From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineFrench Steel Market Faces Turmoil: Nationalization Push Amidst Production Shifts

The French steel sector is facing significant uncertainty as the National Assembly backs nationalizing ArcelorMittal France, as reported in “French National Assembly backs nationalizing ArcelorMittal France, defying government“. This political pressure coincides with fluctuating plant activity levels, although no direct causal relationship between the nationalization efforts and observed activity changes can be explicitly established based on the provided news articles.

The move towards nationalization occurs against a backdrop of broader European steel challenges, as highlighted in “ArcelorMittal criticizes France’s nationalization move, cites structural EU steel challenges“, including import pressure and demand-supply imbalances. This article also points to rising costs and import pressure across the continent, which directly affect the European steel market and specifically the French one.

Measured Plant Activities

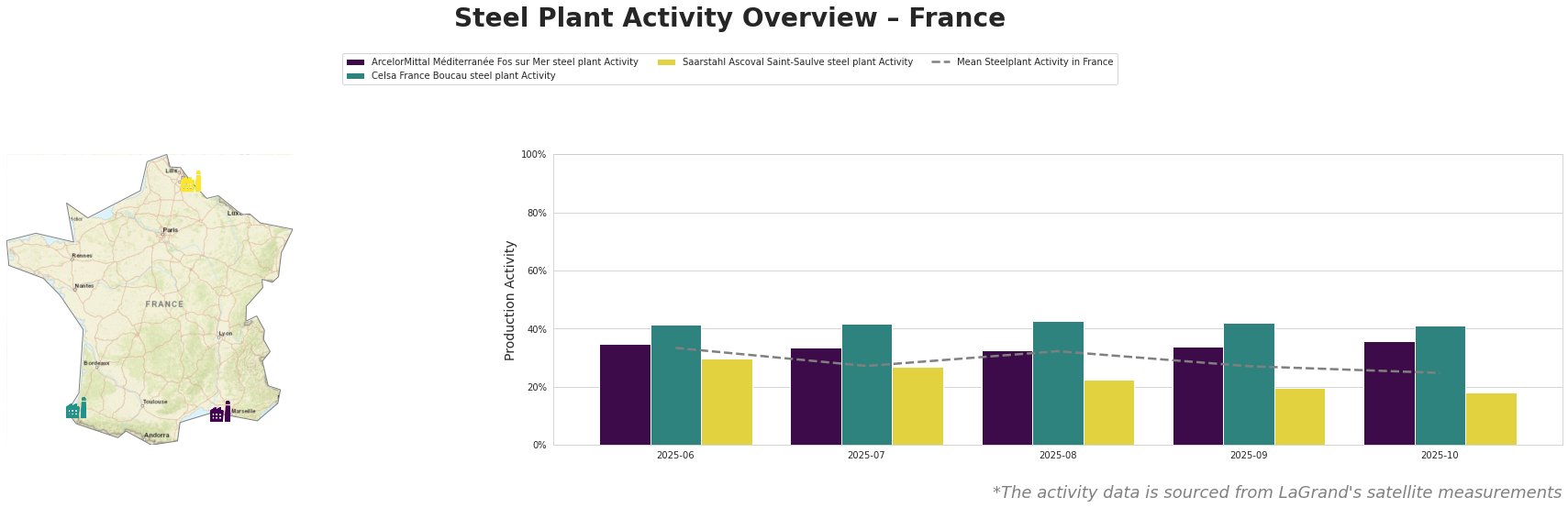

Over the observed period, the mean steel plant activity in France shows a declining trend, from 33% in June to 25% in October. ArcelorMittal Méditerranée Fos sur Mer showed a similar pattern, ending at 36%, showing more resilience with only a slight drop in activity towards the end of the observed period. In comparison, Celsa France Boucau steel plant activity remained relatively stable in comparison to other plants at around 42% but shows a slightly declining trend towards the end. Saarstahl Ascoval Saint-Saulve steel plant experienced a more significant decline, dropping from 30% in June to 18% in October, marking the most substantial decrease among the observed plants and consistently remaining below the national average.

Individual Steel Plant Analysis:

ArcelorMittal Méditerranée Fos sur Mer steel plant, an integrated BF-BOF producer with a 4000 ttpa crude steel capacity, saw its activity fluctuate between 33% and 36%. The plant produces slabs, hot-rolled products, and coils for various sectors. The slight increase to 36% activity in October, occurring as “ArcelorMittal criticizes the nationalization of France and refers to structural problems in steel production in the EU” was published, may be due to efforts to maintain production amidst the uncertainty, but no direct evidence can be established based on the provided news articles.

Celsa France Boucau steel plant, an EAF-based producer with a 1200 ttpa crude steel capacity, showed the most stable activity among the observed plants, hovering around 42%. The plant produces billets and rolled products for the automotive, construction, energy, and transport sectors. While the overall market sentiment is negative, this plant’s consistent output suggests a degree of resilience or specific market advantages but no direct link to the provided news articles can be established.

Saarstahl Ascoval Saint-Saulve steel plant, an EAF-based producer with a 730 ttpa crude steel capacity, experienced the most significant decline, from 30% in June to 18% in October. This drop could indicate operational issues or market-specific challenges that aren’t explicitly addressed in the available news articles. This plant produces continuous cast round bars, forged products, and billets. No direct links to any of the provided news article could be established.

Evaluated Market Implications

The potential nationalization of ArcelorMittal France, combined with the overall decline in steel plant activity, suggests a high degree of market instability. “ArcelorMittal criticizes France’s nationalization move, cites structural EU steel challenges” suggests that the market is already facing the challenge of low-priced imports and needs trade defense measures and a carbon border adjustment mechanism.

Specific Procurement Actions:

- Steel Buyers: Prioritize securing contracts with non-nationalized suppliers outside of France to mitigate risks associated with potential supply disruptions from ArcelorMittal France.

- Market Analysts: Closely monitor the French Senate’s decision regarding the nationalization bill. Additionally, track EU trade policy responses to the challenges outlined in “ArcelorMittal criticizes France’s nationalization move, cites structural EU steel challenges,” as these will significantly impact the competitive landscape. Also, monitor the progress and impact of ArcelorMittal’s investment in new electric steel production capabilities as described in “ArcelorMittal launches new €500 million electric steel production line in France“, to assess its potential to offset potential disruptions from other parts of its French operations.