From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineEuropean Steel Market Poised for Growth: Scrap Supply Tightens Amid Rising Production

The European steel market exhibits a very positive sentiment driven by increased production and demand. Ukrainian steelmakers’ plans to boost output, as reported in “Ukrainian steelmakers have announced an increase in steel production and demand for scrap in 2026 amid a shortage,” are coinciding with concerns about scrap supply chains in the UK, highlighted by “British steelmakers call for strengthening of scrap supply chain in the country” and “Circular Steel Sub-Committee releases UK steel recycling report.” While the news articles suggest potential shifts in demand and supply dynamics, there is no immediate direct correlation observable in the satellite-observed activity data provided for the listed steel plants for the observed time period.

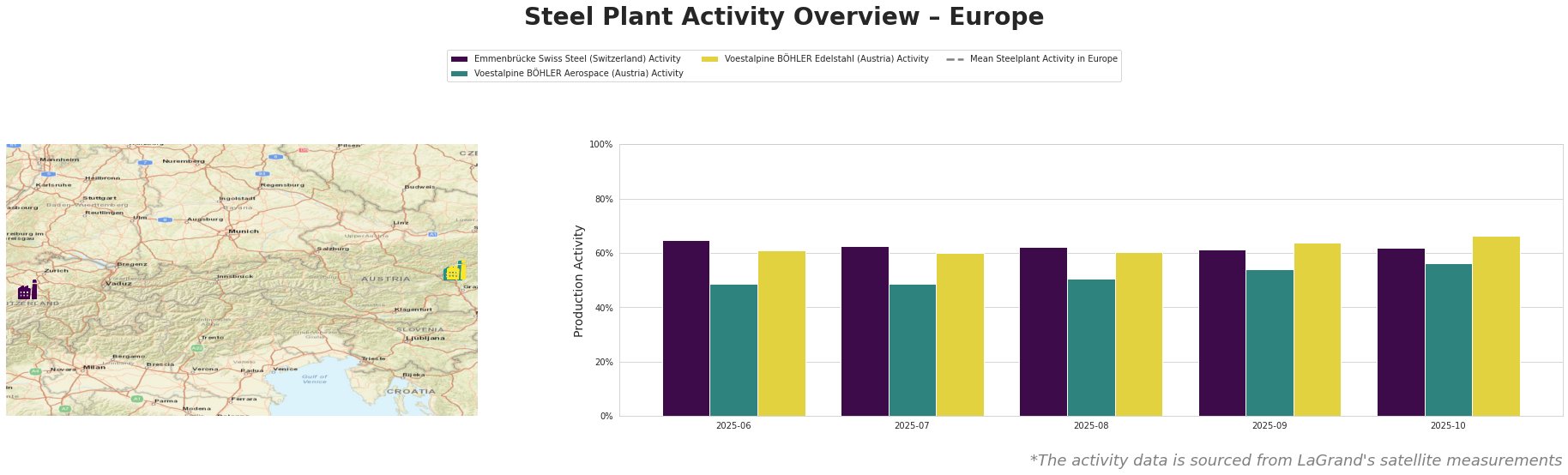

The mean steel plant activity in Europe fluctuated significantly, peaking in July and August 2025 before declining through October. Emmenbrücke Swiss Steel activity in Switzerland shows a slight decline from 65% in June to 61% in September, followed by a minor recovery to 62% in October. Voestalpine BÖHLER Aerospace in Austria experienced a slight increase in activity from 49% in June/July to 56% in October. Voestalpine BÖHLER Edelstahl in Austria saw a peak activity of 66% in October, showing a generally increasing trend over the observed period. The satellite activity levels of Emmenbrücke Swiss Steel do not reflect the scrap shortage impacts highlighted in the news articles. The increasing activity at Voestalpine plants could be related to increased demand, but a direct connection to the scrap market news cannot be established based on the provided information.

Emmenbrücke Swiss Steel, an EAF steel plant in Switzerland, maintained a relatively stable activity level between 61% and 65% during the observed period. There is no satellite evidence in the reported activity levels to suggest any impact related to the scrap market dynamics discussed in the UK and Ukrainian news articles, and any influence on its operations cannot be confirmed.

Voestalpine BÖHLER Aerospace, an Austrian EAF steel plant, showed a gradual increase in activity from 49% to 56% over the observed months. As a producer for the aerospace sector, its activity may be influenced by different market dynamics than those affecting general steel production. No direct link between the news articles and its activity changes can be established.

Voestalpine BÖHLER Edelstahl, also located in Kapfenberg, Austria, and operating EAF technology with a capacity of 145ktpa of crude steel, showed an increase in activity levels from 61% in June to 66% in October. This increase suggests potentially rising demand for its products, but again, there’s no direct satellite evidence to link this specifically to the reported scrap market challenges in the UK or the production increase in Ukraine.

Based on the news articles, potential supply disruptions are concentrated in the UK scrap market and potentially in Ukraine due to increasing domestic demand and exports. The Ukrainian situation could lead to increased steel prices, while the UK’s scrap supply chain issues might hinder the growth of low-carbon steel production. Given the anticipated increase in steel production and potential scrap shortages in Ukraine, as indicated in “Ukrainian steelmakers have announced an increase in steel production and demand for scrap in 2026 amid a shortage,” steel buyers should proactively secure contracts with alternative suppliers outside of Ukraine and the UK. Market analysts should closely monitor scrap export policies from Ukraine, especially the potential implementation of export duties or quotas, as these will significantly impact the European steel market. Furthermore, steel buyers should consider diversifying their sourcing strategies to mitigate risks associated with potential supply chain bottlenecks in the UK, as highlighted in “British steelmakers call for strengthening of scrap supply chain in the country.”