From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineAsia Steel Market: Falling Iron Ore Prices Offset by Indian Import Surge, Plant Activity Mixed

Asia’s steel market shows a neutral sentiment, influenced by falling iron ore prices and increased Indian imports. The news article “BMI expects iron ore prices to fall to $95/t in 2026” highlights expectations of weakening prices, linked to increased supply and soft demand. Conversely, “India increases iron ore imports amid shortage of high-quality raw materials” indicates rising demand in India, potentially offsetting some of the downward price pressure. Activity data from selected steel plants shows mixed trends, though no direct correlations to the news articles could be explicitly established.

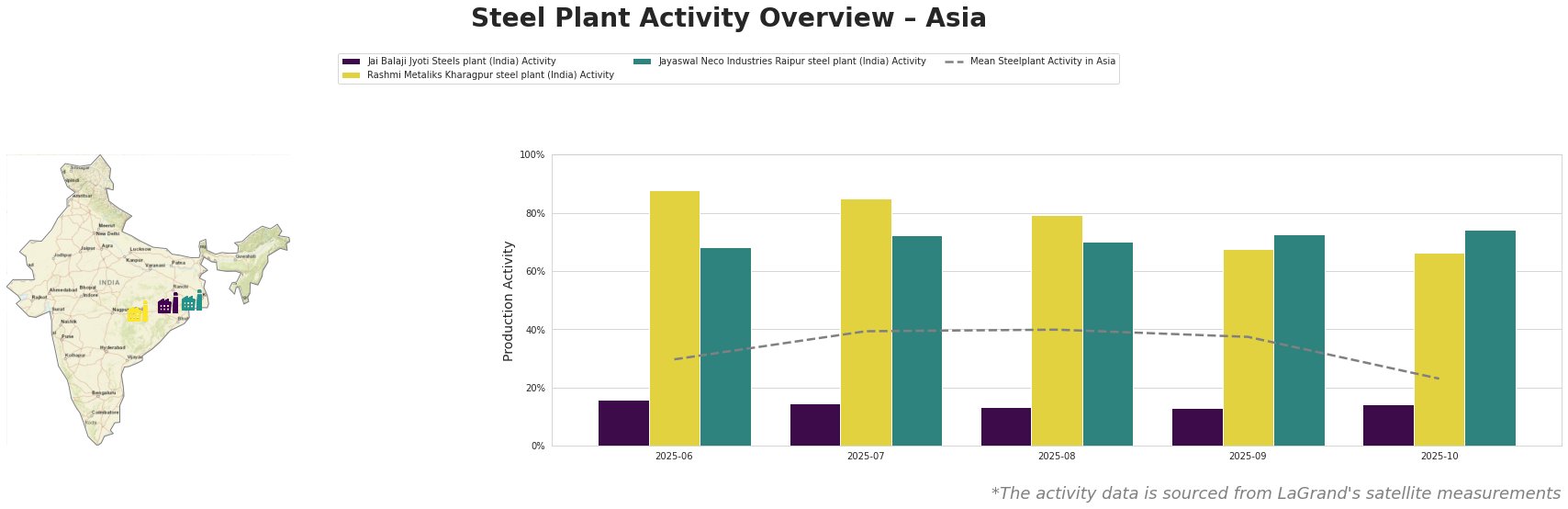

The mean steel plant activity in Asia has fluctuated, showing a significant drop to 23% in October 2025 after peaking at 40% in August 2025. Jai Balaji Jyoti Steels plant in Odisha consistently operated at low activity levels (13-16%) during the observed period, well below the Asian average. Rashmi Metaliks Kharagpur steel plant in West Bengal showed high activity, declining from 88% in June to 66% in October. Jayaswal Neco Industries Raipur steel plant in Chhattisgarh maintained relatively stable activity, fluctuating between 68% and 74%. No direct links between these plant-specific activity levels and the cited news articles could be explicitly established.

Jai Balaji Jyoti Steels plant, an integrated DRI-EAF plant with 92,000 tonnes per annum (ttpa) EAF crude steel capacity and 120,000 ttpa DRI capacity, demonstrated consistently low activity levels. There is no direct connection that can be established between these observed trends and the news articles provided.

Rashmi Metaliks Kharagpur steel plant, a large integrated BF-DRI plant with a 1,500,000 ttpa crude steel capacity and 1,700,000 ttpa iron capacity, exhibited decreasing activity from June to October. Despite its Responsible Steel Certification, the observed decline cannot be explicitly attributed to environmental regulations or production restrictions discussed in “Iron ore prices hit four-month lows in November.”

Jayaswal Neco Industries Raipur steel plant, another integrated BF-DRI plant with a 1,200,000 ttpa crude steel capacity and 1,020,000 ttpa iron capacity, has shown stable activity. Even with ISO 14001 certification, no explicit relationship between this stability and market dynamics from the news articles can be established.

The forecast of falling iron ore prices in “BMI expects iron ore prices to fall to $95/t in 2026” could benefit steel buyers in the long term. However, the surge in Indian imports, as highlighted in “India increases iron ore imports amid shortage of high-quality raw materials,” suggests potential short-term supply constraints and price volatility in the Indian market. Given the high activity levels at Rashmi Metaliks, coupled with the report of India seeking Iron Ore from Brazil, Oman, and Australia, Indian steel buyers should consider diversifying their raw material sourcing strategies to mitigate potential risks associated with domestic supply shortages and the government’s plan to impose a 30% export duty on low-grade iron ore. A seasonal decrease in steel consumption and potential plant shutdowns, as discussed in “Iron ore prices hit four-month lows in November” may impact the market.