From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineUkrainian Steel Output Rises Amidst Export Shifts: European Market Overview

The European steel market faces a complex landscape with rising Ukrainian production and shifting export dynamics. According to “Ukrainian steel industry is operating at 92% capacity utilization – deputy minister,” Ukraine’s steel industry is operating at high capacity despite the ongoing war. This contrasts with the news that “Metinvest reduced steel production by 10% due to the effects of the war,” indicating uneven impacts across Ukrainian producers. While the news articles highlight war effects and operational changes, the satellite data shows no direct relationship.

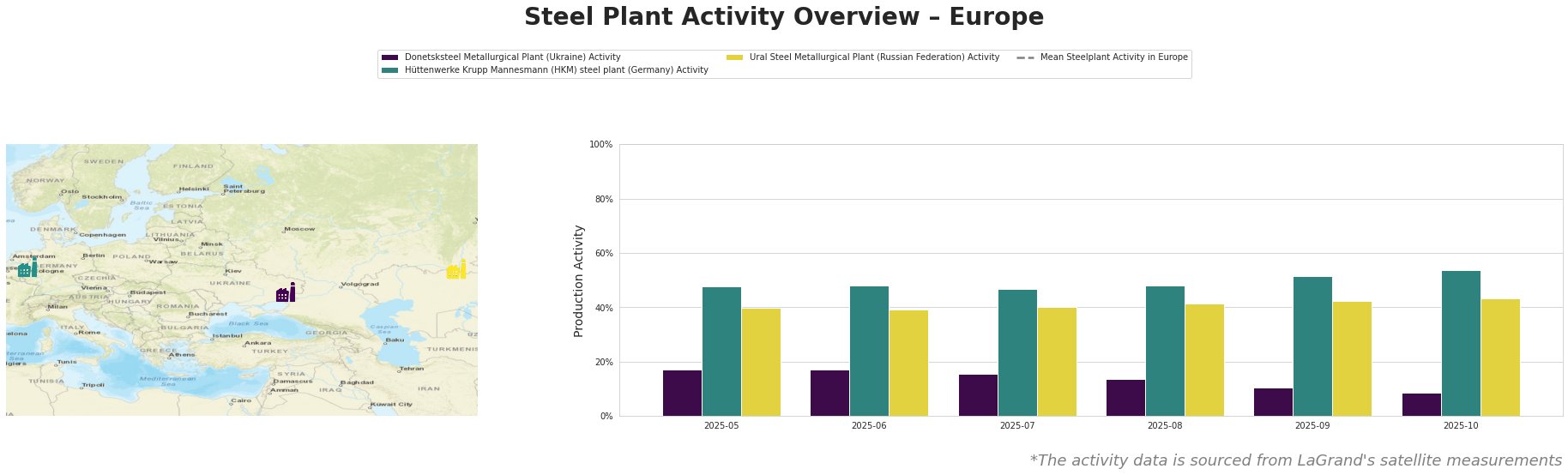

The mean steel plant activity in Europe fluctuated, exhibiting a notable decrease to 271853108.0 by October 2025. Activity at Donetsksteel Metallurgical Plant continuously decreased, reaching a low of 9.0% in October. Conversely, Hüttenwerke Krupp Mannesmann (HKM) steel plant demonstrated a steady increase, peaking at 54.0% in October. Ural Steel Metallurgical Plant also showed a gradual increase, reaching 43.0% in October.

Donetsksteel Metallurgical Plant, located in the Donetsk region of Ukraine, is an integrated steel plant with a capacity of 1.5 million tons of iron production using BF technology. The satellite data reveals a continuous decline in activity at Donetsksteel, from 17.0% in May to 9.0% in October. This decline may be linked to the overall effects of the war as cited in the news article “Metinvest reduced steel production by 10% due to the effects of the war” potentially causing regional disruptions. However, no direct link can be explicitly established with a news article.

Hüttenwerke Krupp Mannesmann (HKM) steel plant, situated in North Rhine-Westphalia, Germany, has a crude steel capacity of 6 million tons using BOF technology. The plant produces crude, semi-finished, and finished rolled products. Observed activity at HKM shows a steady increase from 48.0% in May to 54.0% in October, surpassing the European mean. No direct connection can be established with a news article.

Ural Steel Metallurgical Plant, located in the Orenburg region of Russia, is an integrated plant with a crude steel capacity of 1.6 million tons via EAF and an iron capacity of 2.7 million tons using BF technology. Activity has steadily increased from 40.0% in May to 43.0% in October, near the European mean. No direct connection can be established with a news article.

Increased Ukrainian pig iron production, as highlighted in “Ukraine reports 8.4 percent rise in pig iron output for Jan-Oct 2025” and “Ukraine exported 1.59 million tons of pig iron in January-October,” indicates a potential shift in supply dynamics, particularly to the U.S., which has become a primary consumer. Simultaneously, according to the news article “Ukraine reduced iron ore exports by 4.4% y/y in January-October,” reduced Ukrainian iron ore exports to Poland suggest regional supply chain adjustments.

Evaluated Market Implications:

- Potential Supply Disruptions: The decline in activity at Donetsksteel, combined with broader war-related disruptions cited in “Metinvest reduced steel production by 10% due to the effects of the war,” raises concerns about potential supply chain instability from this specific region, particularly in pig iron.

- Recommended Procurement Actions:

- Steel Buyers: Given the rise in Ukrainian pig iron exports to the US, as reported in “Ukraine exported 1.59 million tons of pig iron in January-October,” European steel buyers should closely monitor pig iron prices and supply routes from alternative sources to mitigate potential disruptions, especially if relying on traditional supply chains involving Poland and Ukrainian iron ore, as “Ukraine reduced iron ore exports by 4.4% y/y in January-October” indicates potential regional supply adjustments.

- Market Analysts: Closely examine the impact of increased Ukrainian pig iron production on global trade flows, specifically noting any shifts in pricing and import patterns in the US and European markets. This should include ongoing monitoring of activity levels at Donetsksteel to understand the potential for continued regional supply challenges.