From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineEU Ferroalloy Import Restrictions and Steel Plant Activity Signal Market Shift

Europe’s steel market faces potential price volatility and supply chain adjustments due to new import restrictions on ferroalloys, impacting both steel producers and buyers. The European Commission’s move, highlighted in articles titled “EU proposes TRQ to reduce ferro-alloy imports by 25 percent,” “EU introduces quotas to restrict imports of ferroalloys,” and “EU imposes definitive safeguard measures on certain ferroalloys,” aims to protect the EU ferroalloy industry. While these articles focus on ferroalloys, critical inputs for steel production, no direct connections between these news articles and observed changes in European steel plant activity levels could be established based on the provided data and plant details.

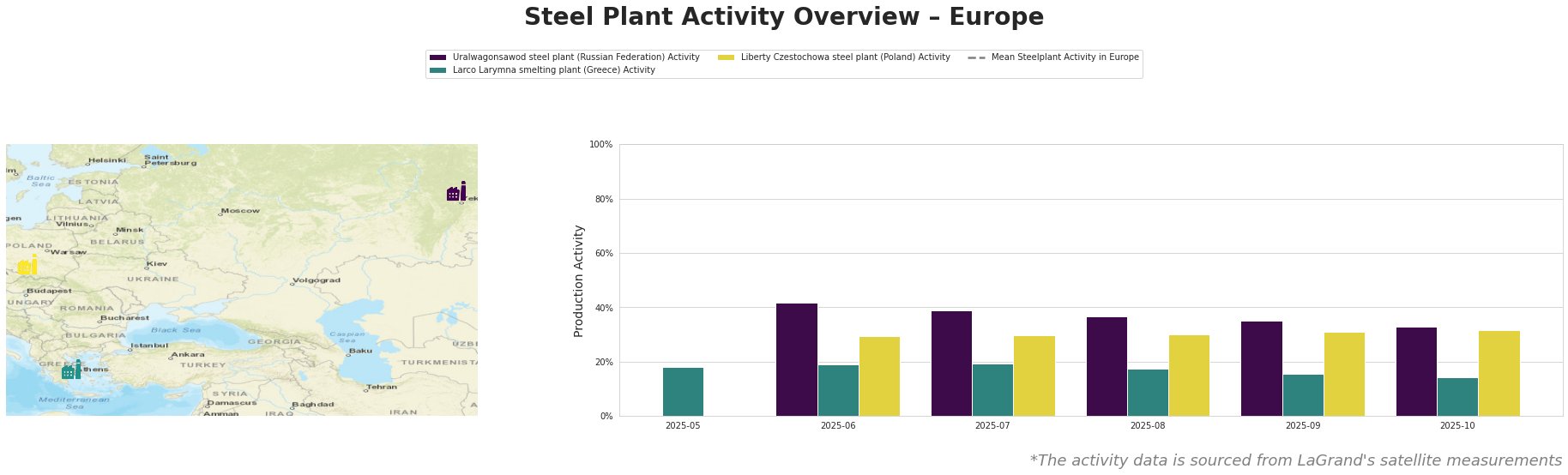

The mean steel plant activity in Europe shows fluctuating activity, peaking in July/August 2025 but declining towards October 2025, with the highest measurement of 407779666.0 observed in both July and August.

Uralwagonsawod steel plant, a Russian Federation facility serving the defense sector, shows a declining activity trend from 42% in June to 33% in October. Given its location and end-user sector, no direct connection to EU ferroalloy import policies can be established based on the provided information.

Larco Larymna smelting plant, a Greek ferronickel producer with an EAF capacity of 1150 crude steel and 2500 Ferronickel , shows relatively stable activity, decreasing from 19% in June/July to 14% in October. While this plant could be affected by the measures described in “EU imposes safeguards on silicon and manganese-based ferroalloy imports“, which highlights the EU’s goal to bolster its supply chain, the observed activity decrease does not obviously support this notion; therefore, we cannot establish a definite, explicit connection.

Liberty Czestochowa steel plant, a Polish EAF steel plant producing semi-finished plate products, shows a slight increase in activity from 30% in June-August to 32% in October. Although Liberty Czestochowa holds ResponsibleSteelCertification, no direct connection can be established between this slight increase and the EU’s ferroalloy import restrictions.

The TRQs on ferroalloys, driven by concerns over rising imports as stated in “EU imposes definitive safeguard measures on certain ferroalloys“, could lead to supply disruptions and increased costs for European steelmakers relying on these imported materials. Considering that Norway, India, and Iceland have specific quotas per EU imposes safeguards on silicon and manganese-based ferroalloy imports, steel buyers should expect possible price increases when buying steel that requires specific alloys produced outside of the EU due to tariffs associated with over-quota imports.

Procurement Actions:

- Diversify Ferroalloy Sources: Steel buyers should proactively explore and qualify alternative sources of ferroalloys within the EU or from countries with favorable TRQ allocations to mitigate potential supply disruptions and price increases.

- Monitor Price Volatility: Closely monitor ferroalloy and steel price fluctuations, especially for products requiring ferroalloys impacted by the TRQs. Consider hedging strategies or forward contracts to manage price risk.

- Engage with Suppliers: Communicate closely with steel suppliers to understand their ferroalloy sourcing strategies and potential impacts on steel prices and delivery times.

- Optimize Steel Specifications: Explore opportunities to optimize steel specifications to reduce reliance on ferroalloys subject to the TRQs, where technically feasible and economically viable.