From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineEuropean Steel Production Diverges: Austria Surges as Italy Exports Plummet; Procurement Strategies Key

Europe’s steel market presents a mixed picture. While Austria shows robust growth, other regions face challenges. Activity data analysis indicates variations at the plant level. “Austria increased steel production by 35.8% y/y in October” and “Belgium increased steel production by 3.4% m/m in October” suggest a potential regional divergence in steel production. These increases might be linked to observed activity at individual plants (see measured activity overview), but direct correlations are not immediately apparent without further data. In contrast, “Italy steel exports decline to ten-year low” highlights weakening demand and export challenges in Southern Europe.

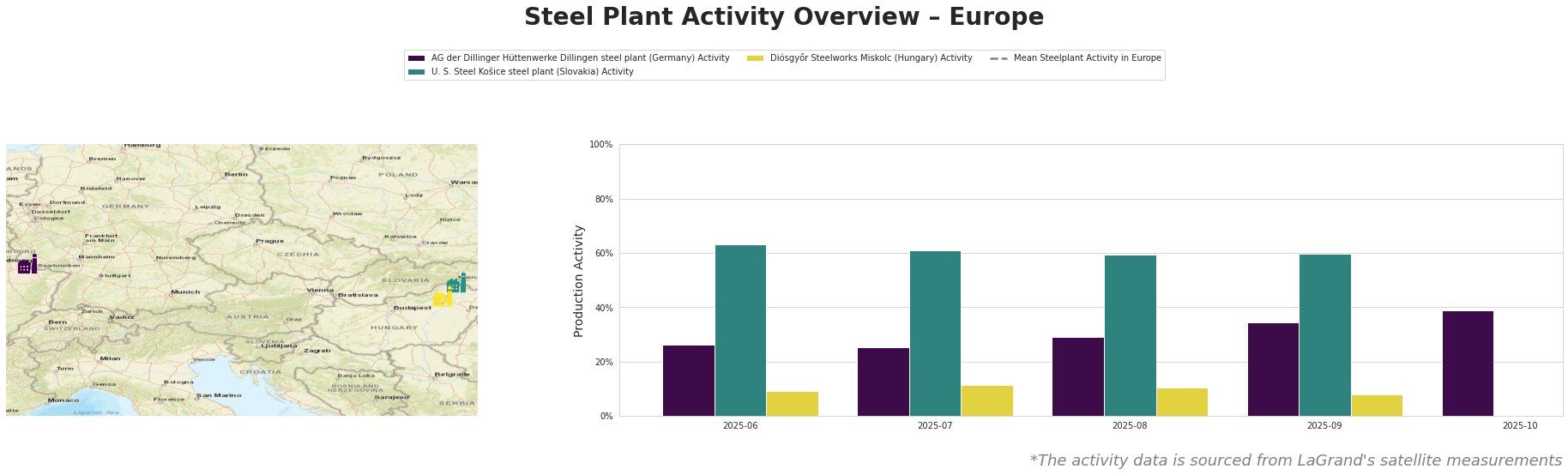

Measured Activity Overview

The mean steel plant activity in Europe fluctuated over the months, peaking in July and August. Activity at AG der Dillinger Hüttenwerke Dillingen steel plant (Germany) steadily increased from June (26%) to October (39%). Activity at U. S. Steel Košice steel plant (Slovakia) decreased gradually from June (63%) to August (59%), followed by a slight increase in September (60%), with no available data for October. Activity at Diósgyőr Steelworks Miskolc (Hungary) remained relatively low and unstable. The significant increase in activity at the Dillinger plant in October cannot be directly linked to any of the provided news articles.

Steel Plant Analysis

AG der Dillinger Hüttenwerke Dillingen steel plant: Located in Saarland, Germany, Dillinger is an integrated BF-BOF steel plant with a crude steel capacity of 2.76 million tonnes and an iron capacity of 4.79 million tonnes. The plant’s activity shows a continuous increase, reaching 39% in October. While the “Austria increased steel production by 35.8% y/y in October” suggests a broader positive trend, there’s no explicit link to this specific plant’s activity. Dillinger focuses on heavy-plate products.

U. S. Steel Košice steel plant: Situated in the Košice Region of Slovakia, this integrated BF-BOF plant has a crude steel capacity of 4.5 million tonnes and an iron capacity of 5 million tonnes. The observed activity shows a gradual decline from 63% in June to 59% in August, followed by a slight rebound to 60% in September. No activity data is available for October. The provided news articles do not directly relate to the observed activity trends at this plant, so it is hard to evaluate potential market implications.

Diósgyőr Steelworks Miskolc: Located in Hungary, this plant uses EAF technology with a crude steel capacity of 550,000 tonnes. The activity remained relatively low and unstable (between 8% and 12%). The plant produces mainly construction steels. None of the provided news articles appear to directly address activity levels at this specific plant. Therefore, it’s difficult to establish a direct connection or provide specific market implications based solely on this data.

Evaluated Market Implications

The contradictory trends create both opportunities and risks. While “Austria ramps up crude steel production in October” and similar findings for Belgium suggest increased availability in Central Europe, the decline in Italian exports (“Italy steel exports decline to ten-year low”) points to potential market weaknesses and oversupply in Southern Europe and export markets. Voestalpine’s planned cutbacks, as mentioned in “Austria ramps up crude steel production in October,” could offset some of the Austrian production increase, creating uncertainty in regional supply.

Procurement Recommendations:

- Central European Buyers: Given the increased production in Austria and Belgium (“Austria increased steel production by 35.8% y/y in October”, “Belgium increased steel production by 3.4% m/m in October”) and the rising activity observed at the Dillinger plant, procurement professionals sourcing heavy plate should explore securing supply agreements with Dillinger or other Central European producers to capitalize on potentially increased regional availability and hedge against potential price increases due to Voestalpine’s planned cutbacks. Continuously monitor the capacity utilization data of Dillinger.

- Italian Steel Buyers: Given the export decline (“Italy steel exports decline to ten-year low”), and despite not having activity data from Italian plants, evaluate domestic sourcing opportunities within Italy, as local producers may offer competitive pricing due to weakened export demand. Thoroughly assess the financial stability of these producers, given the challenging market conditions.

- Buyers relying on U.S. Steel Košice: The lack of October activity data coupled with the general decline from June to August creates uncertainty. Diversify supply sources for buyers dependent on U.S. Steel Košice (Slovakia), because no recent activity data available. Request clarification from U.S. Steel regarding the reasons for the fluctuating activity and missing October data.