From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineOceania Steel Market Optimistic Despite Fluctuations: Production Activity Shifts Signal Potential Opportunities

Oceania’s steel market shows a positive outlook, despite observed fluctuations in plant activity. There were no news articles provided related to the Oceania steel market that would explain the recent changes in observed plant activity. However, the evolving activity levels at key plants suggest potential shifts in supply and demand dynamics.

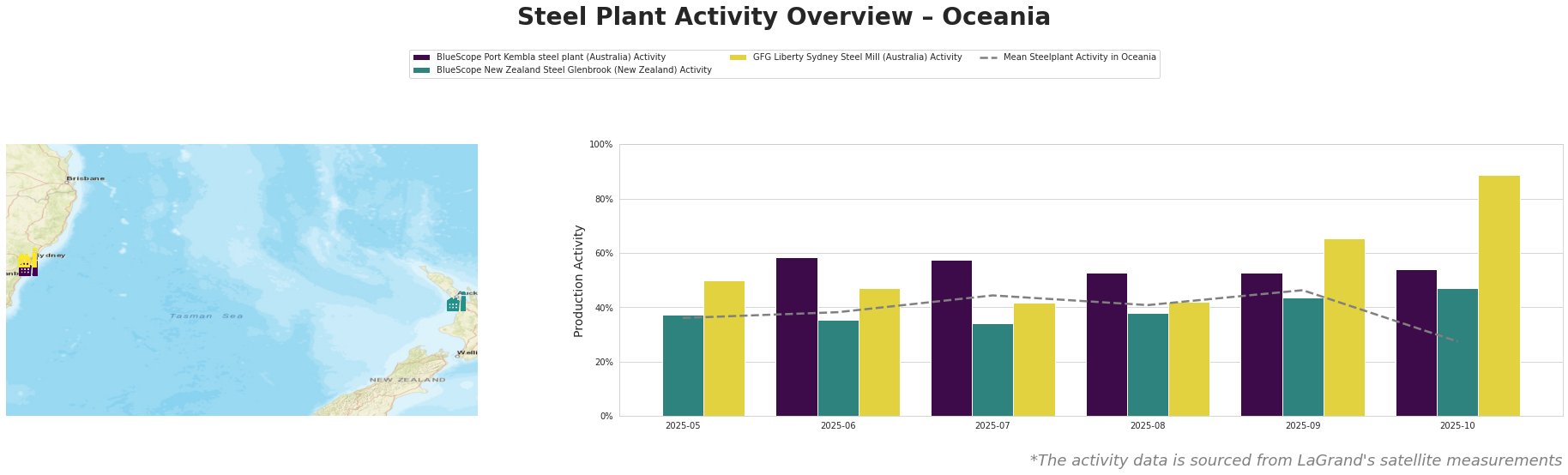

The mean steel plant activity in Oceania fluctuated, peaking at 46% in September 2025 before dropping significantly to 27% in October 2025. BlueScope Port Kembla steel plant in Australia showed relative stability in activity, ranging from 53% to 58%. BlueScope New Zealand Steel Glenbrook experienced more variability, with a low of 34% in July 2025 and a peak of 47% in October 2025. GFG Liberty Sydney Steel Mill exhibited the most significant increase, jumping from 65% in September 2025 to 89% in October 2025.

BlueScope Port Kembla, an integrated BF-BOF operation with a 3.2 million tonnes per annum (ttpa) crude steel capacity, primarily produces slabs, hot rolled coil, and plate for the building and infrastructure sectors. Its activity remained relatively stable around the mid-50% range, consistently above the Oceania average, suggesting steady production.

BlueScope New Zealand Steel Glenbrook, an integrated DRI-BOF plant with a 650 ttpa crude steel capacity, focuses on slabs and hot/cold rolled products for building, packaging, and machinery. Its activity fluctuated, staying mostly below the Oceania average until October, when it rose to 47%. No direct connection could be established between these observed activity levels and the provided European steel market news.

GFG Liberty Sydney Steel Mill, an EAF-based plant with a 750 ttpa crude steel capacity, produces long products like reinforcing bar and mesh for various sectors including building, energy, and transport. The plant’s activity increased significantly, reaching 89% in October 2025, far exceeding both its own historical levels and the regional average. No direct connection can be established between this activity surge and the provided European steel market news articles.

The substantial increase in activity at GFG Liberty Sydney Steel Mill, alongside stable production at BlueScope Port Kembla, may indicate localized increases in demand for long steel products. Given the drop in overall mean steel plant activity, steel buyers should monitor the market closely for potential supply imbalances. Procurement professionals should consider securing supply agreements with GFG Liberty Sydney Steel Mill to capitalize on their increased production and potentially mitigate risks associated with regional supply chain disruptions.