From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineEuropean Steel Market: Climate Talks & Activity Shifts Signal Procurement Opportunities

Europe’s steel market is experiencing a complex interplay of climate policy pressures and fluctuating plant activity. The steel industry’s transition to greener practices and its response to evolving climate finance discussions, as indicated in the article “Cop: UN chief says adaptation compromise possible,” may impact steel supply dynamics.

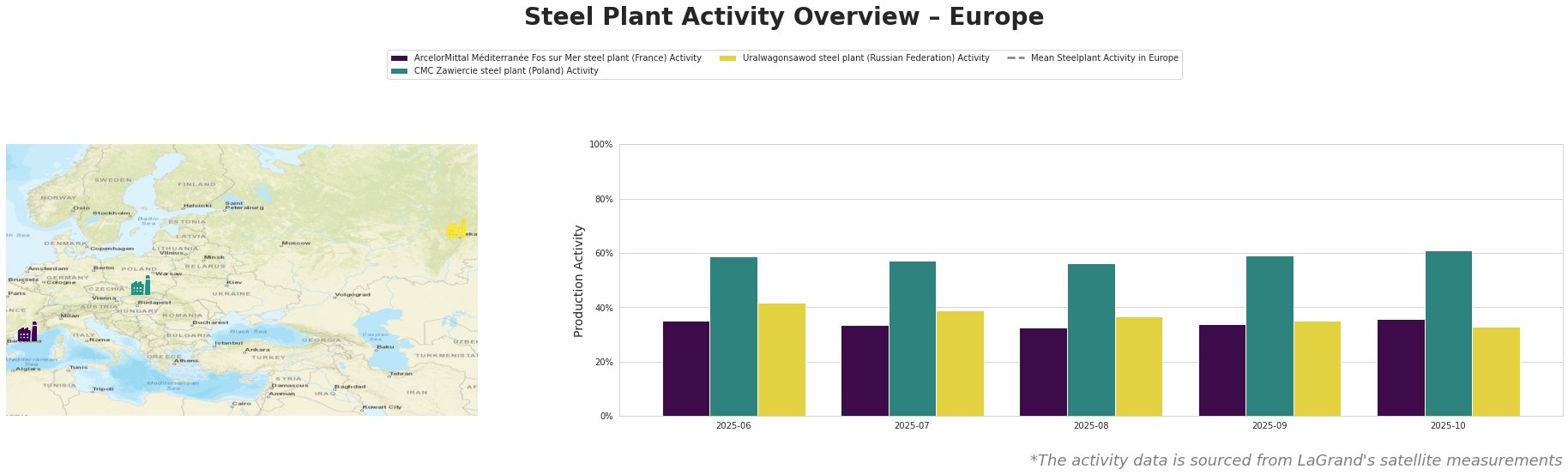

Observed changes in steel plant activity levels, derived from satellite data, show the following recent trends:

Overall, mean steel plant activity in Europe experienced considerable volatility, peaking in July and August, then declining through October.

ArcelorMittal Méditerranée Fos sur Mer, an integrated BF-BOF steel plant in France with a crude steel capacity of 4000 ttpa, showed stable activity levels, fluctuating between 33% and 36% over the observed period. The plant is certified under ResponsibleSteel, yet no direct impact on activity levels can be established in connection with the article “Klimawandel: So lässt sich die Klimakrise aufhalten” concerning climate change mitigation strategies.

CMC Zawiercie, a Polish EAF-based steel plant with a capacity of 1700 ttpa, showed a consistently high activity level compared to the mean, reaching 61% in October. While the plant has ISO14001 and ResponsibleSteel certifications, no connection to the news articles can be directly derived from the satellite data, but it is worth noting the significantly higher activity level compared to the French plant.

Uralwagonsawod, a steel plant in the Russian Federation, showed a decreasing trend in activity from 42% in June to 33% in October. As “Cop: Summit in overtime as countries remain deadlocked” reports on fossil fuel phase-out disagreements and adaptation finance discussions, no explicit relationship to the Uralwagonsawod activity levels can be established given the absence of climate-related certifications and available production process details.

Evaluated Market Implications

The evolving climate finance discussions, as reported in “Cop: UN chief says adaptation compromise possible,” and the potential for policy changes to incentivize emissions reductions could impact older BF/BOF facilities like ArcelorMittal Méditerranée Fos sur Mer. Given the COP30 discussions emphasizing adaptation finance and the EU’s conditional openness to increasing it based on emission reduction commitments, steel buyers should prepare for potential supply chain disruptions as plants with less green technology may face stricter environmental regulations, as ArcelorMittal Méditerranée Fos sur Mer is scheduled to shutdown its BOF by 2030.

Recommended Procurement Actions:

- Diversify Supplier Base: Proactively engage with and qualify EAF-based steel suppliers like CMC Zawiercie, which demonstrate relatively stable and high activity levels in the face of broader market fluctuations, as a hedge against potential disruptions affecting integrated mills.

- Monitor Policy Developments: Closely track EU and national climate policy changes, specifically those related to carbon pricing and emissions standards, to anticipate potential cost increases and supply shifts, especially considering the disagreement around fossil fuel phase-out roadmaps highlighted in “Cop: Summit in overtime as countries remain deadlocked“.

- Prioritize Green Steel Procurement: Given the long-term trend towards decarbonization, favor steel suppliers with demonstrated commitments to emissions reductions and certified under programs like ResponsibleSteel to mitigate future risks associated with stricter environmental regulations and carbon border adjustment mechanisms.