From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineEurope Steel Market: Stable Longs Amid Romanian Liquidity Issues, Plant Activity Mixed

The European long steel market exhibits overall stability, with pockets of upward price tension amidst weak demand. This assessment is supported by the news articles “European longs market stable overall” and “The European long position market is generally stable“, which report consistent pricing for rebar and wire rod in Italy. Satellite observations, however, show mixed activity levels at key steel plants, with no immediate direct relationship to pricing trends apparent.

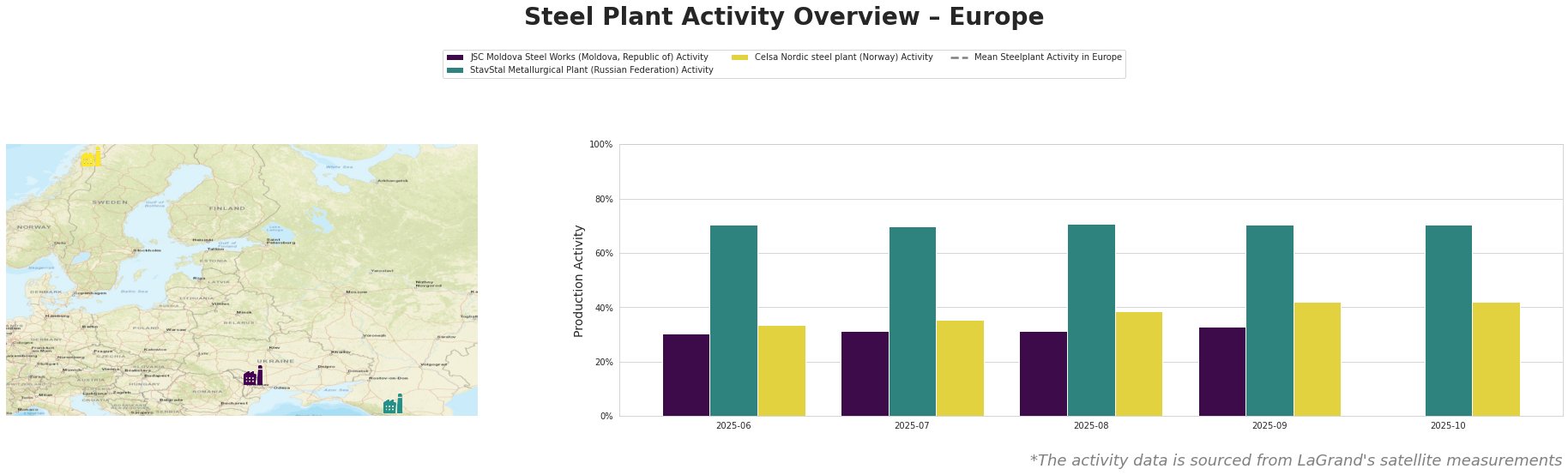

Measured activity levels across selected European steel plants reveal the following trends:

Overall plant activity decreased considerably in Europe in October.

JSC Moldova Steel Works, an EAF-based plant in Transnistria with a 1 million tonne crude steel capacity, saw minimal changes in activity between June and September 2025, ranging from 30% to 33%. October data is unavailable. This stable activity, however, does not appear to directly correlate with the pricing trends reported in “European longs market stable overall“.

StavStal Metallurgical Plant, a 500,000-tonne EAF-based long products producer in Russia, maintained a consistently high activity level of around 70-71% between June and October 2025. No connection can be established between this activity level and the pricing dynamics reported in the provided news articles.

Celsa Nordic steel plant, a 700,000-tonne EAF-based producer of long products in Norway, demonstrated a gradual increase in activity from 34% in June to 42% in September and October 2025. This increase does not appear to be directly reflected in any specific pricing pressures identified in the provided news articles.

While the overall European long steel market appears stable, the article “Romanian longs market still struggles amid slow demand and liquidity pressures, but local prices hold firm” highlights specific challenges in Romania. This article notes that despite weak demand and liquidity issues, Romanian rebar and wire rod prices remain firm, but traders are offering discounts to stimulate sales. Furthermore the article “European longs prices show upward tension amid low orders” and “Prices for European long positions show upward tension amid low order levels” indicate producers are attempting to increase prices, especially in Italy, but buyers are resisting.

Given the stability in much of Europe coupled with liquidity issues in Romania, steel buyers should:

- Prioritize building relationships with suppliers outside Romania: The struggles described in “Romanian longs market still struggles amid slow demand and liquidity pressures, but local prices hold firm” may make Romanian suppliers less reliable.

- Carefully monitor Italian price negotiations: Given the content of the articles “European longs prices show upward tension amid low orders” and “Prices for European long positions show upward tension amid low order levels“, procurement professionals should be aware of the possibility of upward price movement if Italian producers succeed in price hikes.