From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineIndia Steel Sector Heats Up: Capacity Expansion Drives Optimistic Outlook

India’s steel market displays positive momentum, fueled by capacity expansions and robust demand, as evidenced by recent developments at key plants and projected consumption growth. This report analyzes these trends and provides actionable insights for steel buyers.

The steel sector in India is experiencing capacity expansions to meet growing demand. The growth and expansion are explicitly showcased by the following articles: “Tata Steel plans to turn Kalinganagar into its largest production base” and “India plans to double the capacity of the steel mill in Rourkela“. The article “Demand for steel in India remains on a growth trajectory” outlines the market forces driving these changes. A direct relationship between these news articles and specific changes in plant activity levels as observed by satellite could not be explicitly established in the observed period.

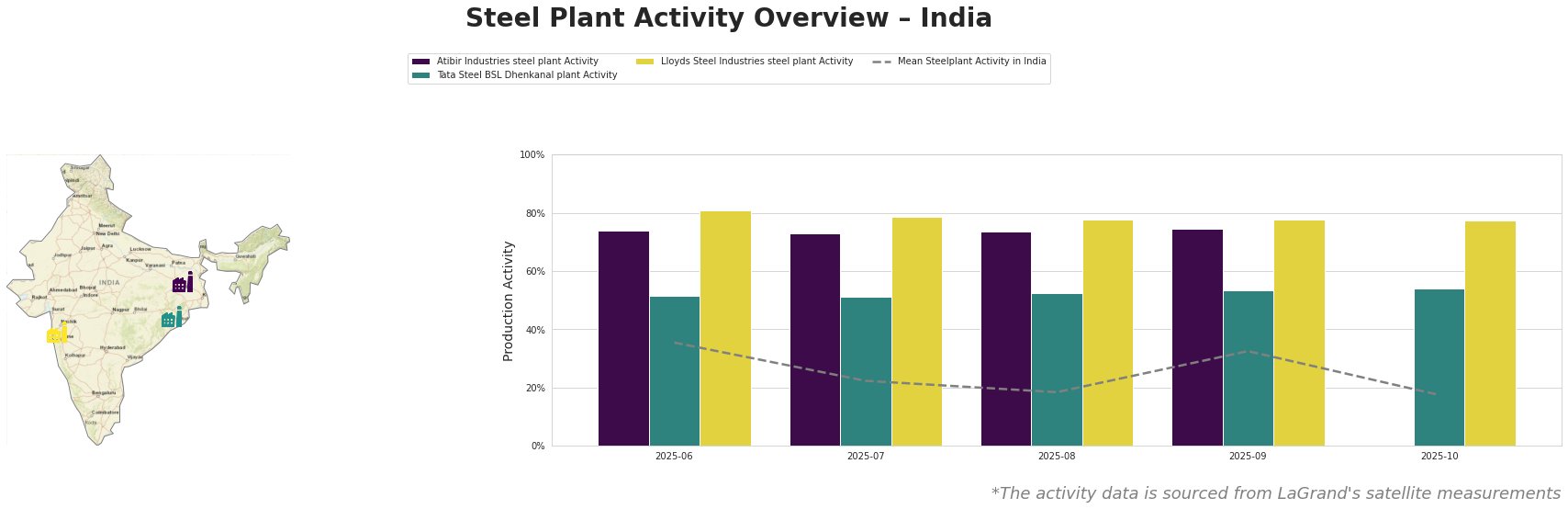

The mean steel plant activity in India shows fluctuation, with a low point in October 2025 (17.0%) after gradually dropping from June (35%). Atibir Industries steel plant shows the highest activity in September 2025 at 75%.Tata Steel BSL Dhenkanal plant has a steady increase in activity in the period observed. Lloyds Steel Industries steel plant maintains relatively high activity but declines gradually from June (81%) to August (78%), holding steady until the end of the reported period.

Atibir Industries, located in Jharkhand, operates an integrated (BF) steel plant with a crude steel capacity of 600 ttpa, utilizing BF and BOF technologies. The plant consistently operated at high activity levels. It is above the Indian average, ranging from 73% to 75% during the observed period. No direct connection could be established between this consistent high activity and any of the news articles provided.

Tata Steel BSL Dhenkanal plant in Odisha, features integrated BF and DRI processes. It possesses a crude steel capacity of 5600 ttpa. The observed activity shows a steady increase from 51% in June 2025 to 54% in October 2025. While the article “Tata Steel plans to turn Kalinganagar into its largest production base” highlights Tata Steel’s overall expansion in Odisha, including a large investment into an entirely different plant in Kalinganagar, no direct connection can be explicitly established between this specific expansion announcement and the observed activity at the Dhenkanal plant.

Lloyds Steel Industries steel plant in Maharashtra relies on electric arc furnace (EAF) technology with a crude steel capacity of 641 ttpa. Activity is relatively high compared to the Indian average, with a gradual decline from 81% in June 2025 to 78% in August 2025 and remaining stable through October 2025. The news articles do not provide a direct explanation for this observed trend.

Given the ongoing expansions reported in “Tata Steel plans to turn Kalinganagar into its largest production base” and “India plans to double the capacity of the steel mill in Rourkela”, steel buyers should anticipate increased availability of steel in the medium to long term, potentially influencing price negotiations. Focus procurement efforts on regions served by these expanding plants (Odisha). Closely monitor developments at Tata Steel’s Kalinganagar plant, as its planned doubling of capacity could significantly impact the supply of high-quality steel. Buyers should consider negotiating long-term contracts with these expanding producers to secure stable supply and potentially benefit from economies of scale.