From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineNorway Steel Market: Ferroalloy Import Quotas & Stable Plant Activity Signal Supply Adjustments

Norway’s steel market faces potential shifts due to new EU ferroalloy import quotas while domestic plant activity remains steady. The “EU imposes safeguards on silicon and manganese-based ferroalloy imports” and related articles indicate potential supply chain adjustments for Norwegian steel producers. Satellite observations show stable activity at Celsa Nordic, suggesting resilience but warranting close monitoring in light of these trade policy changes.

The European Commission’s recent implementation of safeguard measures on ferroalloy imports, as detailed in “EU states to vote on TRQ, variable duty alloy safeguard“, “EU proposes TRQ to reduce ferroalloy imports by 25 percent” (multiple publications), “EU introduces quotas to restrict imports of ferroalloys“, and “Assofermet urges EU ferroalloys safeguard revision“, introduces tariff-rate quotas (TRQs) that could impact Norway, despite its close ties to the EU. These measures aim to reduce ferroalloy imports by 25% based on 2022-2024 averages, potentially affecting Norwegian producers dependent on these exports.

Measured Activity Overview

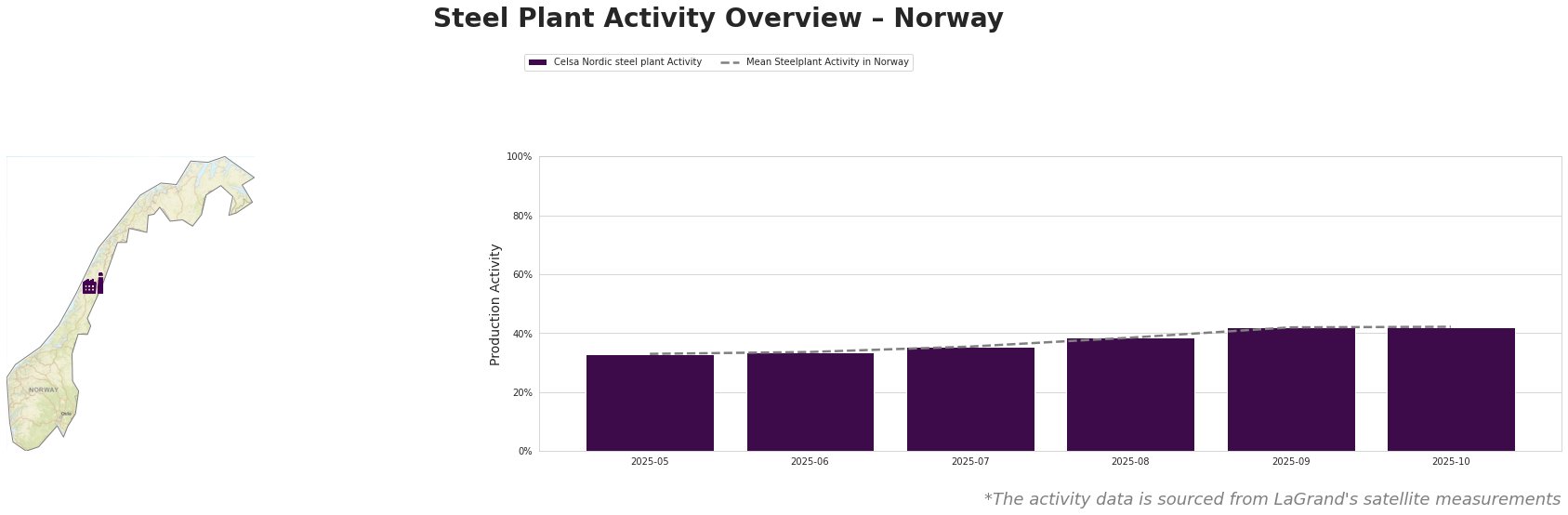

From May to October 2025, the mean steel plant activity in Norway increased steadily from 33% to 42%, indicating overall growth. Celsa Nordic’s activity mirrored this trend, maintaining the same activity level as the national average during this period. The peak activity of 42% in September and October is notable. However, based on the provided information, no direct link can be established between the observed activity levels and the news articles regarding EU ferroalloy import quotas.

Steel Plant Name: Celsa Nordic steel plant

Celsa Nordic, located in Mo i Rana, operates a 700,000-tonne EAF-based steel plant focused on semi-finished (billets) and finished rolled products (rebar, wire rod) primarily for the building and infrastructure sectors. The plant is ResponsibleSteel certified. Satellite data shows a consistent increase in activity from May to October 2025, reaching 42% of its all-time high. While the plant demonstrates steady growth, based on the provided information, no direct relationship can be established between this steady increase and the news articles regarding EU ferroalloy import quotas. However, given Celsa Nordic’s reliance on ferroalloys in its EAF process, the “EU imposes safeguards on silicon and manganese-based ferroalloy imports”, and associated articles outlining potential import restrictions, warrant careful monitoring of potential future impacts on the plant’s operations.

Evaluated Market Implications

The EU’s new ferroalloy import quotas, as reported in multiple articles including “EU imposes safeguards on silicon and manganese-based ferroalloy imports,” create potential supply disruptions for Norwegian steel producers reliant on imported ferroalloys. Although Celsa Nordic’s activity has been stable, the tariffs outlined in “EU states to vote on TRQ, variable duty alloy safeguard” on imports exceeding the TRQs could increase production costs and impact profitability.

Recommended Procurement Actions:

- Steel Buyers: Given the potential for increased ferroalloy costs due to the new EU quotas, steel buyers should secure contracts with fixed-price clauses wherever possible to mitigate the risk of price fluctuations. Prioritize domestic supply where possible, but carefully weigh cost implications against the benefits of supply chain security.

- Market Analysts: Analysts should closely monitor the implementation of the TRQs and their impact on ferroalloy prices, specifically for ferromanganese, ferrosilicon, and related alloys. Track import statistics from Norway and Iceland to assess the real-world impact of the new regulations. Pay close attention to any announcements from Assofermet, Euroalliages and similar trade bodies.