From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineAsia Steel Market Faces Pressure: India Exports Surge Amidst China Slowdown

The Asian steel market is under pressure due to weak demand and high production, as indicated by “Asian steel market to remain under pressure in Q4 – S&P Global.” While a direct link between this general market pressure and activity changes at specific plants cannot be definitively established, the news article provides context for the observed trends in China. The surge in India’s steel exports, reported in “India became a net exporter of rolled steel in October,” doesn’t appear to have a direct, immediate link to the activity levels of the observed plants based on current data.

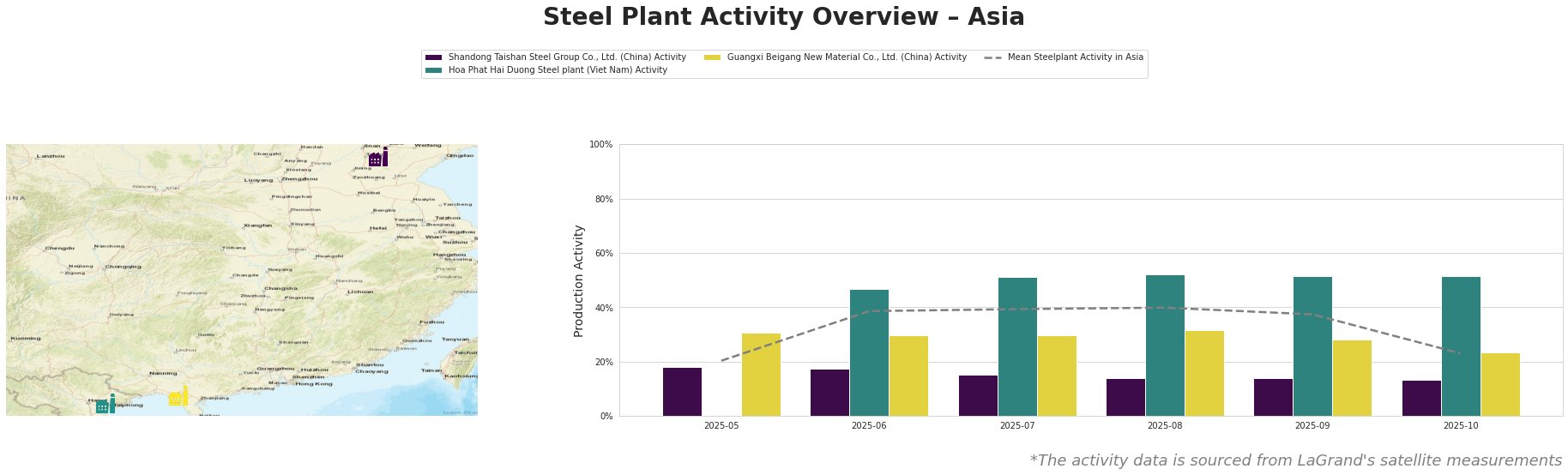

Here’s a look at monthly steel plant activity in Asia:

The mean steel plant activity in Asia saw a significant drop in October, falling from 37% to 23%. Shandong Taishan Steel Group’s activity remained consistently low, while Hoa Phat Hai Duong Steel plant showed stable activity. Guangxi Beigang New Material also experienced a drop in activity in October, coinciding with the overall market downturn.

Shandong Taishan Steel Group Co., Ltd., a major integrated BF steel producer in Shandong, China, with a crude steel capacity of 5 million tons, has shown consistently low activity, fluctuating between 18% and 13% between May and October. This low activity is below the Asian average and may be correlated with China’s effort to restructure the steel industry, as noted in “Asian steel market to remain under pressure in Q4 – S&P Global,” although a direct causal relationship cannot be definitively established.

Hoa Phat Hai Duong Steel plant, a Vietnamese integrated BF/BOF producer focused on finished rolled products, including construction steel and hot rolled coil, maintained a consistently high activity level, fluctuating between 47% and 52% over the observed period. This stability contrasts sharply with the fluctuations observed elsewhere in Asia. No specific news directly explains this plant’s steady performance.

Guangxi Beigang New Material Co., Ltd., a Chinese integrated BF/EAF steel plant producing both carbon and stainless steel products, experienced a decline in activity in October, dropping from 28% to 23%. This decline might be related to the environmental restrictions and reduced steel demand in China, as described in “Iron ore prices have fallen by 4.4% since the beginning of November,” but no explicit link can be confirmed.

Given the decline in Asian steel plant activity and the continued pressure on the market, as well as the fact that “Iron ore prices have fallen by 4.4% since the beginning of November” procurement professionals should prioritize:

- Monitoring Chinese steel export trends: The “Asian steel market to remain under pressure in Q4 – S&P Global” article highlights that China’s steel exports are crucial for easing inventory pressure. Track these exports closely, as any significant increase could further depress prices, presenting a potential buying opportunity.

- Assess inventory levels carefully: Given uncertainties around Chinese demand and potential supply chain disruptions, buyers should carefully assess and manage their steel inventory levels.

- Consider Indian steel: Given “India became a net exporter of rolled steel in October”, look for opportunities to source steel from India, since they are increasing the supply.