From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineUkrainian Steel Production Up Despite Export Challenges: Plant Activity Varies Amid Shifting Trade Flows

Ukraine’s steel sector shows resilience with increased rolled steel production, detailed in “Ukraine produced 5.38 million tons of rolled steel in January-October“. This growth, however, coexists with shifting export dynamics, as evidenced by “Ukraine reduced iron ore exports by 4.4% y/y in January-October” and “Ukraine exported 1.59 million tons of pig iron in January-October.” The reported fluctuations in iron ore exports to key markets may indirectly impact the operational tempo of domestic steel plants. Despite this indirect relationship, no explicit immediate connection between export data and plant activity can be directly inferred from the news articles provided.

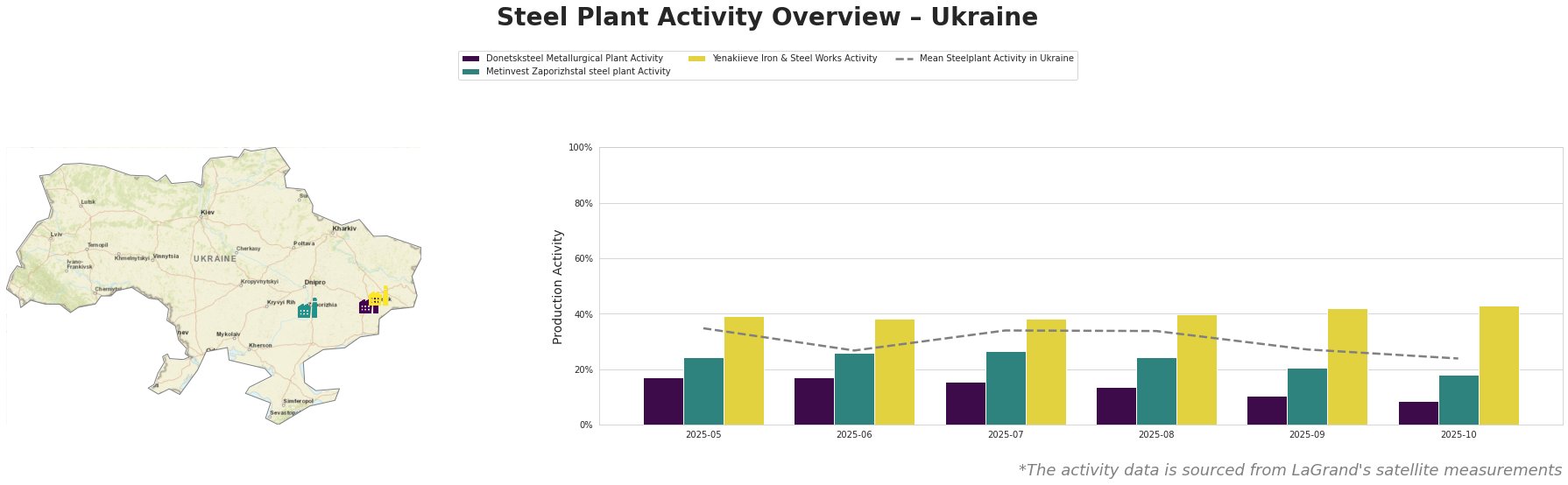

The mean steel plant activity in Ukraine shows a declining trend from May (35.0%) to October (24.0%), with notable fluctuations. Donetsksteel Metallurgical Plant shows a continuous decline from 17.0% in May to 9.0% in October, consistently operating below the national average. Metinvest Zaporizhstal steel plant also experienced a decline, from 24.0% in May to 18.0% in October. Yenakiieve Iron & Steel Works presents a contrasting picture, with activity rising from 39.0% in May to 43.0% in October, significantly exceeding the national average in the observed period. No explicit connection between these activity levels and the provided news articles can be directly inferred.

Donetsksteel Metallurgical Plant, an integrated BF-EAF producer focusing on pig iron, saw its activity drop from 17.0% in May to 9.0% in October. Given its reliance on BF technology and pig iron production, the surge in pig iron exports reported in “Ukraine exported 1.59 million tons of pig iron in January-October” does not appear to have positively impacted Donetsksteel’s operational activity, as its levels remained consistently low and decreased over time.

Metinvest Zaporizhstal steel plant, a large integrated BF-OHF producer of finished rolled products like hot-rolled coil and sheets, experienced a decrease in activity from 24.0% in May to 18.0% in October. Despite the overall increase in rolled steel production reported in “Ukraine produced 5.38 million tons of rolled steel in January-October,” Zaporizhstal’s activity declined, suggesting potential shifts in production focus or challenges in maintaining output levels. No direct connection between the decline in activity and export challenges can be inferred.

Yenakiieve Iron & Steel Works, an integrated BF-BOF producer of semi-finished and finished rolled products, increased its activity from 39.0% in May to 43.0% in October, bucking the overall downward trend. The “Ukraine produced 5.38 million tons of rolled steel in January-October” article indicates a 2.2% increase in rolled steel production, which might correlate with Yenakiieve’s increased activity. However, a direct causal relationship cannot be definitively established based solely on the provided information.

The observed shifts in pig iron exports highlighted in “Ukraine exported 1.59 million tons of pig iron in January-October,” particularly the increased reliance on the U.S. market, may lead to localized supply pressure depending on the logistical capabilities and operational efficiency of specific Ukrainian mills like Donetsksteel Metallurgical Plant and Yenakiieve Iron & Steel Works.

Recommended Actions: Steel buyers should closely monitor pig iron availability and pricing from Ukrainian producers, especially those reliant on BF technology. Consider diversifying pig iron supply sources to mitigate potential disruptions linked to shifting export destinations. Market analysts should closely track regional production data to identify potential supply bottlenecks.