From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineAsian Steel Market Optimism: Rising Exports and Production Despite Regional Pressures

Asia’s steel market demonstrates resilience driven by export growth and shifting trade dynamics, despite facing regional pressures. The increase in exports from key players like China and India, as highlighted in “China’s Steel Exports Rise 6.6% in January–October 2025” and “India Becomes a Net Exporter of Steel in October,” showcases a proactive response to both domestic and international market conditions, although a direct relationship between these articles and the provided satellite observed activity changes cannot be explicitly established.

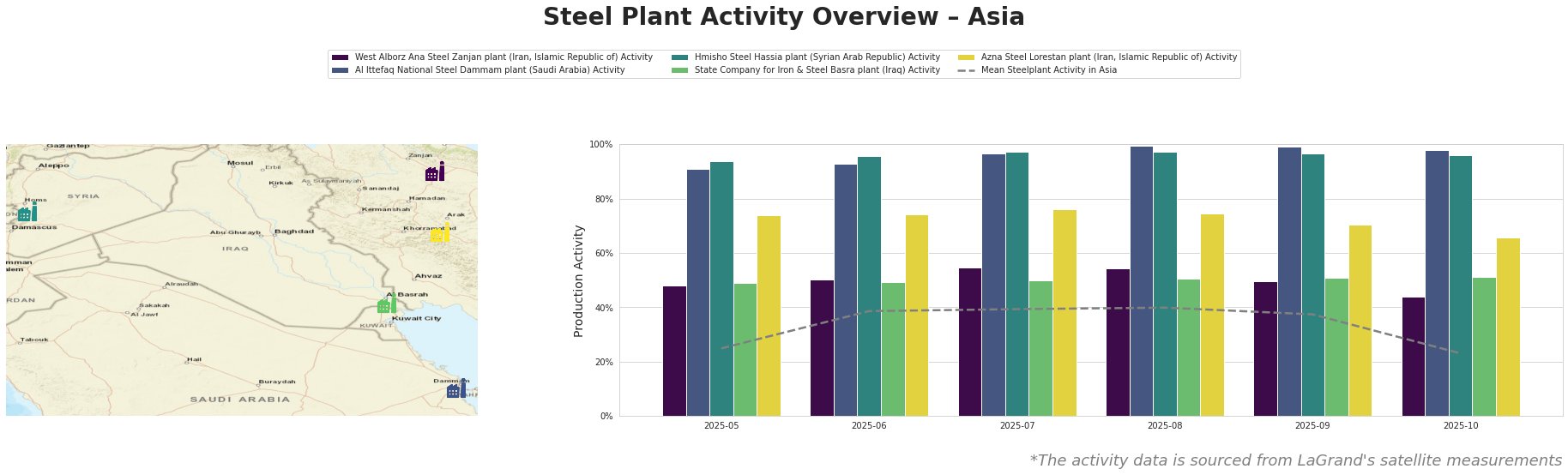

Observed monthly activity levels for selected plants are shown in the following table:

The mean steel plant activity in Asia fluctuated, peaking at 40% in August and dropping to 23% in October. The Al Ittefaq National Steel Dammam plant (Saudi Arabia) operated near maximum observed capacity, remaining consistently above 90% throughout the observed period, peaking at 100% in August. The Hmisho Steel Hassia plant (Syrian Arab Republic) also exhibited high activity, staying in the high 90s. In contrast, West Alborz Ana Steel Zanjan plant (Iran, Islamic Republic of), State Company for Iron & Steel Basra plant (Iraq) and Azna Steel Lorestan plant (Iran, Islamic Republic of) operated at significantly lower activity levels relative to the other observed plants.

West Alborz Ana Steel Zanjan plant (Iran, Islamic Republic of), a 1.5 million tonnes per annum (ttpa) crude steel producer utilizing DRI and EAF technologies, showed a decline in activity from 48% in May to 44% in October. Although there is no direct link to the news articles, this drop could be related to broader economic pressures.

Al Ittefaq National Steel Dammam plant (Saudi Arabia), with a 1 ttpa crude steel capacity and similar DRI/EAF processes, consistently operated at very high levels. Its activity remained near maximum, reaching 100% in August. This high activity could reflect increased demand driven by the redirection of Chinese steel exports to Saudi Arabia, as mentioned in “China increases steel exports to Saudi Arabia amid trade restrictions,” although no direct connection can be confirmed.

Hmisho Steel Hassia plant (Syrian Arab Republic), a smaller 0.8 ttpa integrated plant using BF and EAF, maintained high activity around the mid to high nineties, potentially indicating a focus on regional semi-finished steel demand. No explicit connection to any of the news articles could be established.

State Company for Iron & Steel Basra plant (Iraq), with a smaller 0.5 ttpa EAF-based production, exhibited relatively stable activity around 50%. No direct connection to any of the provided news articles can be established.

Azna Steel Lorestan plant (Iran, Islamic Republic of), producing 1.2 ttpa via EAF, experienced a decrease from 74% in May to 66% in October. While the drop does not directly correlate to any specific news, a broader economic factor may play a role.

The sustained high activity at Al Ittefaq in Saudi Arabia, coupled with the information in “China increases steel exports to Saudi Arabia amid trade restrictions,” suggests potential advantages for buyers sourcing from Saudi Arabia. The drop in activity at the Iranian plants cannot be directly linked to a news event, but could point to regional pressures.

Evaluated Market Implications:

Potential supply disruptions could arise from the decreased activity observed at the West Alborz Ana Steel Zanjan and Azna Steel Lorestan plants in Iran.

Recommended Procurement Actions:

* Steel Buyers: Given China’s increased exports to Saudi Arabia and Al Ittefaq National Steel’s consistently high activity, buyers seeking billets should explore sourcing options from Saudi Arabia to secure supply, as the country has a high pelletizing capacity and domestic demand is not as high as domestic production.

* Market Analysts: Closely monitor Iranian steel plant activity and regional trade dynamics for early indicators of potential supply constraints and price volatility. Further investigate factors influencing production decreases, as they do not appear to be directly linked to protectionist measures in larger Asian steel markets.