From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineEurope Steel Market: CBAM Uncertainty and Stable HRC Prices Amidst Fluctuating Plant Activity

The European steel market faces a complex landscape of stable prices and supply chain uncertainties. Trading of hot-rolled coil (HRC) is nearly stagnant due to ample stocks and CBAM ambiguity, as noted in “European HRC trading at near standstill amid ample stocks, CBAM uncertainty.” This report analyzes this market environment with satellite-observed activity, revealing a mixed picture of steel plant operations, where no direct correlation between HRC trading and plant activity could be established with the data available. Despite this, heavy plate prices are edging higher supported by persistent expectations of CBAM costs according to “Steel heavy plate prices edge higher supported by persistent expectations of CBAM costs.”

Here’s a breakdown of observed steel plant activity:

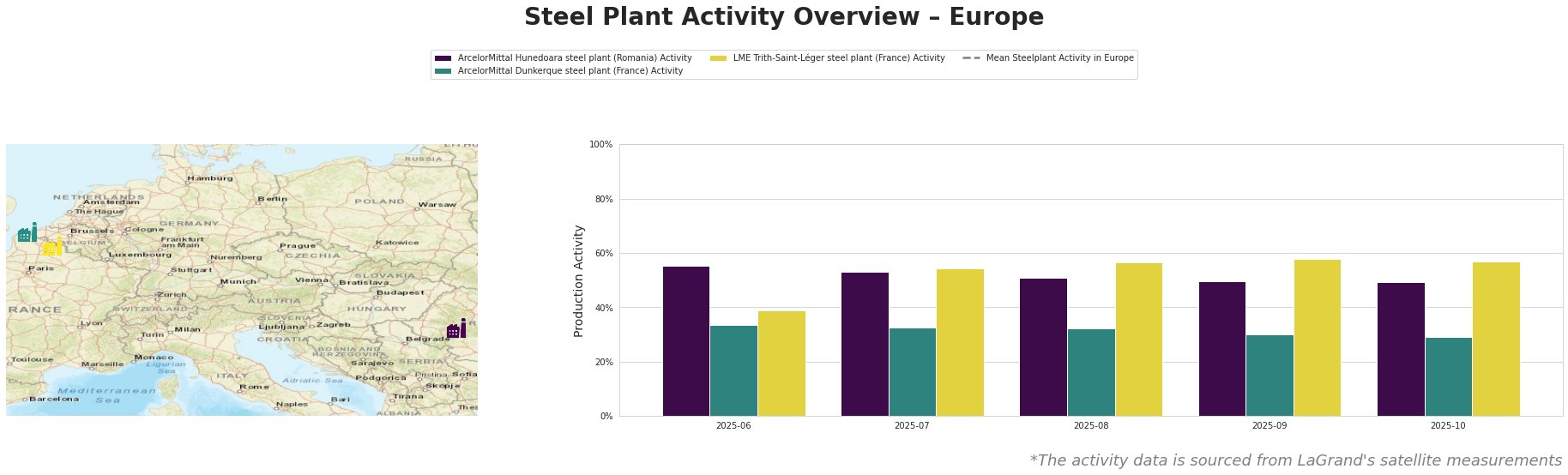

Overall, the mean steel plant activity in Europe has fluctuated significantly, peaking in July and August before decreasing substantially in October.

ArcelorMittal Hunedoara: This Romanian steel plant, operating solely with EAF technology and specializing in long profiles, experienced a steady decline in activity from June (55%) to October (49%). It is slightly higher than EU mean activity at the beginning of the observation period, but lower at the end. The recent decrease does not seem to be directly linked with news about European HRC prices or CBAM discussions.

ArcelorMittal Dunkerque: This integrated BF-BOF steel plant in France, a major producer of slabs and hot-rolled coil, showed relatively stable activity, consistently remaining between 29% and 33% . However, this level is significantly below the European average activity. There’s no apparent link to the HRC market stagnation or CBAM uncertainty reported in the news.

LME Trith-Saint-Léger: Operating an EAF for producing slabs and hot rolled products, this French plant displayed a gradual increase in activity from June (39%) to September (58%), with a slight decrease to 57% in October. This is the only plant from the sample to show higher activity than the EU mean. Again, no direct link can be established between this plant’s operational patterns and the broader market trends described in the provided news articles.

The article “Europe steel market in the final week of november: Weak demand, tighter quotas and stabilizing prices” further highlights market uncertainties, including stabilizing prices for HRC and decreasing steel production, while Turkish-European steel ties are strengthening.

Evaluated Market Implications

Given the overall market sentiment of neutrality and the information presented, the following implications and recommendations can be made:

- Potential Supply Disruptions: While HRC trading faces stagnation due to existing stock levels and CBAM uncertainty as stated in “European HRC trading at near standstill amid ample stocks, CBAM uncertainty,” the observed decline in activity at ArcelorMittal Hunedoara raises a flag for potential future supply constraints in long profiles.

- Procurement Actions:

- For buyers of long profiles: Closely monitor ArcelorMittal Hunedoara’s production and inventory levels. Diversify suppliers or negotiate longer-term contracts to mitigate potential supply shortages arising from the plant’s reduced activity. Since activity has been slowly decreasing over the observed period, consider purchasing additional volumes earlier to secure current pricing.

- For buyers in general: Given the stable HRC prices but uncertain CBAM implementation (as highlighted in “European HRC trading at near standstill amid ample stocks, CBAM uncertainty“), prioritize DDP-based import contracts to minimize risk associated with fluctuating CBAM costs. Although import prices may be slightly higher, the cost certainty outweighs the potential savings from CFR offers, especially if CBAM costs escalate unexpectedly.

- For market analysts: Monitor Turkish steel companies’ activity in the EU given “Europe steel market in the final week of november: Weak demand, tighter quotas and stabilizing prices” indicates “Turkish-European steel ties strengthen, with Turkish companies securing significant EU project contracts”.

These recommendations are based on the specific details extracted from the provided news articles and the observed satellite data and are intended to inform strategic decision-making in a complex and evolving market.