From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineEuropean Steel Market Resilient Amidst Lithium Shift: Plant Activity Stable Despite Nickel Price Pressures

Europe’s steel market demonstrates stability as Australian lithium dynamics and Indonesian nickel concerns unfold, with observed plant activity showing resilience. The situation around battery metals is important because they can be used to produce better and more energy efficient steel alloys. While “Australia eyes Indonesia’s nickel in its play for critical mineral supremacy“ highlights concerns about nickel prices and environmental impacts, no direct immediate impact on European steel plant activity is observable from satellite data. There’s no observable immediate connection between the reported lithium market adjustments described in “Australian MinRes and South Korean Posco create joint venture for lithium production“ and “Australia’s Oct lithium loadings dip after record Sep“ and European steel plant activity.

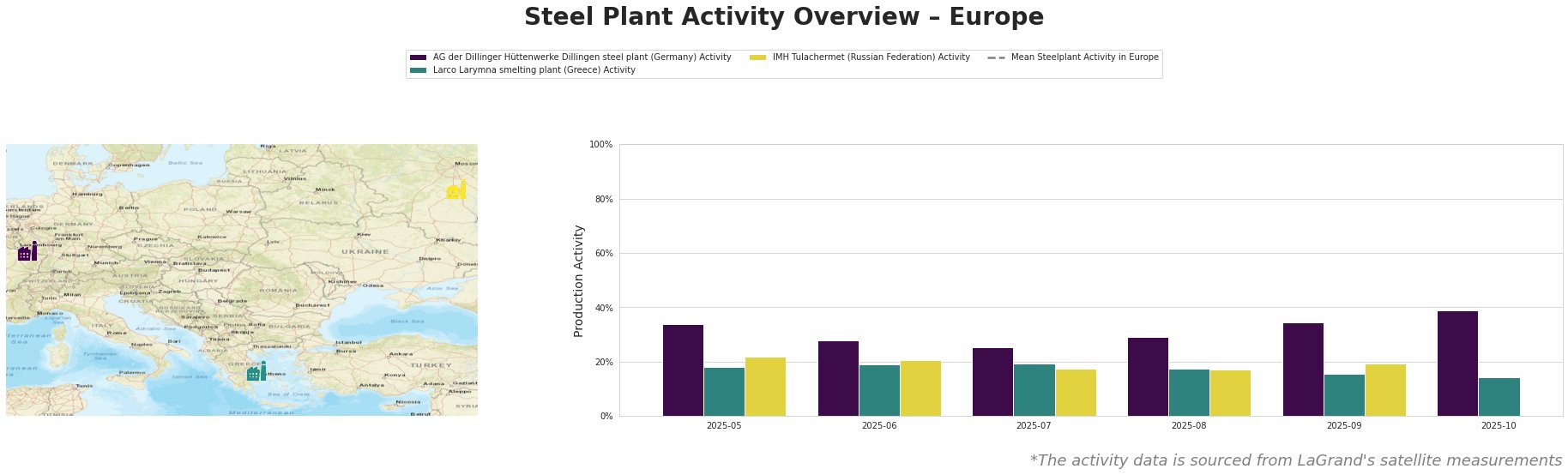

The satellite data reveals generally stable activity across the observed European steel plants, with some minor fluctuations. The mean steel plant activity in Europe fluctuated throughout the period, with peaks in July and August, and lows in October. AG der Dillinger Hüttenwerke Dillingen steel plant saw a gradual increase in activity, reaching its highest level in October (39.0). Larco Larymna smelting plant experienced a slight decrease in activity, dropping to its lowest point in October (14.0). IMH Tulachermet’s activity remained relatively stable, with a slight decrease in October (17.0).

AG der Dillinger Hüttenwerke Dillingen steel plant, located in Saarland, Germany, is an integrated BF-BOF steel plant with a crude steel capacity of 2.76 million tonnes. Its main products include heavy-plate products such as non-alloy structural steels, high-strength quenched & tempered fine-grained steels and offshore steels. The plant’s activity saw a consistent rise, reaching 39% in October, a local maximum within the observed timeframe. This increase in activity cannot be directly linked to any of the provided news articles.

The Larco Larymna smelting plant in Thessaly, Greece, primarily produces ferronickel using electric arc furnaces (EAF), with a ferronickel capacity of 2.5 million tonnes. The plant experienced a gradual decline in activity, reaching 14% in October. No connection to the Australian lithium/nickel market situation can be established based on the available information.

IMH Tulachermet, situated in Tula, Russian Federation, is an integrated BF-BOF steel plant with a crude steel capacity of 1.8 million tonnes. The plant produces semi-finished and finished rolled products, including billet, rebar, and wire rod. Its activity remained relatively stable throughout the period, with a slight decrease to 17% in October. There is no immediate connection between the activity level of this plant and the provided news articles on Australian lithium and Indonesian nickel.

Given the stability in European steel plant activity despite fluctuations in the lithium and nickel markets, steel buyers and market analysts should:

- Monitor nickel price volatility: Closely track nickel price fluctuations, particularly influenced by Indonesian production, as highlighted in “Australia eyes Indonesia’s nickel in its play for critical mineral supremacy.” While current activity levels aren’t affected, sustained price declines could eventually impact production costs for certain steel alloys.

- Maintain existing procurement strategies: Based on observed plant activity, there’s no immediate need to drastically alter procurement strategies. However, be prepared to adjust if nickel price volatility escalates.

- Diversify sourcing (Long-term): While not immediately pressing, the news around battery metal markets demonstrates the need for more diverse and geopolitically stable access to raw materials that are used to produce steel alloys and better performing steels.