From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineBrazil Steel Market Shows Resilience Amidst COP30 and Climate Action Focus

Brazil’s steel market shows resilience despite climate-related discussions at COP30. Recent changes in steel plant activity, potentially impacted by shifts towards climate action plans highlighted in “COP30: Was Brasilien an Klimakonferenzen ändern will,” are being closely monitored. While no immediate causal relationship can be definitively stated, the increased focus on implementation discussed in “Cop: Paris goals remain elusive” and “Weltklimakonferenz COP30: Die Chance von Belém” is driving market sentiment.

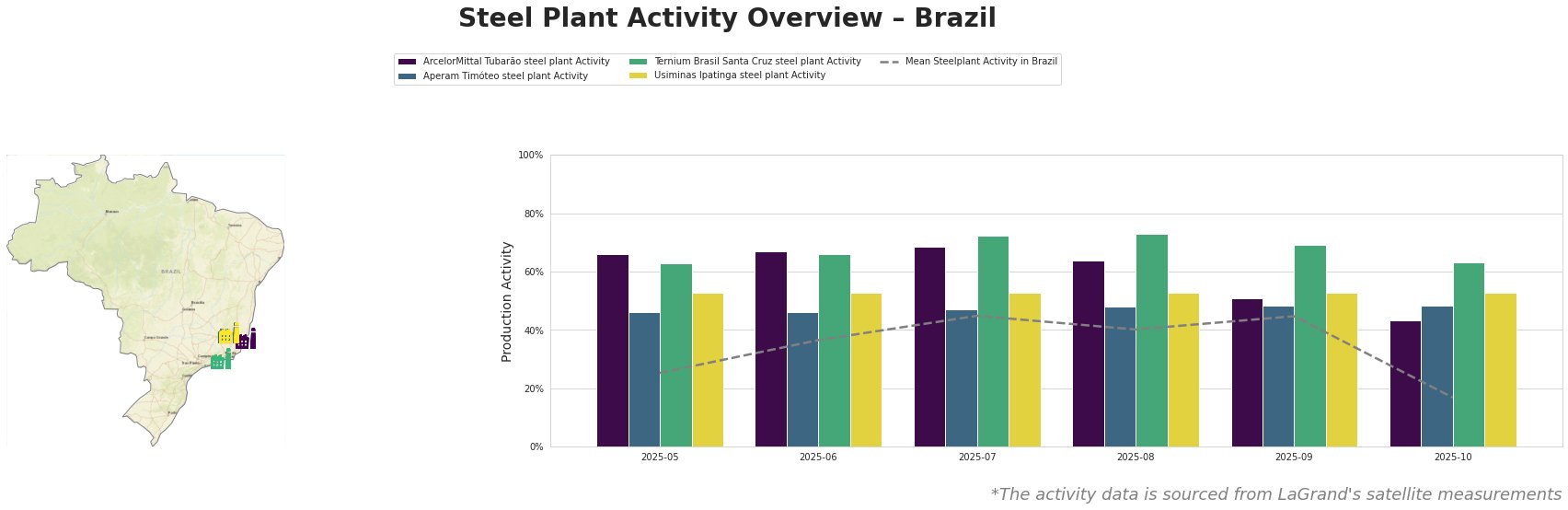

Observed plant activity shows a mean of 25% in May, peaking at 45% in July and September, before significantly dropping to 17% in October. ArcelorMittal Tubarão demonstrated the highest activity relative to other plants for the majority of the observed period, peaking at 68% in July and decreasing to 43% in October. Aperam Timóteo remained relatively stable at just under 50% throughout the observed period. Ternium Brasil showed consistently high activity, peaking at 73% in August and declining to 63% in October. Usiminas Ipatinga operated at a constant 53%. The sharp drop in the mean activity in October is largely influenced by the sharp decreases in ArcelorMittal Tubarão and Ternium Brasil Santa Cruz plants.

ArcelorMittal Tubarão, located in Espírito Santo, is an integrated steel plant with a crude steel capacity of 7500 ttpa, relying on BF and BOF technologies for semi-finished and finished rolled products. The plant’s activity peaked at 68% in July, before experiencing a significant drop to 43% in October. While the news articles discuss climate action and COP30, a direct link between these events and the recent activity drop at ArcelorMittal Tubarão cannot be definitively established.

Aperam Timóteo, situated in Minas Gerais, features both BF and EAF technologies with a crude steel capacity of 900 ttpa, specializing in finished rolled products like stainless steel and electrical steel. Activity at Aperam Timóteo has remained stable, fluctuating around 47%, suggesting consistent operations and minimal impact from COP30-related discussions. No direct connection to the provided news articles could be established.

Ternium Brasil Santa Cruz, located in Rio de Janeiro, has a crude steel capacity of 5200 ttpa using BF and BOF processes, producing semi-finished slabs. The plant’s activity peaked at 73% in August before decreasing to 63% in October. The drop in activity may be correlated with broader market uncertainties.

Usiminas Ipatinga, an integrated steel plant in Minas Gerais, boasts a crude steel capacity of 5000 ttpa, utilizing BF and BOF technologies to produce a range of semi-finished and finished rolled products. Notably, activity at Usiminas Ipatinga remained constant at 53% throughout the observed period, indicating stable production regardless of the climate discussions and the “first test on divisive issues” highlighted in “Cop 30 braces for first test on divisive issues“.

Given the observed decrease in overall steel plant activity in Brazil, especially at ArcelorMittal Tubarão and Ternium Brasil, potentially linked to broader market uncertainties amplified by the discussions at COP30 as highlighted in “Cop 30 braces for first test on divisive issues,” steel buyers should:

- Prioritize securing slab inventory: Given Ternium Brasil Santa Cruz’s production focus on slabs and its activity decrease, buyers reliant on their supply should proactively build inventory to mitigate potential short-term disruptions.

- Diversify supplier base: Due to the potential impacts of climate finance and trade measure discussions raised in “Cop 30 braces for first test on divisive issues,” explore alternative slab supply options to reduce dependence on specific plants or regions potentially affected by COP30 outcomes.