From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineAsia Steel Market: Mixed Activity Signals Amidst North American Price Hikes

Asia’s steel market presents a mixed picture, with fluctuating plant activity levels against the backdrop of rising steel prices in North America. The North American price increases, detailed in “Canadian steel companies announce steel price increases,” “American steel producers are gradually raising prices for rolled products,” and “NLMK USA raises prices for hot-rolled and cold-rolled steel by $50/t,” do not appear to have a direct immediate impact on activity levels in the observed Asian steel plants.

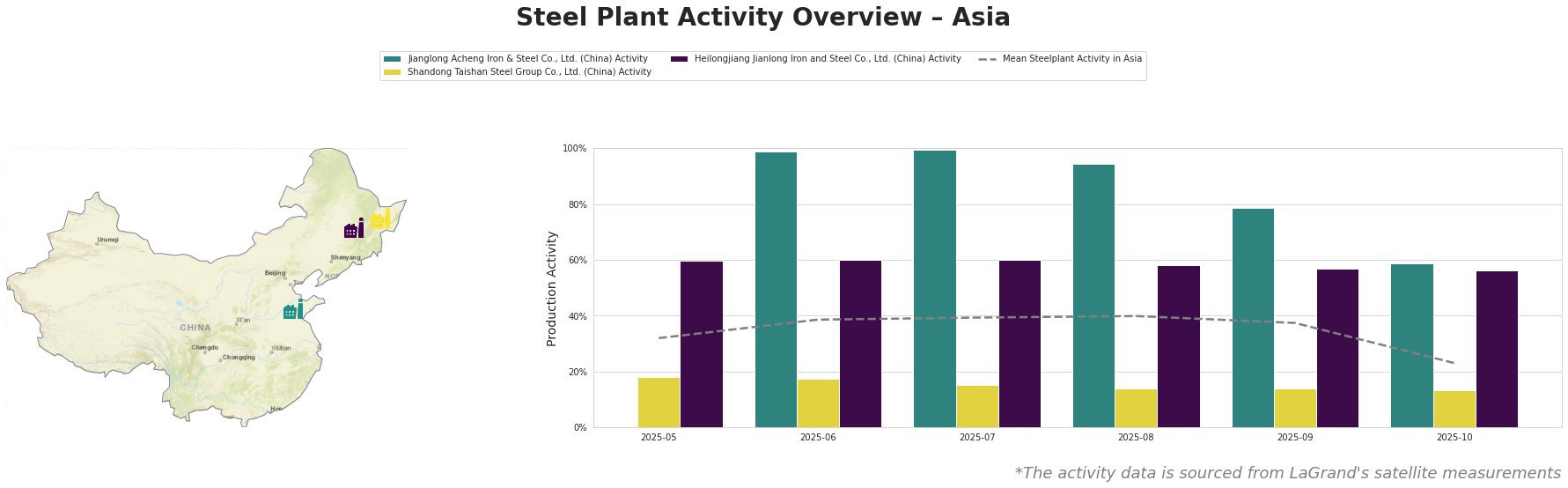

The mean steel plant activity in Asia decreased significantly in October to 23%, after staying relatively stable between 32% and 40% from May to September. Jianglong Acheng Iron & Steel Co., Ltd. showed very high activity between June and August (94-100%), then decreased to 79% and 59% for September and October respectively. Shandong Taishan Steel Group Co., Ltd. exhibited a consistently low activity level (13-18%) throughout the observed period. Heilongjiang Jianlong Iron and Steel Co., Ltd. displayed a stable but declining activity level of between 60% and 56% from May to October.

Jianglong Acheng Iron & Steel Co., Ltd.

Jianglong Acheng Iron & Steel, a Heilongjiang-based integrated steel plant with a crude steel capacity of 1.1 million tonnes, utilizes BF-BOF technology to produce finished rolled products, including hot-rolled and coated steel. Its primary end-user sectors are automotive, energy, and tools & machinery. The plant’s activity peaked at 100% in July 2025 but experienced a noticeable decline to 59% by October. It is ISO14001 and ResponsibleSteel certified. No direct connection between the sharp activity decline and the cited news articles regarding North American price increases can be explicitly established.

Shandong Taishan Steel Group Co., Ltd.

Shandong Taishan Steel Group, located in Shandong province, has a crude steel capacity of 5 million tonnes and is an integrated steel plant that relies on BF-BOF-EAF technologies for production. Its product portfolio consists of hot-rolled coil, cold-rolled coil, and stainless steel. The plant’s activity has remained consistently low, ranging from 13% to 18% throughout the observed period, indicating potential operational constraints or strategic production adjustments. The company is ResponsibleSteel certified. No direct link to the North American price increases reported in the news articles can be established based on the current information.

Heilongjiang Jianlong Iron and Steel Co., Ltd.

Heilongjiang Jianlong Iron and Steel, another Heilongjiang-based integrated steel plant, produces 2 million tonnes of crude steel using BF-BOF technology. The plant specializes in finished rolled products such as hot-rolled ribbed steel bars, seamless steel tube products and rebar. Activity levels have been relatively stable, gradually decreasing from 60% in May to 56% in October. No direct connection between the slightly declining activity and the cited news articles regarding North American price increases can be explicitly established.

Evaluated Market Implications

The observed decrease in mean steel plant activity in Asia, coupled with the stability or decline in individual plant activity (Jianglong Acheng Iron & Steel Co., Ltd., Shandong Taishan Steel Group Co., Ltd., Heilongjiang Jianlong Iron and Steel Co., Ltd.), may indicate potential supply constraints in the coming months, depending on the causes for the reduced activity. While North American steel producers are raising prices, no direct link can be established to current production activity in the observed Asian plants.

Procurement Actions for Steel Buyers and Analysts:

- Monitor Asian Steel Plant Activity: Closely monitor the activity levels of key steel plants in Asia, particularly Jianglong Acheng Iron & Steel Co., Ltd., to anticipate potential supply disruptions. The observed decline in production requires continued tracking.

- Assess Global Price Arbitrage Opportunities: While North American prices are rising, assess potential opportunities to source steel from regions with stable or declining prices, carefully considering transportation costs and lead times, as well as geopolitical risks.

- Diversify Sourcing: To mitigate potential risks, diversify steel sourcing strategies across multiple regions and suppliers. This is especially pertinent given the fluctuations observed in Asia and the price increases in North America.