From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineItalian Steel Market: Stable Longs, Rising Coil Prices Amid CBAM Concerns

The Italian steel market exhibits diverging trends, with long steel products remaining stable while coil prices are increasing amid concerns over the upcoming Carbon Border Adjustment Mechanism (CBAM). As highlighted in “European steel HRC market still quiet amid push for higher offers,” HRC prices in Italy saw a slight decrease, but the article “Overview of European roll and environmentally friendly steel: roll prices in Northwest Europe are rising” points to rising coil prices due to stricter quotas and CBAM, which could impact Italian domestic prices. No explicit connection between these articles and observed plant activity can be made.

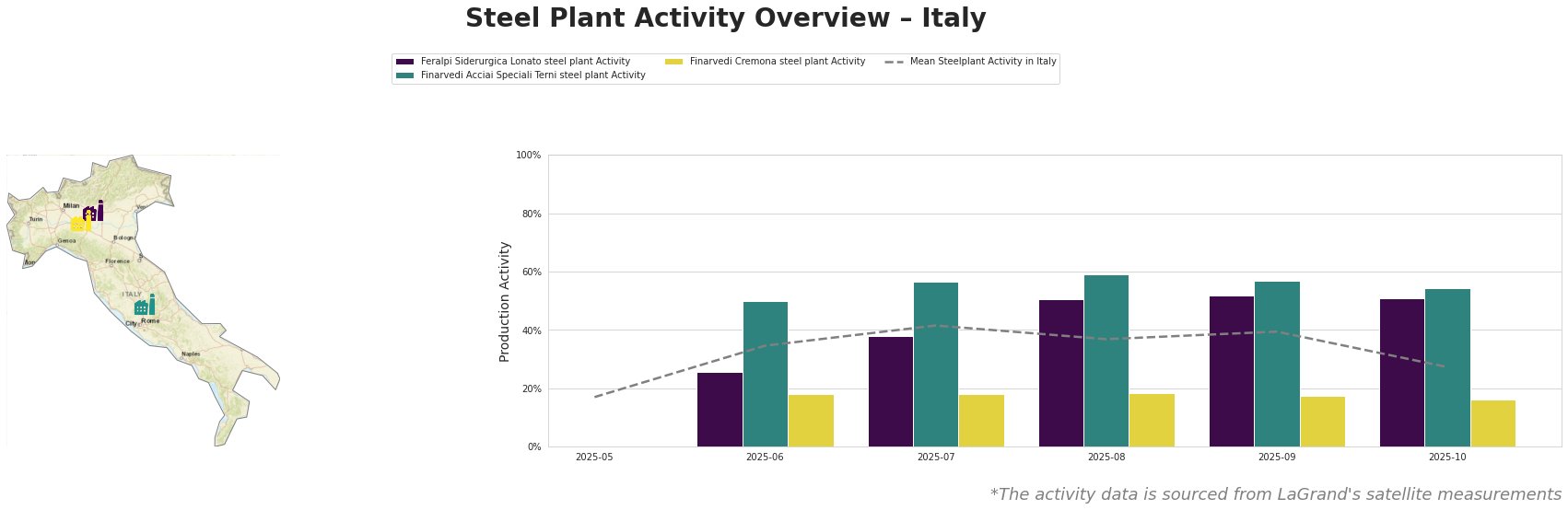

The mean steel plant activity in Italy peaked in July 2025 at 42% and then declined to 27% by October. Feralpi Siderurgica Lonato’s activity has been consistently above the mean since June, peaking at 52% in September and remaining high at 51% in October. Finarvedi Acciai Speciali Terni displayed the highest activity levels among the observed plants, peaking at 59% in August, but dropping to 54% in October. Finarvedi Cremona showed consistently low activity levels between 16% and 18%. No explicit connection can be drawn between these general activity shifts and the specific pricing developments mentioned in the provided news articles.

Feralpi Siderurgica Lonato steel plant: This plant, located in the Province of Brescia, operates an EAF with a capacity of 1.1 million tonnes of crude steel annually, focusing on rebar, billets, mesh, and wire rod production. The consistently high activity levels, exceeding the national mean, do not show any link to the stable long steel market described in “European longs market stable overall“.

Finarvedi Acciai Speciali Terni steel plant: Situated in the Province of Terni, this EAF-based plant has a 1.45 million tonne crude steel capacity, producing hot-rolled, cold-rolled coils, strips, sheets, and stainless steels for the automotive, building, and packaging sectors. The plant’s activity levels, consistently above the Italian mean, and especially the August peak at 59%, cannot be directly linked to the reported increase in coil prices and concerns over CBAM detailed in “Overview of European roll and environmentally friendly steel: roll prices in Northwest Europe are rising“.

Finarvedi Cremona steel plant: Located in the Province of Cremona, this plant has the largest crude steel capacity of the observed plants at 3.85 million tonnes, utilizing EAF technology to produce hot-rolled coil, galvanized, pickled, and pre-painted products mainly for the automotive sector. The consistently low activity, ranging between 16-18%, cannot be directly linked to the price increase in coil, even if this plant focuses on coil production.

Given the anticipated increase in coil prices due to CBAM and stricter quotas as suggested by “Overview of European roll and environmentally friendly steel: roll prices in Northwest Europe are rising,” and given the general decline in activity among the observed steel plants, steel buyers should consider securing contracts for coil products promptly to mitigate potential future price increases and availability issues. While the long steel market remains stable according to “European longs market stable overall,” procurement strategies should account for potential future fluctuations influenced by external factors.