From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineAsia Steel Market: Production Shifts Amidst US Price Hikes

Asia’s steel market shows fluctuating plant activity, potentially influenced by global price dynamics but without directly verifiable links. The observations correlate with a market where North American steelmakers are enacting price increases. Specifically, activity data from key Chinese steel plants shows shifts, though direct links to the articles “Canadian Steel Companies announce price increases“, “Canadian steel companies announce steel price increases“, and “American steel producers are gradually raising prices for rolled products” cannot be explicitly established based on available data.

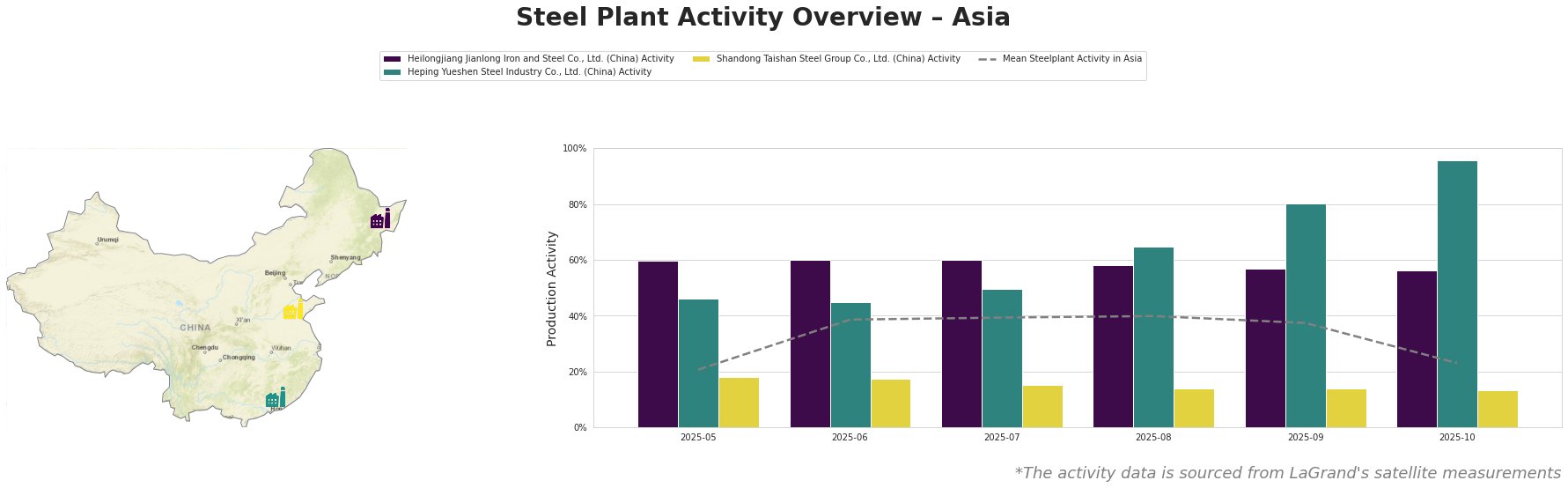

The mean steel plant activity in Asia fluctuated, ranging from a low of 21% in May 2025 to a high of 40% in August 2025, before dropping significantly to 23% in October 2025. Heilongjiang Jianlong Iron and Steel Co., Ltd. maintained relatively stable activity levels around 60% throughout the observed period, experiencing only a slight decrease to 56% by October. Heping Yueshen Steel Industry Co., Ltd. showed a significant increase in activity, rising from 46% in May to 96% in October. Shandong Taishan Steel Group Co., Ltd. displayed a consistently low activity level, fluctuating between 13% and 18% over the same period.

Heilongjiang Jianlong Iron and Steel Co., Ltd., an integrated BF-based steel plant in Heilongjiang with a 2000 ktpa crude steel capacity focused on finished rolled products like rebar, maintained a relatively stable high level of activity. The slight decrease in activity from 60% to 56% between May and October 2025 is not directly linked to any of the provided news articles about North American price increases.

Heping Yueshen Steel Industry Co., Ltd., an EAF-based steel plant in Guangdong with a 1400 ktpa crude steel capacity producing hot rolled rebar, exhibited a significant increase in activity, rising from 46% in May to 96% in October 2025. This substantial increase in activity could signal a shift in production strategy, however, no explicit connection can be established with the “Canadian Steel Companies announce price increases“, “Canadian steel companies announce steel price increases“, and “American steel producers are gradually raising prices for rolled products” articles.

Shandong Taishan Steel Group Co., Ltd., an integrated BF/EAF-based steel plant in Shandong with a 5000 ktpa crude steel capacity manufacturing hot and cold rolled coil and stainless steel, consistently operated at low activity levels (13-18%) throughout the observed period. This consistently low level of activity suggests a potential capacity underutilization, but no explicit connection can be established with the “Canadian Steel Companies announce price increases“, “Canadian steel companies announce steel price increases“, and “American steel producers are gradually raising prices for rolled products” articles.

The observed increase in activity at Heping Yueshen Steel Industry Co., Ltd. could indicate a potential shift in regional supply dynamics, possibly in response to anticipated demand. While Canadian and US steel price increases are being implemented, a direct link to this activity increase cannot be definitively established.

Procurement Action: Steel buyers should closely monitor Heping Yueshen Steel Industry Co., Ltd. production and inventory levels for rebar, as its increased activity may influence regional pricing. Diversifying rebar supply sources to include Heping Yueshen Steel Industry Co., Ltd. could be considered, depending on quality and pricing competitiveness.