From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EnginePositive Momentum in Asia’s Steel Market: China’s Export Surge and India’s Net Export Status

The steel market in Asia is experiencing a positive turn, highlighted by significant developments in China and India. According to “China’s Steel Exports Rise 6.6% in January–October 2025“, China’s steel exports saw a year-on-year increase of 6.6%, amounting to 97.74 million tons. Concurrently, “India Becomes a Net Exporter of Steel in October“ indicates that India transitioned to being a net exporter, with finished steel exports surging by 44.7% from the previous year. These announcements correlate with notable increases in plant activity across the region.

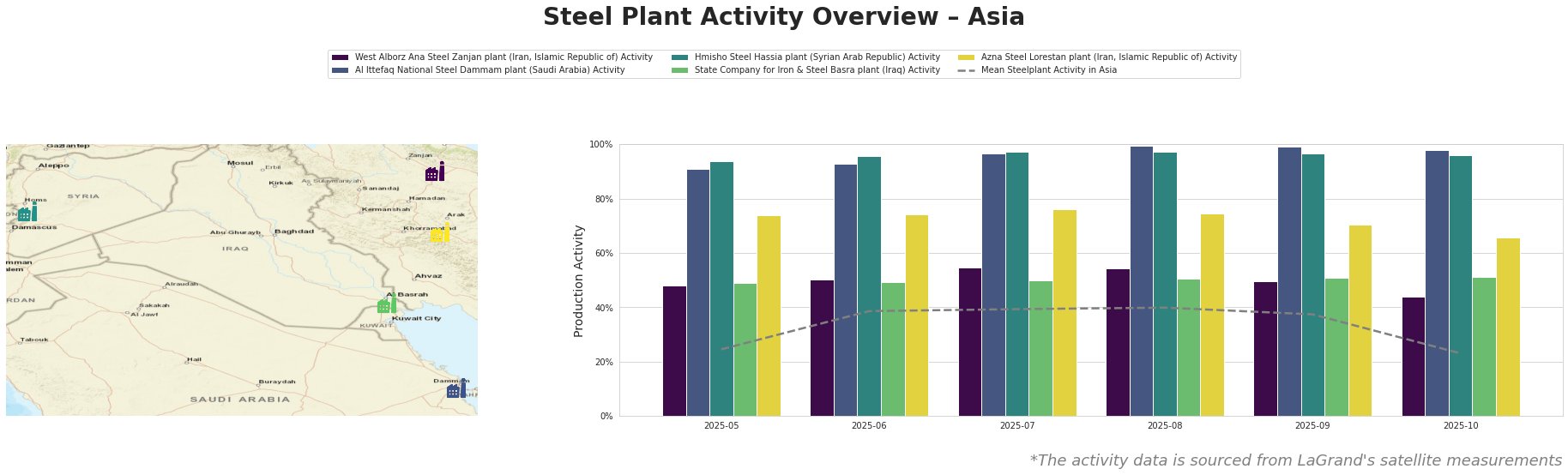

The West Alborz Ana Steel Zanjan plant saw its activity drop from a peak of 55.0% in July to 44.0% in October, which may reflect a strategic alignment with the declining export levels noted in “China increased steel exports by 6.6% y/y in January-October“ despite benefiting from rising exports to Saudi Arabia.

Conversely, the Al Ittefaq National Steel Dammam plant maintained high activity levels throughout the monitoring period, peaking at 100% in August, closely aligning with China’s increased shipments to Saudi Arabia, affirming the region’s growing demand for steel as highlighted in the article “China increases steel exports to Saudi Arabia amid trade restrictions.”

The Hmisho Steel Hassia plant consistently showed activity close to its operational capacity, reflecting resilience amidst the wider Asian market pressures articulated in “Asian steel market to remain under pressure in Q4.” The plant’s activity remained stable, compared to significant fluctuations in other regions.

In light of these observations, steel buyers should capitalize on India’s transition to a net exporter status while closely monitoring China’s continued export growth. With Indian finished steel production increasing by 10% and demand on the rise, procurement strategies should consider sourcing from Indian steel mills to mitigate supply disruptions, particularly in regions impacted by China’s evolving trade landscape and activity changes. Focusing on diversified suppliers from India, especially amidst the fluctuations of Chinese exports, will better position stakeholders against potential shortages.