularly for railway and defense sectors.

Procurement Recommendations:

- Monitor JSW Steel’s output: Given the rising activity at JSW Steel Salem and the impending capacity expansion due to the JFE investment, buyers should closely monitor JSW’s production and pricing strategies. Secure supply agreements early to capitalize on potential increased output.

- Assess Raw Material Supply Chains: The increased production from JSW and the potential revival of VISL will likely increase demand for iron ore and coking coal. Procurement teams should assess their raw material supply chains for potential bottlenecks and price volatility. Diversification of supply sources may be necessary.

- Evaluate VISL’s Revival Impact: Stay informed about the progress of the VISL revival, as it could offer a new supply source, particularly for specific steel grades used in railway and defense applications. Early engagement with SAIL regarding VISL’s future production plans could provide a competitive advantage.