From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineNorth American Steel Market: Stable Production Amidst Economic Uncertainty, Monitor Calvert

The North American steel market exhibits stable production despite economic headwinds. Increased layoff announcements and general economic uncertainty, as highlighted in “Layoff plans in the United States for October are the highest since 2003: Challenger” and “Stock market today: Dow, S&P 500, Nasdaq sink as AI valuation concerns mount amid bleak jobs data,” have not yet translated into significant production decreases at most major steel plants, except for a slight decrease in the North American mean steel plant activity. The tech sector volatility mentioned in “Morning Bid: Tech bounce stalls” and anticipation of a potential government shutdown resolution per “Stock market today: Dow, S&P 500, Nasdaq diverge as Big Tech wobbles ahead of House shutdown vote” do not have a clear connection to the observed activity data.

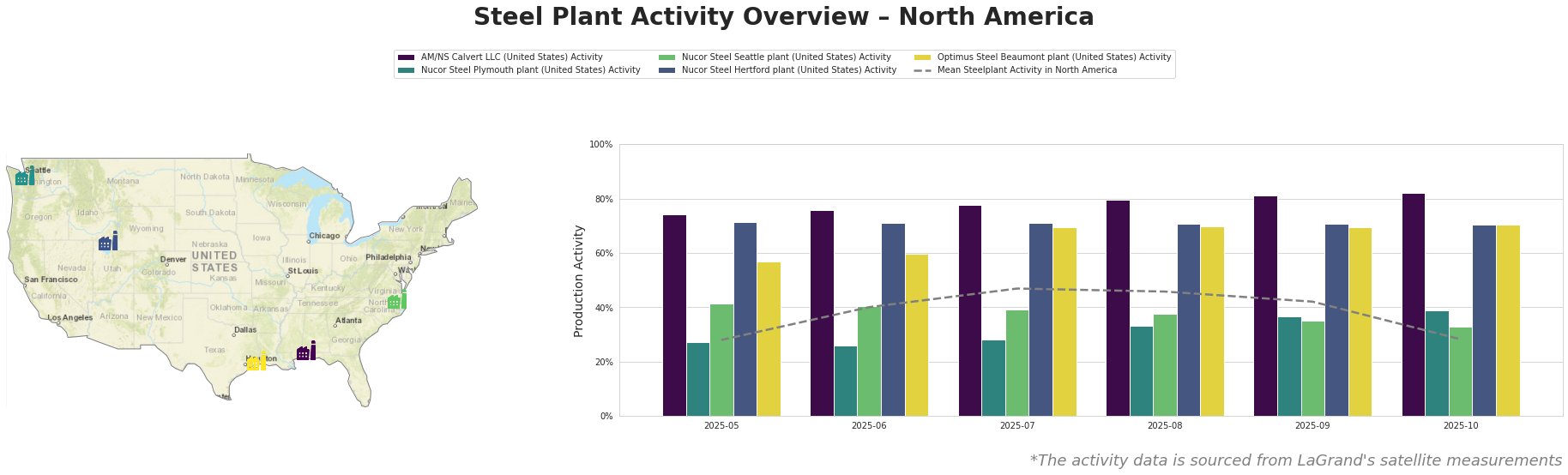

The mean steel plant activity in North America decreased significantly in October, reaching 28.0%, down from 42.0% in September, and the high of 47.0% in July. AM/NS Calvert LLC shows a continuous activity increase, reaching 82.0% in October. Nucor Steel Plymouth shows a slight increase, reaching 39.0% activity in October. Nucor Steel Seattle shows a steady decline, reaching 33.0% in October. Nucor Steel Hertford maintains a consistent activity level at 71.0%. Optimus Steel Beaumont maintains similar activity, recording 70.0% in October.

AM/NS Calvert LLC, located in Alabama, operates with a 1500 ttpa EAF capacity, focusing on finished rolled products like hot-rolled, cold-rolled sheet, and advanced coated products for automotive and infrastructure sectors. Its activity has consistently increased, reaching 82% in October, well above the North American mean. There is no clear link between this increasing activity and the economic uncertainties detailed in “Layoff plans in the United States for October are the highest since 2003: Challenger” or the tech sector volatility described in “Morning Bid: Tech bounce stalls.”

Nucor Steel Plymouth, Utah, an EAF steel plant with a 908 ttpa capacity producing bar products, experienced a slight activity increase to 39% in October. Nucor Steel Seattle, Washington, also an EAF plant with 855 ttpa capacity producing bar products, saw a decrease to 33% activity. Nucor Steel Hertford in North Carolina, specializing in plate production with an EAF capacity of 1542 ttpa, maintained a stable activity level of 71%. Optimus Steel Beaumont, Texas, with a 700 ttpa EAF capacity producing wire rods and coiled rebar, also maintained high activity at 70%. No direct correlation can be established between the fluctuations in activity levels at these Nucor and Optimus Steel plants and the macroeconomic news events.

While most plants maintain relatively stable activity, the decrease in the North American mean steel plant activity, combined with increasing layoff announcements highlighted in “Layoff plans in the United States for October are the highest since 2003: Challenger“, introduce uncertainty. Steel buyers should closely monitor AM/NS Calvert LLC, given its counter-trend activity increase. This plant’s output becomes increasingly important in the face of potential future broader production cuts in the North American market.

Steel buyers should also consider diversifying their supply sources to mitigate potential disruptions. While no immediate action is needed, continuously monitoring activity is critical.