From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineAsia Steel Market Poised for Growth Amidst Green Steel Standard Harmonization

Asia’s steel market demonstrates positive momentum, driven by the push for global low-emission steel standards, potentially impacting production strategies and procurement decisions. The initiatives detailed in “Responsiblesteel partners with Europe and China on global low-emission steel standards,” “Responsiblesteel cooperates with Europe and China in the field of global low-emission steel production standards,” and “ResponsibleSteel, China, and Europe to agree on global standards for green steel” highlight the move towards unified greenhouse gas measurement and classification. While the news emphasizes standardization and potential market shifts, no direct impact on specific plant activity levels is explicitly established from these announcements.

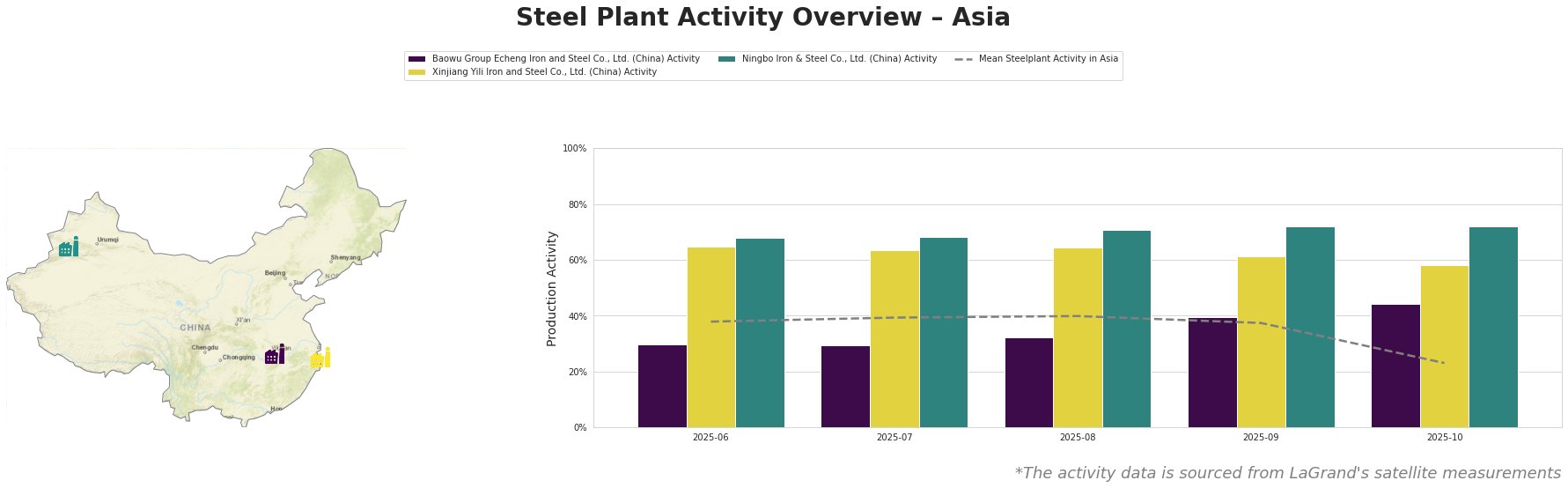

The following table details the monthly activity trends for selected steel plants in Asia:

The mean steel plant activity in Asia shows a sharp decline in October to 23.0, after gradually rising from June to August (38.0 to 40.0) and subsequently decreasing in September (37.0).

Baowu Group Echeng Iron and Steel Co., Ltd., an integrated steel plant in Hubei with a crude steel capacity of 4400 ttpa utilizing BF and BOF technologies and holding ResponsibleSteel certification, exhibited a fluctuating activity pattern. Starting at 30.0 in June, it slightly decreased to 29.0 in July before increasing to 32.0 in August, then jumping to 40.0 in September, before peaking at 44.0 in October. The plant’s ResponsibleSteel certification aligns it with the goals stated in “Responsiblesteel partners with Europe and China on global low-emission steel standards“, but no direct correlation between this news and activity fluctuations can be explicitly established.

Xinjiang Yili Iron and Steel Co., Ltd., also an integrated steel plant located in Xinjiang with a smaller crude steel capacity of 1000 ttpa based on BF/BOF and holding ResponsibleSteel certification, demonstrated relatively high activity levels compared to the mean. Activity started at 65.0 in June, saw a slight dip to 64.0 in July before returning to 65.0 in August. Then, activity dropped to 61.0 in September, followed by another drop to 58.0 in October. While possessing ResponsibleSteel certification, aligning it with the themes of “ResponsibleSteel, China, and Europe to agree on global standards for green steel“, no specific connection to the observed activity changes can be determined.

Ningbo Iron & Steel Co., Ltd., an integrated plant in Zhejiang with a crude steel capacity of 4000 ttpa and using BF/BOF, showed consistently high activity. Starting at 68.0 in June, activity remained constant in July, increased to 71.0 in August, and peaked at 72.0 in September and remained constant in October. Similar to the other plants, while holding ResponsibleSteel certification and therefore participating in the trends described in “Responsiblesteel cooperates with Europe and China in the field of global low-emission steel production standards“, no direct link between the news and its stable, high activity is evident.

The sharp drop in mean activity in Asia, coupled with the individual plant fluctuations, warrants a cautious approach. The harmonization efforts for green steel standards may lead to adjustments in production processes.

Evaluated Market Implications:

- Potential Supply Disruptions: The observed drop in mean steel plant activity in Asia during October, alongside significant fluctuations in plant-specific activity, suggests a potential for short-term supply disruptions.

- Procurement Actions:

- Steel Buyers: Given the potential for supply volatility and the ongoing shift towards greener steel production, buyers should secure contracts with suppliers demonstrating a commitment to low-emission standards. Prioritize suppliers with ResponsibleSteel certification, as highlighted in “ResponsibleSteel, China, and Europe to agree on global standards for green steel“.

- Market Analysts: Closely monitor the evolving green steel standards and their implementation across Asian steel plants. Track activity data in conjunction with policy changes to anticipate supply chain adjustments. Focus on plants actively adopting low-emission technologies and those strategically positioned to benefit from the harmonization of global green steel standards.