From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineItalian Steel Market: Stagnant Demand Persists Despite Upward Price Pressure

In Italy, the long steel market faces a complex situation with “The European long position market is generally stable” despite “European longs prices show upward tension amid low orders“. This report analyzes observed steel plant activity in conjunction with these market dynamics to provide actionable insights. While the news articles do not explicitly mention specific plant production changes, observed activity levels offer additional context.

Measured Activity Overview:

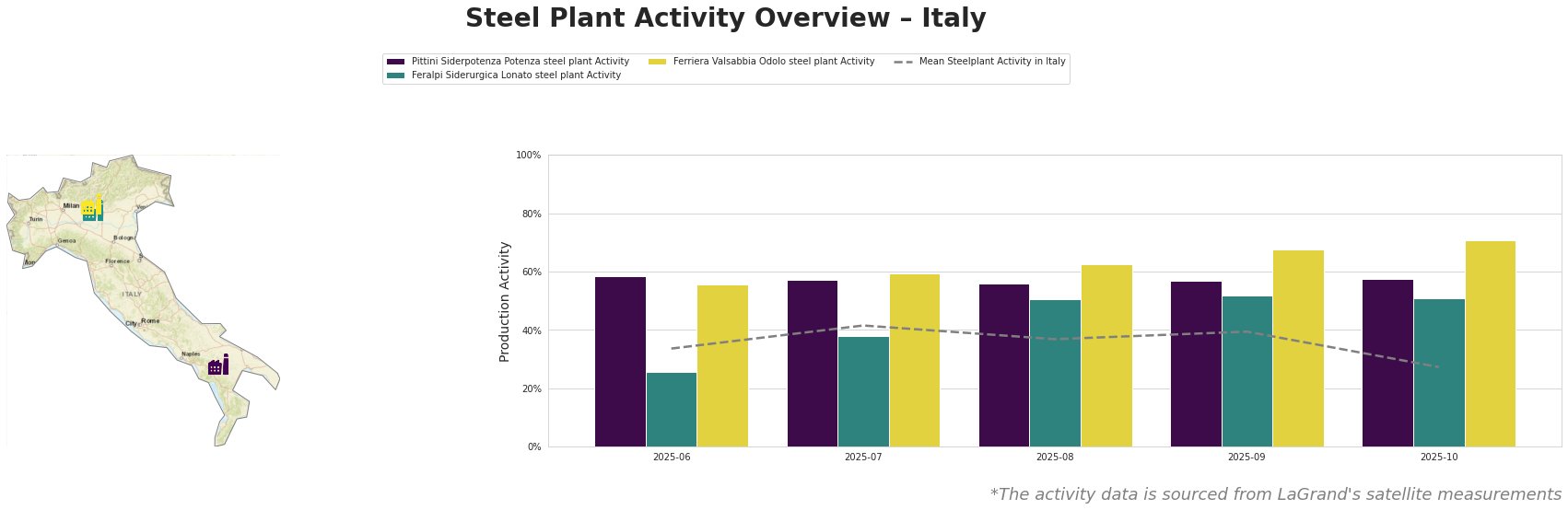

Overall, the mean steel plant activity in Italy experienced volatility, peaking in July at 42.0 and then declined significantly to 27.0 in October. Notably, Ferriera Valsabbia Odolo steel plant consistently operated above the mean and peaked in October at 71.0. Pittini Siderpotenza Potenza steel plant also operated above the mean and remained relatively stable around 57-59, while Feralpi Siderurgica Lonato steel plant was below average until August, then rising to around 50%. The news articles do not directly explain these fluctuations.

Plant Information:

Pittini Siderpotenza Potenza steel plant, located in the Province of Potenza with a crude steel capacity of 700ktpa via EAF technology, focuses on rebar for the building and infrastructure sectors. Its activity level remained relatively stable between 56 and 59 throughout the observed period, indicating consistent production despite the broader market tensions described in “European longs prices show upward tension amid low orders”. No direct link between the plant’s consistent operation and news reports can be explicitly established.

Feralpi Siderurgica Lonato steel plant, situated in the Province of Brescia, boasts an EAF-based crude steel capacity of 1100ktpa and produces rebar, billets, mesh, and wire rod. Its activity levels increased from 26.0 in June to around 50% for the last three reporting months. This increase might reflect attempts to capitalize on the “upward tension” described in “European longs prices show upward tension amid low orders”, though the news articles don’t directly explain this trend.

Ferriera Valsabbia Odolo steel plant, also in the Province of Brescia, has an EAF-based crude steel capacity of 900ktpa, producing billets and rebar. Its activity consistently exceeded the Italian average, rising to 71.0 in October. This suggests robust production even as “The European long position market is generally stable”, and may reflect increased demand for its specific product mix. No direct connection between its activity and the news articles could be explicitly established.

Evaluated Market Implications:

Despite reported attempts to raise prices as mentioned in “European longs prices show upward tension amid low orders”, Italian rebar buyers are resistant, and the market remains stable according to “The European long position market is generally stable”. The satellite data shows divergent plant activity levels, with one plant running well above average.

Recommended Procurement Actions: Given the stable pricing environment and evidence of consistent production at plants like Pittini Siderpotenza and Ferriera Valsabbia, steel buyers should negotiate firmly, leveraging the current market conditions.

Buyers should monitor import prices, especially from Turkey and Indonesia, as referenced in “The European long position market is generally stable”, as these may offer cost-effective alternatives.