From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineBrazil Steel Market Report: Navigating Climate Policy Uncertainty Amidst Variable Production Activity

Brazil’s steel market faces a Neutral sentiment impacted by ongoing climate discussions and fluctuations in plant activities. The recent articles titled “COP30 in Brasilien: Indigene Aktivisten stürmen Gelände der Klimakonferenz – Verletzte bei Zusammenstößen“ and “Cop: Cop 30 braces for first test on divisive issues“ indicate escalating tensions during COP30, reflecting concerns about Brazil’s climate policies as activists clash, thereby potentially affecting long-term expectations for regulatory frameworks that could impact the steel sector.

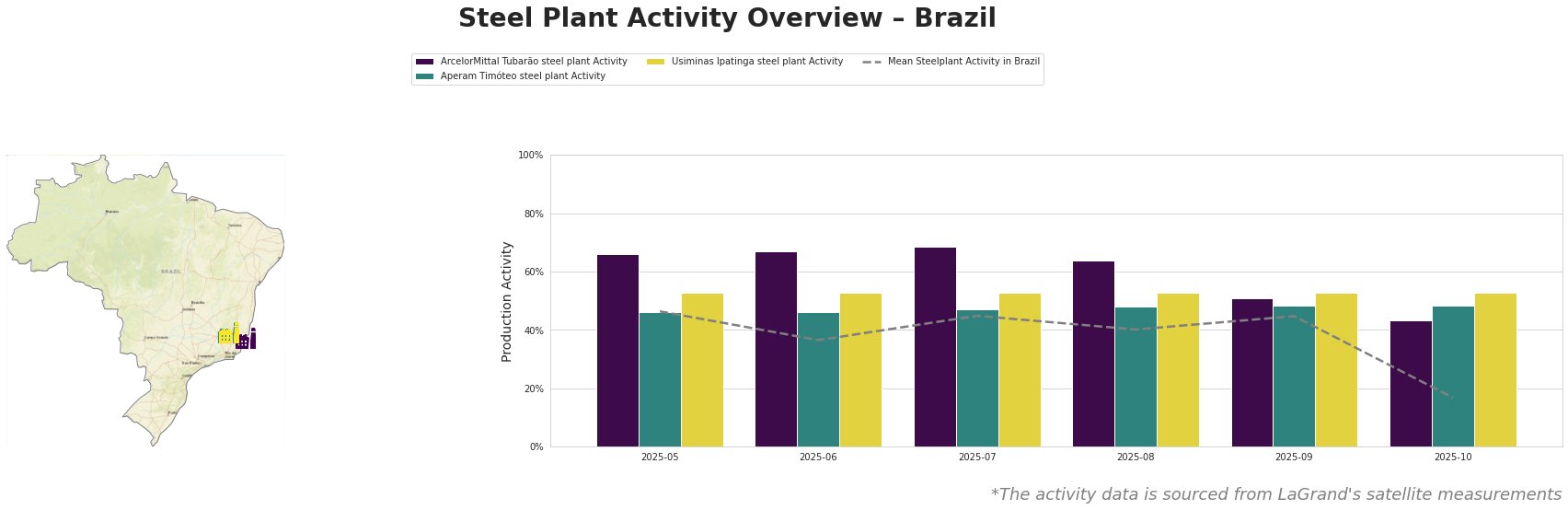

Measured Activity Overview

The activity levels at the ArcelorMittal Tubarão steel plant peaked at 68.0% in July before declining to 43.0% by October—a significant drop that does not explicitly align with the climate-related news but could indicate potential operational or supply chain issues. The mean activity across all plants fell sharply in October to 17.0%, reflecting broader challenges within the industry. The Aperam Timóteo steel plant remained stable around 48.0%, while Usiminas Ipatinga maintained consistent output, indicating resilience in operations despite external pressures.

Plant Information

The ArcelorMittal Tubarão steel plant, located in Espírito Santo, demonstrated robust production capabilities with a high integration level via a blast furnace process, producing significant quantities of both semi-finished and finished rolled products. However, its activity decline from 68.0% to 43.0% suggests internal operational shifts that haven’t been directly linked to the recent tumultuous climate discussions.

The Aperam Timóteo steel plant operates in Minas Gerais with a dual production strategy, combining both BOF and EAF processes. Its relatively stable activity level across the month may indicate resilience to external shocks, despite the uncertainties surrounding Brazil’s climate policies as addressed in articles such as “Weltklimakonferenz COP30: Die Chance von Belém.” However, the absence of a direct correlation with recent unrest hints at underlying continuity in operations.

For Usiminas Ipatinga, with a capacity for semi-finished and finished products, the observed stability at 53.0% aligns with its established operational structure. Nonetheless, shifts in regulatory conditions stemming from COP30 discussions could indirectly impact long-term operational forecasts.

Evaluated Market Implications

The unsteady activity levels at ArcelorMittal Tubarão coupled with the pronounced mean activity drop signal potential supply disruptions, particularly as operational clarity remains clouded by ongoing negotiations highlighted in “COP 30 in Brasilien: Läutet Belém das Ende des fossilen Zeitalters ein?” Steel buyers should carefully consider procurement timelines, especially regarding sources reliant on stable operational conditions.

Strategically, it is recommended that buyers strengthen engagement with alternative suppliers, particularly those unaffected by ongoing climate protests. Continued monitoring of the COP30’s progress is crucial; shifts in policy or funding mechanisms could drastically reshape the procurement landscape, warranting agile adjustments to supply strategies to mitigate risks associated with regulatory changes and market volatility.