From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineChina Steel Market Poised for Growth Amidst Green Standards and Stable Production

China’s steel market shows signs of continued stability amid the push for greener production standards. The market is responding to collaborative efforts for low-emission steel standards as highlighted in “Responsiblesteel partners with Europe and China on global low-emission steel standards“, “Responsiblesteel cooperates with Europe and China in the field of global low-emission steel production standards“, and “ResponsibleSteel, China, and Europe to agree on global standards for green steel“. Satellite-observed activity data of major Chinese steel plants indicates generally stable production levels, although no direct correlation between specific activity changes and the news articles can be established.

Here’s a summary of recent monthly activity trends:

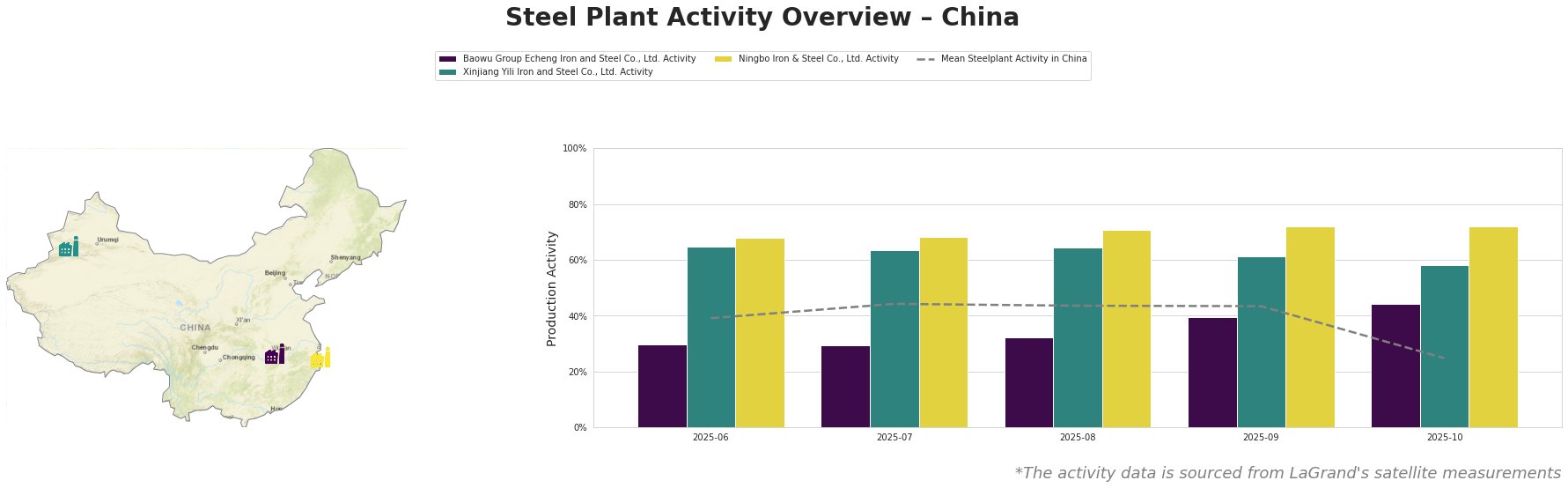

Overall, the mean steel plant activity in China fluctuated between 39% and 44% from June to September 2025 before experiencing a notable drop to 25% in October.

Baowu Group Echeng Iron and Steel Co., Ltd., a Hubei-based integrated steel plant with a 4.4 million tonne BOF crude steel capacity and ResponsibleSteel certification, has seen a slight increase in activity in recent months, rising from 30% in June to 44% in October. It is to be noted that, the October activity is notably lower than the mean steel plant activity of China in the period from June to September. There is no clear evidence linking these production changes to the recently announced green steel standard collaborations.

Xinjiang Yili Iron and Steel Co., Ltd., located in Xinjiang, operates with a 1 million tonne BOF crude steel capacity and holds ResponsibleSteel certification. Activity levels have shown a slight decrease, dropping from 65% in June to 58% in October. This plant consistently outperformed the national average. No explicit connection can be established between this trend and the new green steel initiatives.

Ningbo Iron & Steel Co., Ltd., situated in Zhejiang, boasts a 4 million tonne BOF crude steel capacity and ResponsibleSteel certification. The plant has demonstrated stable activity, ranging between 68% and 72% over the past five months. Like Xinjiang Yili Iron, its activity is consistently higher than the national average. No direct link can be currently established between the recent green steel standards news and Ningbo Iron & Steel’s production trends.

The push for unified green steel standards across Europe and China, as evidenced by the “Responsiblesteel partners with Europe and China on global low-emission steel standards“, “Responsiblesteel cooperates with Europe and China in the field of global low-emission steel production standards“, and “ResponsibleSteel, China, and Europe to agree on global standards for green steel” articles, is unlikely to cause significant supply disruptions in the short term. However, steel buyers should closely monitor plants with ResponsibleSteel certification, such as Baowu Group Echeng, Xinjiang Yili, and Ningbo Iron & Steel. While these plants have demonstrated stable or increasing activity levels, the increasing focus on green steel production could result in longer-term capital expenditure to meet those requirements. Therefore, procurement analysts should incorporate the cost of ResponsibleSteel standards into total cost of ownership calculations.